PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684781

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684781

Smart Tag Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

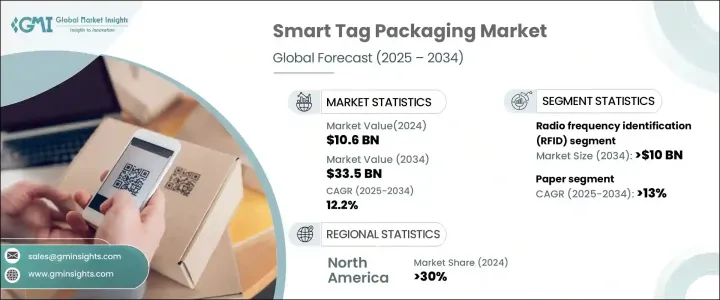

The Global Smart Tag Packaging Market reached USD 10.6 billion in 2024 and is projected to expand at a CAGR of 12.2% from 2025 to 2034. This rapid expansion is fueled by increasing consumer demand for sustainability, the growing adoption of circular economy principles, and advancements in digital tracking technologies. Businesses across various industries are leveraging smart tag technologies to enhance efficiency, optimize supply chains, improve transparency, and minimize environmental impact. As companies strive for better product tracking and authentication, the integration of smart tags into packaging is becoming a critical component of modern logistics and inventory management. The demand for real-time data, reduced waste, and enhanced security is accelerating adoption, positioning smart tag packaging as a key enabler of next-generation supply chain solutions. With regulatory frameworks worldwide emphasizing traceability and waste reduction, organizations are turning to smart packaging solutions to stay compliant and competitive.

By technology, the market is segmented into QR codes and barcodes, near-field communication (NFC), Bluetooth Low Energy (BLE) tags, radio frequency identification (RFID), and others. The RFID segment is set to generate USD 10 billion by 2034, driven by its ability to facilitate real-time product tracking, streamline inventory management, and combat counterfeiting. Unlike traditional barcode systems, RFID does not require direct scanning, offering enhanced operational efficiency. The technology enables precise location tracking and automated data collection, making it a preferred solution for industries seeking automation and security. Retail, logistics, and healthcare sectors are witnessing increased adoption as RFID reduces losses, improves workflow accuracy, and strengthens anti-theft measures. As businesses focus on digital transformation, the reliance on RFID for advanced asset tracking is expected to rise, solidifying its role as the dominant smart tag technology.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.6 Billion |

| Forecast Value | $33.5 Billion |

| CAGR | 12.2% |

The market is also categorized by material, including paper, plastic, metal, and composite materials. The paper segment is poised to grow at a CAGR of 13% during the forecast period, fueled by the rising demand for sustainable and eco-friendly packaging solutions. With increasing global concerns over plastic pollution, businesses are actively seeking biodegradable alternatives. Regulations against single-use plastics are accelerating the shift toward recyclable materials, making paper-based smart tags a preferred choice. Smart tag integration into paper packaging maintains functionality while reducing environmental impact, aligning with the sustainability goals of brands and consumers alike.

The North American smart tag packaging market accounted for a 30% share in 2024, with the United States leading regional growth. The demand for smart tag packaging in the U.S. is driven by the need for enhanced supply chain transparency, efficient inventory management, and advanced anti-theft solutions. The region's strong technological infrastructure supports the widespread adoption of innovative tracking systems, aligning with industry trends in automation and digitalization. Regulatory requirements emphasizing transparency and waste reduction are further boosting the integration of smart tags across retail, logistics, and healthcare. With businesses prioritizing customer satisfaction and loss prevention, smart tag technologies are playing an essential role in transforming operational efficiencies.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2022-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Key news & initiatives

- 3.3 Regulatory landscape

- 3.4 Impact forces

- 3.4.1 Growth drivers

- 3.4.1.1 Sustainability and circular economy initiatives

- 3.4.1.2 Technological advancements in RFID and IoT

- 3.4.1.3 Rising consumer demand for transparency and product authentication

- 3.4.1.4 Increased adoption of smart packaging in retail and e-commerce

- 3.4.1.5 Government regulations and industry standards for traceability

- 3.4.2 Industry pitfalls & challenges

- 3.4.2.1 High production costs of smart tags

- 3.4.2.2 Compatibility and integration issues

- 3.4.1 Growth drivers

- 3.5 Growth potential analysis

- 3.6 Porter’s analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Technology, 2021-2034 (USD Billion & Kilo Tons)

- 5.1 Key trends

- 5.2 Radio frequency identification (RFID)

- 5.3 Near field communication (NFC)

- 5.4 QR codes and barcodes

- 5.5 Bluetooth low energy (BLE) Tags

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Material, 2021-2034 (USD Billion & Kilo Tons)

- 6.1 Key trends

- 6.2 Paper

- 6.3 Plastic

- 6.4 Metal

- 6.5 Composite materials

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion & Kilo Tons)

- 7.1 Key trends

- 7.2 Tracking & monitoring

- 7.3 Authentication & security

- 7.4 Anti-theft & loss prevention

- 7.5 Environmental monitoring

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Billion & Kilo Tons)

- 8.1 Key trends

- 8.2 Automotive

- 8.3 Food & beverages

- 8.4 Healthcare & pharmaceuticals

- 8.5 Logistics & supply chain

- 8.6 Retail and consumer goods

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion & Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Amcor

- 10.2 Checkpoint Systems

- 10.3 Impinj

- 10.4 International Paper

- 10.5 Invengo Technology

- 10.6 Multi-Color Corporation

- 10.7 Schreiner Group

- 10.8 Sealed Air

- 10.9 Smart Label Solutions

- 10.10 Stora Enso

- 10.11 Tageos

- 10.12 Zebra Technologies