PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913453

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913453

Bicycle Roller Brake Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

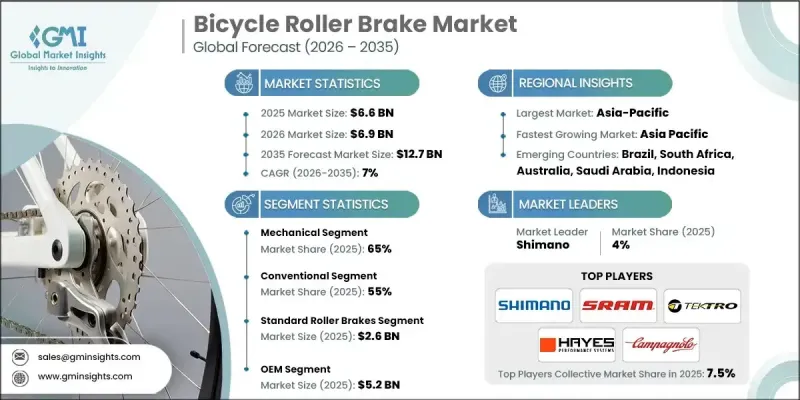

The Global Bicycle Roller Brake Market was valued at USD 6.6 billion in 2025 and is estimated to grow at a CAGR of 7% to reach USD 12.7 billion by 2035.

The market is described as undergoing notable transformation due to shifting rider expectations, steady advancements in braking technologies, and long-term changes in urban transportation behavior. It is explained that these forces are redefining competition and opening new revenue pathways for brands that respond quickly to evolving customer needs. Roller brakes are identified as enclosed braking solutions designed for consistent performance and long service life, particularly valued in urban and utility cycling environments where reliability in varied weather conditions is essential. It is emphasized that the rising preference for bicycles requiring minimal servicing has significantly supported demand, especially among city commuters seeking dependable transportation without technical upkeep. The market narrative highlights that the growing presence of integrated, low-maintenance bicycle platforms has contributed to increased adoption. It is further stated that large-scale shared mobility operators increasingly favor durable braking systems to limit downtime, which has accelerated acceptance. Overall, demand is said to be shaped by users prioritizing convenience, longevity, and ease of ownership, positioning roller brakes as a practical solution in mature and high-usage cycling markets.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $6.6 Billion |

| Forecast Value | $12.7 Billion |

| CAGR | 7% |

The mechanical segment accounted for 65% share in 2025 and is forecast to grow at a CAGR of 6% from 2026 to 2035. Mechanical roller brakes are described as cable-actuated systems that deliver dependable stopping power while remaining cost-efficient. These solutions are said to rely on established mechanical leverage principles that ensure stable performance over long periods. The segment benefits from widespread compatibility with standard components, mature distribution networks, and straightforward maintenance processes. It is further noted that the ability to diagnose and service these systems without specialized equipment continues to support their strong adoption across global markets.

The conventional bicycle segment held a 55% share in 2025 and is projected to grow at a CAGR of 6.3% through 2035. This dominance is attributed to high sales volumes associated with everyday transportation bicycles. It is explained that these products are positioned as affordable mobility options where consistent braking performance is essential. Manufacturers are said to increasingly rely on roller brake systems to enhance durability and product appeal within established categories, particularly as innovation opportunities remain limited in traditional bicycle designs.

Asia-Pacific Bicycle Roller Brake Market generated USD 2.1 billion in 2025. The region's leadership is linked to its extensive manufacturing infrastructure and large cycling population. China, Japan, and India are referenced as major contributors to production capacity and consumer demand. China is identified as the primary manufacturing hub, accounting for nearly 68% of worldwide bicycle output. Annual production in the country is stated at 46 million units, equal to approximately 1,300,000 bicycles per month, positioning China as both the largest consumer and supplier of roller brake systems.

Key companies operating in the Bicycle Roller Brake Market include Shimano, SRAM, Tektro Technology, Campagnolo, Magura, Hayes Performance Systems, Promax Components, Clarks Cycle Systems, Alhonga, and Hope Technology (IPCO). Companies in the Bicycle Roller Brake Market are said to be strengthening their positions through a combination of product innovation, manufacturing optimization, and strategic partnerships. Leading players are focusing on improving durability, heat management, and system efficiency to meet evolving performance expectations. Many manufacturers are investing in automation and localized production to reduce costs and ensure consistent quality. Strategic collaborations with bicycle manufacturers and fleet operators are also emphasized as a key approach to securing long-term supply agreements. In addition, companies are expanding their presence in high-growth regions by strengthening distribution networks and offering tailored solutions aligned with regional riding.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Break

- 2.2.4 Bicycle

- 2.2.5 Application

- 2.2.6 Sales Channel

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Component manufacturers

- 3.1.1.2 Break manufacturers & integrators

- 3.1.1.3 Bicycle manufacturers

- 3.1.1.4 Aftermarket distribution channels

- 3.1.1.5 End-user & service networks

- 3.1.2 Cost structure

- 3.1.3 Profit margin

- 3.1.4 Value addition at each stage

- 3.1.5 Vertical integration trends

- 3.1.6 Disruptors

- 3.1.1 Supplier landscape

- 3.2 Impact on forces

- 3.2.1 Growth drivers

- 3.2.1.1 Urbanization & growth of commuter cycling

- 3.2.1.2 Expansion of e-bikes & utility bikes

- 3.2.1.3 Safety & reliability preference over rim brakes

- 3.2.1.4 OEM integration in city/comfort bicycle segments

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Competition from disc brakes

