PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684695

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684695

Data Center Energy Storage Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

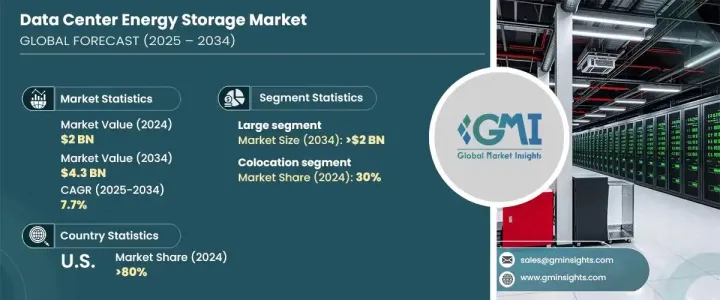

The Global Data Center Energy Storage Market, valued at USD 2 billion in 2024, is on a strong growth trajectory, with a projected CAGR of 7.7% between 2025 and 2034. As the demand for digital services surges, data centers are under increasing pressure to adopt efficient energy storage solutions that ensure uninterrupted power supply and optimize energy consumption. Businesses are moving away from traditional power grids, focusing instead on advanced storage technologies that align with sustainability goals and enhance operational resilience. With growing concerns over carbon footprints and rising energy costs, the push for renewable energy integration is stronger than ever. Companies are leveraging cutting-edge storage systems to maintain uptime, reduce electricity expenses, and support the shift toward a greener digital infrastructure.

The rapid expansion of cloud computing, artificial intelligence, and big data analytics has intensified the need for scalable energy storage solutions. Digital transactions and data processing continue to escalate, increasing dependency on energy-efficient systems that can sustain high-performance computing. Organizations worldwide are investing in innovative energy storage technologies to improve power reliability and minimize the risk of downtime. As regulatory frameworks emphasize sustainability, data centers are prioritizing eco-friendly energy solutions to remain competitive in the evolving market. The industry's transition toward hybrid energy storage, incorporating lithium-ion batteries, flywheels, and other energy-efficient systems, further underscores the shift toward a resilient, sustainable infrastructure. With the continued advancement of power management systems, data centers are optimizing energy efficiency while maintaining high-speed computing performance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2 Billion |

| Forecast Value | $4.3 Billion |

| CAGR | 7.7% |

Market segmentation by data center size includes small, medium, and large facilities. In 2024, large data centers accounted for 46% of the market share, with revenue projections reaching USD 2 billion by 2034. High-capacity data centers depend on sophisticated energy storage solutions to ensure seamless operations, preventing disruptions in critical computing environments. As energy demands rise, businesses are integrating advanced storage technologies to enhance system resilience, reduce power failures, and optimize energy efficiency. These large-scale centers require robust storage infrastructure to support increasing data loads, driving significant investments in energy storage systems.

The market is further categorized by application, covering banking, energy, government, healthcare, manufacturing, IT, and colocation services. In 2024, colocation centers held a 30% market share, reflecting the growing preference for shared data storage facilities. Businesses utilizing colocation services prioritize continuous power availability, making energy storage solutions an essential component of their operational strategy. The increasing reliance on third-party data storage has intensified the demand for energy-efficient infrastructure, compelling colocation providers to implement cutting-edge power management solutions. Advanced energy storage technology ensures cost-effective operations while maintaining reliability, further driving adoption across the sector.

The US data center energy storage market accounted for 80% of the global share in 2024, solidifying its position as a major industry driver. The region's leadership in large-scale infrastructure projects has accelerated the adoption of advanced storage solutions as businesses seek more flexible and cost-effective energy consumption strategies. Companies across North America are actively enhancing energy efficiency initiatives to meet sustainability targets, reducing carbon emissions, and improving power reliability. The strong focus on eco-friendly infrastructure and continuous investment in energy storage technologies have positioned the region at the forefront of market growth. With increasing efforts to achieve carbon neutrality, North American data centers are setting new standards for energy efficiency, reinforcing market expansion and long-term viability.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material suppliers

- 3.1.2 Component suppliers

- 3.1.3 Manufacturers

- 3.1.4 Technology providers

- 3.1.5 Distributors

- 3.1.6 End users

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Regulatory landscape

- 3.7 Pricing analysis

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Integration of renewable energy sources for efficiency

- 3.8.1.2 Demand for backup power solutions in data centers

- 3.8.1.3 Adoption of green energy storage solutions

- 3.8.1.4 Technological advancements in energy storage systems

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 High upfront costs of energy storage technologies

- 3.8.2.2 Technological limitations in large-scale deployments

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Data Center Size, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Small

- 5.3 Medium

- 5.4 Large

Chapter 6 Market Estimates & Forecast, By Tier, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Tier 1

- 6.3 Tier 2

- 6.4 Tier 3

- 6.5 Tier 4

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Lithium-ion batteries

- 7.3 Lead-acid batteries

- 7.4 Nickel-cadmium batteries

- 7.5 Flywheel energy storage

- 7.6 Supercapacitors

- 7.7 Flow batteries

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 BFSI

- 8.3 Colocation

- 8.4 Energy

- 8.5 Government

- 8.6 Healthcare

- 8.7 Manufacturing

- 8.8 IT & telecom

- 8.9 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 ABB

- 10.2 BYD

- 10.3 Cummins

- 10.4 Delta

- 10.5 Eaton

- 10.6 Generac Power Systems

- 10.7 Hitachi Energy

- 10.8 Huawei

- 10.9 Johnson Controls International

- 10.10 Legrand

- 10.11 LG Energy Solution

- 10.12 Mitsubishi

- 10.13 Riello Elettronica

- 10.14 Samsung SDI

- 10.15 Schneider Electric

- 10.16 Siemens

- 10.17 Socomec

- 10.18 Tesla

- 10.19 Toshiba

- 10.20 Vertiv