PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684715

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684715

Automotive Variable Displacement Pumps Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

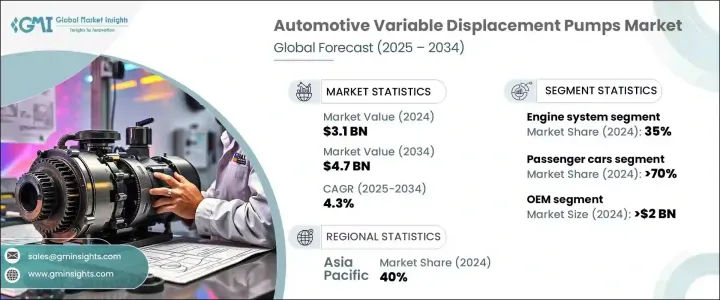

The Global Automotive Variable Displacement Pumps Market was valued at USD 3.1 billion in 2024 and is projected to grow at a CAGR of 4.3% between 2025 and 2034. The demand for fuel-efficient and environmentally friendly vehicles is increasing, driven by stringent emission regulations and evolving consumer preferences. Governments worldwide are enforcing stricter laws to lower carbon footprints and promote energy-efficient transportation, compelling automakers to integrate advanced technologies into their vehicles. Variable displacement pumps are emerging as a key solution, optimizing engine performance, enhancing fuel economy, and minimizing energy losses.

As automakers focus on achieving sustainability goals, hybrid and fuel-efficient vehicles are gaining traction, further boosting demand for these systems. Consumers are increasingly prioritizing fuel economy, making it imperative for manufacturers to adopt energy-efficient components that comply with regulatory standards. The need for energy optimization is also accelerating innovation in vehicle design, encouraging manufacturers to explore new ways to enhance performance while meeting global sustainability benchmarks. With rising fuel prices and a shift towards hybrid and electric vehicle adoption, variable displacement pumps are poised to play a crucial role in modern automotive engineering. The continued emphasis on fuel efficiency presents significant growth opportunities for industry players, ensuring sustained market demand for these pumps in the years ahead.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.1 Billion |

| Forecast Value | $4.7 Billion |

| CAGR | 4.3% |

The market is segmented by vehicle type into passenger and commercial vehicles, with passenger cars accounting for 70% of the total market share in 2024. This segment is expected to generate USD 3 billion by 2034. The increasing adoption of hybrid and fuel-efficient vehicles is propelling the demand for advanced automotive components that improve efficiency and functionality. Variable displacement pumps are crucial in optimizing hybrid vehicle performance, reducing unnecessary fluid displacement in non-hydraulic applications, and enhancing overall fuel management. These pumps help regulate energy consumption, allowing automakers to meet stricter fuel efficiency requirements without compromising vehicle performance.

The market is also classified by application into engine systems, transmission systems, power steering systems, fuel management systems, and brake systems, among others. Engine systems held a 35% market share in 2024, with variable displacement pumps playing a critical role in optimizing internal combustion engine performance. These pumps adjust fluid flow to regulate fuel consumption, improving overall efficiency while ensuring compliance with stringent emissions regulations. Automakers are leveraging this technology to design more fuel-efficient engines, giving them a competitive edge in an industry increasingly focused on sustainability and high performance.

The Asia Pacific automotive variable displacement pumps market held a dominant 40% share in 2024, with China leading the region's growth. The rising demand for fuel-efficient commercial vehicles is driving the adoption of these pumps, particularly in transportation and logistics sectors where reducing fuel consumption is a top priority. With an extensive fleet of commercial vehicles operating in the region, the need for advanced engine optimization solutions is stronger than ever. Manufacturers are heavily investing in innovative pump technologies to help vehicles comply with fuel efficiency regulations while ensuring high operational performance.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material suppliers

- 3.1.2 Component suppliers

- 3.1.3 Manufacturers

- 3.1.4 Technology providers

- 3.1.5 End users

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Pricing analysis

- 3.9 Cost breakdown analysis

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Rising fuel costs and environmental concerns

- 3.10.1.2 Strict global regulations on emissions and fuel economy

- 3.10.1.3 Higher automotive production in emerging economies and rising disposable incomes

- 3.10.1.4 Technological advancements in pump design and control systems

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 High initial costs

- 3.10.2.2 Limited compatibility with all vehicle types

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Pump, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Oil pump

- 5.3 Transmission pump

- 5.4 Power steering pump

- 5.5 Water pump

- 5.6 Fuel pump

- 5.7 Coolant pump

Chapter 6 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Electronic

- 6.3 Hydraulic

- 6.4 Mechanical

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Passenger cars

- 7.2.1 Sedans

- 7.2.2 Hatchbacks

- 7.2.3 SUVs

- 7.2.4 Others

- 7.3 Commercial vehicles

- 7.3.1 Light Commercial Vehicles (LCVs)

- 7.3.2 Heavy Commercial Vehicles (HCVs)

Chapter 8 Market Estimates & Forecast, By Material, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Aluminum

- 8.3 Steel

- 8.4 Cast Iron

- 8.5 Composite material

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Engine systems

- 9.3 Transmission systems

- 9.4 Power steering systems

- 9.5 Fuel management systems

- 9.6 Brake systems

- 9.7 Others

Chapter 10 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 OEM

- 10.3 Aftermarket

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn,Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Southeast Asia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 South Africa

- 11.6.3 Saudi Arabia

Chapter 12 Company Profiles

- 12.1 AISIN SEIKI

- 12.2 Bosch

- 12.3 Bucher Industries

- 12.4 Continental

- 12.5 Danfoss

- 12.6 Denso Corporation

- 12.7 Eaton Corporation

- 12.8 GKN Automotive

- 12.9 HELLA GmbH

- 12.10 Hitachi Automotive Systems

- 12.11 HUSCO Automotive

- 12.12 Johnson Electric

- 12.13 JTEKT Corporation

- 12.14 Magna International

- 12.15 Mikuni Corporation

- 12.16 Parker Hannifin

- 12.17 Rheinmetall Automotive

- 12.18 Schaeffler AG

- 12.19 Valeo

- 12.20 ZF Friedrichshafen