PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684643

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684643

Cigarette Making Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

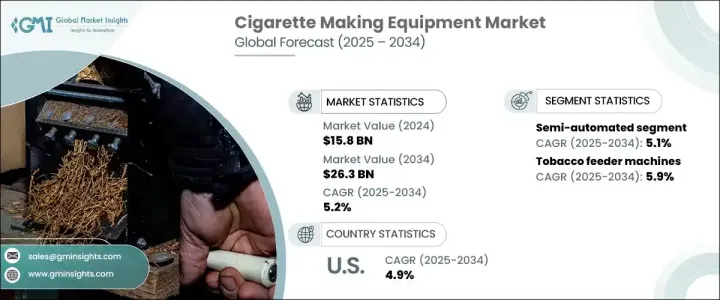

The Global Cigarette Making Equipment Market was valued at USD 15.8 billion in 2024, with projections indicating a steady growth at a CAGR of 5.2% from 2025 to 2034. This growth is driven by the rising demand for automation within cigarette production. Manufacturers are increasingly turning to advanced automated machinery to enhance production efficiency, minimize costs, and meet the increasing demand for large-scale production while upholding consistent quality. In particular, there is a noticeable trend toward reducing manual labor through automation, which allows businesses to streamline operations and improve overall productivity. This shift not only addresses labor shortages but also responds to consumer expectations for high-quality products produced more cost-effectively. As automation technologies become more sophisticated, manufacturers are investing in equipment that can increase output and precision, further fueling the market's expansion.

One of the key segments driving this market is the tobacco feeder machines, which contributed USD 3.6 billion to the market in 2024. These machines are expected to continue their upward trajectory, with a forecasted CAGR of 5.9% through 2034. Tobacco feeder machines are integral to ensuring the accurate and consistent feeding of tobacco into rolling systems. Their role in enhancing operational efficiency, reducing material waste, and maintaining high product quality has made them essential in modern cigarette production lines. With their modular design, these machines can be easily upgraded to meet evolving production demands, further driving their adoption. Despite their advanced automation capabilities, some manual or semi-automated steps may still be necessary for certain tasks, such as filter placement and packaging.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15.8 Billion |

| Forecast Value | $26.3 Billion |

| CAGR | 5.2% |

The semi-automated segment also holds a significant market share, accounting for 45% in 2024, and is set to grow at a CAGR of 5.1% between 2025 and 2034. Semi-automated machines are particularly favored by small- and medium-scale manufacturers in emerging markets due to their affordability and flexibility. These machines offer a balance between cost-effectiveness and automation, performing core tasks like tobacco feeding, paper cutting, and rod formation while allowing for manual intervention in certain areas. Their modularity enables businesses to scale operations as needed without committing to full automation upfront.

The U.S. cigarette-making equipment market generated USD 1.9 billion in 2024, and it is projected to grow at a CAGR of 4.9% from 2025 to 2034. This growth is largely attributed to the country's focus on adopting advanced automation technologies and precision engineering. The U.S. is home to several leading manufacturers known for their innovative approaches and high-quality standards, which not only serve domestic needs but also cater to global markets. These manufacturers are committed to maintaining high regulatory standards, further propelling the growth of the market within the U.S.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.5 Secondary

- 1.5.1.1 Paid sources

- 1.5.1.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing automation in production processes.

- 3.6.1.2 Rising demand for RYO and customizable cigarettes.

- 3.6.1.3 Expansion in emerging markets.

- 3.6.1.4 Adoption of sustainable manufacturing practices.

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Stringent government regulations on tobacco products.

- 3.6.2.2 Declining cigarette consumption in developed regions due to health awareness

- 3.6.1 Growth drivers

- 3.7 Technological & innovation landscape

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Equipment Type, 2021 – 2034 (USD Billion) (Thousand units)

- 5.1 Key trends

- 5.2 Tobacco feeder machines

- 5.3 Cigarette packaging machines

- 5.3.1 Primary packaging machines (Wrapping, Sealing)

- 5.3.2 Secondary packaging machines(Cartooning, Bundling)

- 5.4 Rod forming machinery

- 5.5 Cigarette filter making machines

- 5.6 Cutting machines

- 5.7 Flavoring & blending machinery

- 5.8 Material handling equipment

- 5.9 Others (rolling machines, curing machines, etc.)

Chapter 6 Market Estimates and Forecast, By Automation level, 2021 – 2034 (USD Billion) (Thousand units)

- 6.1 Key trends

- 6.2 Manual

- 6.3 Semi-Automated

- 6.4 Fully automated

Chapter 7 Market Estimates and Forecast, By Capacity, 2021 – 2034 (USD Billion) (Thousand units)

- 7.1 Key trends

- 7.2 Low-speed machines (under 4000 cigarettes/min)

- 7.3 Medium-speed machines (4000-8000 cigarettes/min)

- 7.4 High-speed machines (above 8000 cigarettes/min)

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 (USD Billion) (Thousand units)

- 8.1 Key trends

- 8.2 Tobacco manufacturers

- 8.3 Small-Scale producers

- 8.4 Contract manufacturers

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 – 2034, (USD Billion) (Thousand units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021 – 2034, (USD Billion) (Thousand units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 11.1 CBK

- 11.2 Cipta Bena Kencana

- 11.3 Decouflé

- 11.4 Dynamic Tools Pvt Ltd.

- 11.5 Focke & Co.

- 11.6 G.D S.p.A.

- 11.7 Hauni Maschinenbau GmbH

- 11.8 HK UPPERBOND INDUSTRIAL LIMITED

- 11.9 ITM Group

- 11.10 Körber Technologies

- 11.11 Makepak International

- 11.12 Molins

- 11.13 Orchid Tobacco Machinery

- 11.14 Sasib S.p.A.

- 11.15 Tianjin Pioneering Machinery