- 3.2.2.2 Heat buildup under steep/high-speed use

- 3.2.3 Market opportunities

- 3.2.3.1 Growth of low-maintenance bicycle platforms

- 3.2.3.2 Integration with internal gear hubs

- 3.2.3.3 Emerging demand in bike-sharing fleets

- 3.2.3.4 Product improvements (heat dissipation & modulation)

- 3.2.1 Growth drivers

- 3.3 Technology trends & innovation ecosystem

- 3.3.1 Current technologies

- 3.3.2 Emerging technologies

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.1.1 U.S. Consumer Product Safety Commission (CPSC) standards

- 3.5.1.2 ASTM international standards (F2043, F1898)

- 3.5.1.3 Canada bicycle safety regulations

- 3.5.2 Europe

- 3.5.2.1 EN 15194 (E-Bike Standard)

- 3.5.2.2 European pedal-powered bicycle regulations

- 3.5.2.3 Low-Emission / Urban mobility policies

- 3.5.3 Asia-Pacific

- 3.5.3.1 China GB standards for bicycles and e-bikes

- 3.5.3.2 India Automotive Industry Standards (AIS 052 for E-Bikes)

- 3.5.3.3 Japan JIS standards

- 3.5.3.4 ASEAN bicycle standards

- 3.5.4 Latin America

- 3.5.4.1 Brazil ABNT NBR standards

- 3.5.4.2 Argentina INTA / IRAM standards

- 3.5.4.3 Mexico NOM standards

- 3.5.5 Middle East & Africa

- 3.5.5.1 UAE GSO / ESMA bicycle regulations

- 3.5.5.2 Saudi Arabia SASO bicycle standards

- 3.5.5.3 South Africa SABS bicycle safety regulations

- 3.5.1 North America

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

- 3.8 Cost breakdown analysis

- 3.9 Price trends

- 3.9.1 By region

- 3.9.2 By product

- 3.10 Patent analysis

- 3.11 Production statistics

- 3.11.1 Production hubs

- 3.11.2 Consumption hubs

- 3.11.3 Export and import

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Technology benchmarking: roller brakes vs alternatives

- 3.13.1 Roller brakes vs rim brakes

- 3.13.2 Roller brakes vs mechanical disc brakes

- 3.13.3 Roller brakes vs hydraulic disc brakes

- 3.13.4 Performance, cost, maintenance & safety trade-offs

- 3.14 OEM specification & adoption strategy

- 3.14.1 Roller brake fitment by bicycle category

- 3.14.2 Entry-level vs mid-range OEM positioning

- 3.14.3 Regional OEM preference patterns

- 3.14.4 Design-for-cost vs design-for-durability trade-offs

- 3.15 System compatibility & integration considerations

- 3.16 Aftermarket demand dynamics

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia-Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

- 4.5 Key developments

- 4.5.1 Mergers & acquisitions

- 4.5.2 Partnerships & collaborations

- 4.5.3 New product launches

- 4.5.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Product, 2022 - 2035 ($Bn, Units)

- 5.1 Key trends

- 5.2 Standard roller brakes

- 5.3 High-performance roller brakes

- 5.4 Integrated hub-gear roller brakes

- 5.5 Coaster brakes

Chapter 6 Market Estimates & Forecast, By Break, 2022 - 2035 ($Bn, Units)

- 6.1 Key trends

- 6.2 Mechanical

- 6.3 Hydraulic

Chapter 7 Market Estimates & Forecast, By Bicycle, 2022 - 2035 ($Bn, Units)

- 7.1 Key trends

- 7.2 Conventional

- 7.3 E-bike

Chapter 8 Market Estimates & Forecast, By Application, 2022 - 2035 ($Bn, Units)

- 8.1 Key trends

- 8.2 City/Urban bicycles

- 8.3 Mountain bicycles

- 8.4 Racing bicycles

- 8.5 Hybrid bicycles

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2022 - 2035 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035 ($Bn, Units)

- 10.1 North America

- 10.1.1 US

- 10.1.2 Canada

- 10.2 Europe

- 10.2.1 UK

- 10.2.2 Germany

- 10.2.3 France

- 10.2.4 Italy

- 10.2.5 Spain

- 10.2.6 Belgium

- 10.2.7 Netherlands

- 10.2.8 Sweden

- 10.2.9 Russia

- 10.3 Asia Pacific

- 10.3.1 China

- 10.3.2 India

- 10.3.3 Japan

- 10.3.4 Australia

- 10.3.5 Singapore

- 10.3.6 South Korea

- 10.3.7 Vietnam

- 10.3.8 Indonesia

- 10.4 Latin America

- 10.4.1 Brazil

- 10.4.2 Mexico

- 10.4.3 Argentina

- 10.5 MEA

- 10.5.1 South Africa

- 10.5.2 Saudi Arabia

- 10.5.3 UAE

Chapter 11 Company Profiles

- 11.1 Global players

- 11.1.1 Campagnolo

- 11.1.2 Hayes Performance Systems

- 11.1.3 Magura

- 11.1.4 Promax Components

- 11.1.5 Shimano

- 11.1.6 SRAM

- 11.1.7 SunRace Sturmey-Archer

- 11.1.8 Tektro Technology

- 11.2 Region players

- 11.2.1 Alhonga

- 11.2.2 Avid

- 11.2.3 Cane Creek

- 11.2.4 Clarks Cycle Systems

- 11.2.5 Dia-Compe

- 11.2.6 Hope Technology

- 11.2.7 Jagwire

- 11.2.8 KCNC

- 11.2.9 Paul Component Engineering

- 11.3 Emerging players

- 11.3.1 TRP Cycling Components

- 11.3.2 Weinmann

- 11.3.3 XLC Components