PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684588

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684588

Brewing Additive Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

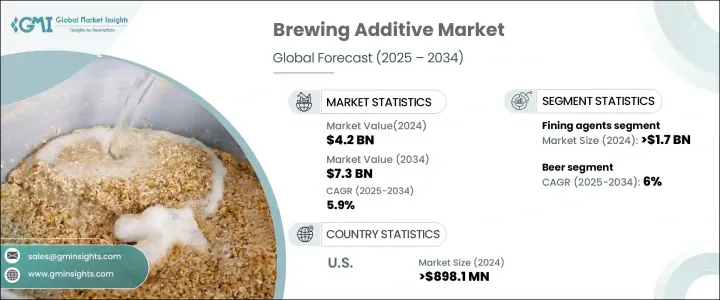

The Global Brewing Additive Market is poised for significant growth, valued at USD 4.2 billion in 2024, with projections pointing to a CAGR of 5.9% from 2025 to 2034. This growth is driven by the increasing consumer demand for premium alcoholic beverages that offer enhanced clarity, stability, and rich flavor profiles. In recent years, consumers have gravitated towards craft and high-quality alcoholic drinks, which are fueling a surge in the adoption of innovative brewing additives that streamline production processes while ensuring top-notch consistency. Breweries are becoming more focused on meeting the evolving preferences of their customers, which has resulted in a competitive market environment where innovation is key.

The trend towards craft beers, non-alcoholic options, and low-alcohol beverages is further pushing this market forward. As consumers seek healthier and more sustainable alternatives, the brewing industry is adapting by embracing eco-friendly, natural ingredients that are both cleaner and more transparent. This shift aligns with the growing demand for clean-label additives, where ingredient sourcing is transparent and environmentally sustainable. Technological advancements in brewing processes have also spurred the demand for high-quality additives that help improve production efficiency and product quality. All of these factors are driving a dynamic and competitive landscape, making this market one of the most promising sectors in the beverage industry.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.2 Billion |

| Forecast Value | $7.3 Billion |

| CAGR | 5.9% |

Brewing additives, including fining agents, stabilizers, and antifoaming agents, are essential to ensuring the consistent production of high-quality beverages. These ingredients help enhance the sensory qualities of the product, such as clarity and stability, which are crucial for maintaining the appeal of the final product. As the demand for visually appealing and clear beverages continues to rise, the use of these additives has become more widespread among breweries. Natural ingredients, such as bentonite, silica gel, and isinglass, are increasingly favored due to their alignment with the clean-label trend, catering to the growing preference for transparency and sustainability.

In 2024, the fining agents segment generated USD 1.7 billion and is expected to grow at a robust CAGR of 6.1% from 2025 to 2034. These agents are instrumental in enhancing the clarity of beverages by removing undesirable particles, proteins, and polyphenols. The rising consumer preference for premium and craft beverages, which demand higher clarity and product stability, has significantly boosted the use of fining agents.

The beer sector remains the largest contributor to the brewing additives market, accounting for USD 2.9 billion in 2024. This segment is expected to grow at a CAGR of 6% through 2034. The global consumption of beer, coupled with the growing popularity of premium and craft beer varieties, continues to drive the demand for specialized additives. Additives like stabilizers, fining agents, and antifoaming agents play a critical role in improving the production efficiency, clarity, and flavor stability of beer, further contributing to the growth of this sector.

In the U.S., the brewing additive market was valued at USD 898.1 million in 2024, with a projected CAGR of 3.6% from 2025 to 2034. With a thriving brewing industry that encompasses both large-scale breweries and an innovative microbrewery sector, the U.S. is a key player in this market. As craft beers and non-alcoholic beverages gain traction in the country, demand for premium brewing additives is expected to keep rising, reflecting the ongoing shift toward high-quality, innovative beverage solutions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for premium and craft beverages

- 3.6.1.2 Technological advancements in brewing processes

- 3.6.1.3 Growth in home brewing and microbreweries

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Fluctuations in raw material availability

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion) (Tons)

- 5.1 Key trends

- 5.2 Fining agents

- 5.3 Antifoaming agents

- 5.4 Stabilizers

- 5.5 Color enhancers

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Tons)

- 6.1 Key trends

- 6.2 Wine

- 6.3 Beer

- 6.4 Others

Chapter 7 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Russia

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.6 MEA

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 AEB Brewing

- 8.2 Agrovin

- 8.3 ATPGroup

- 8.4 Enartis

- 8.5 General Filtration

- 8.6 Lesaffre

- 8.7 Mangrove Jacks

- 8.8 RahrBSG

- 8.9 Still Spirits