PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684784

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684784

On-Board Diagnostics (OBD) Aftermarket Size - By Product, By Vehicle, By Application, By Component, Growth Forecast, 2025 - 2034

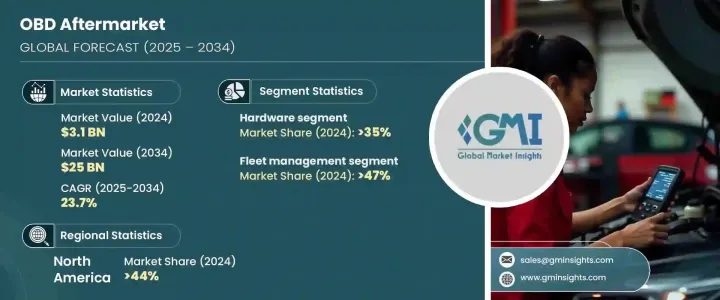

The global on-board diagnostics aftermarket, valued at USD 3.1 billion in 2024, is set to experience remarkable growth, with projections indicating a CAGR of 23.7% from 2025 to 2034. This rapid expansion is fueled by the increasing reliance on remote vehicle diagnostic systems powered by data-driven technologies. These advanced solutions provide real-time access to a vehicle's operational data, enabling remote monitoring and proactive maintenance. By offering instant insights into vehicle performance, OBD systems enhance safety, prevent unexpected breakdowns, and ensure timely servicing. As the automotive industry continues to embrace digital transformation, OBD aftermarket solutions are playing a critical role in vehicle longevity, optimizing performance, and maintaining stringent safety standards.

The Surge In Demand For Smart Automotive Solutions, Regulatory Compliance Requirements, And Consumer Preferences For Enhanced Vehicle Management Tools Are Key Drivers Of Market growth. With features such as predictive maintenance, real-time analytics, and seamless integration with modern connectivity protocols, OBD solutions are evolving to meet the diverse needs of internal combustion, hybrid, and electric vehicles. These advanced systems are essential for improving diagnostics, ensuring smooth vehicle operations, and delivering actionable insights to users. The adoption of cutting-edge vehicle connectivity technologies has further propelled the market, making it a cornerstone of modern vehicle management. As automakers and aftermarket service providers continue investing in innovation, OBD solutions will remain at the forefront of automotive advancements.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.1 Billion |

| Forecast Value | $25 Billion |

| CAGR | 23.7% |

The hardware segment, which accounted for 35% of the market share in 2024, is expected to hold 30% by 2034. The steady introduction of advanced diagnostic tools is driving this segment, offering enhanced capabilities for analyzing vehicle data and delivering real-time insights. These innovations are revolutionizing automotive diagnostics, enabling users to assess vehicle performance more efficiently. As technology advances, next-generation OBD hardware will provide even greater accuracy, allowing users to detect and address issues before they escalate. This shift underscores the industry's focus on predictive and preventive maintenance, ensuring vehicles remain in optimal condition for extended periods.

The OBD aftermarket is categorized based on application into consumer telematics, fleet management, car sharing, and usage-based insurance. The fleet management segment dominated in 2024, capturing 47% of the market share. Fleet operators are increasingly leveraging OBD technology to monitor vehicle movement, optimize routes, and track driving behavior in real time. By integrating OBD with digital mapping and advanced tracking features, fleet managers gain greater control over vehicle utilization, leading to improved efficiency and cost savings. Additionally, the seamless integration of OBD systems with fleet management platforms enhances operational transparency, reduces unauthorized activities, and minimizes downtime, making it an essential tool for logistics and transportation industries.

North America held a commanding 44% share of the OBD aftermarket in 2024, driven by a well-established automotive industry and continuous advancements in vehicle diagnostics technology. The region's strong emphasis on regulatory compliance, preventive maintenance, and automotive innovation has accelerated the widespread adoption of OBD solutions. With a robust presence of leading automotive manufacturers and a mature aftermarket ecosystem, North America has positioned itself as a leader in the global market. The growing demand for connected vehicle technologies and fleet optimization solutions is further fueling regional growth, ensuring sustained market expansion in the years to come.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Component suppliers

- 3.1.2 Technology providers

- 3.1.3 Distributors

- 3.1.4 End users

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Shifting focus toward remote diagnostics technology

- 3.7.1.2 Growing trend of automotive Internet of Things (IoT)

- 3.7.1.3 Increasing global automotive production

- 3.7.1.4 Rising emphasis on emission control standards

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Cybersecurity threats and privacy concerns

- 3.7.2.2 Compatibility and interoperability issues

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Passenger vehicles

- 5.2.1 Hatchback

- 5.2.2 Sedan

- 5.2.3 SUVs

- 5.3 Commercial vehicles

- 5.3.1 Light commercial vehicles (LCVs)

- 5.3.2 Heavy commercial vehicles (HCVs)

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Consumer telematics

- 6.3 Fleet management

- 6.4 Car sharing

- 6.5 Usage-based insurance (UBI)

Chapter 7 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Hardware

- 7.2.1 OBD scanners

- 7.2.2 OBD dongles

- 7.3 Software

- 7.3.1 PC-based OBD scanning tools

- 7.3.2 Apps (OBD telematics platforms)

- 7.4 Service

- 7.4.1 Training and consulting

- 7.4.2 Integration and management

- 7.4.3 Managed service

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 Autel

- 9.2 Agilis Systems

- 9.3 AVL DiTEST

- 9.4 Bridgestone

- 9.5 CalAmp Corporation

- 9.6 Continental

- 9.7 Danlaw

- 9.8 ERM Electronic Systems LTD (Ituran)

- 9.9 Geotab

- 9.10 Hella

- 9.11 Innova Electronics

- 9.12 Launch Tech

- 9.13 Nexar

- 9.14 Robert Bosch

- 9.15 ScanTool

- 9.16 TomTom Telematics

- 9.17 Verizon Connect

- 9.18 Xirgo Technologies

- 9.19 ZF Friedrichshafen

- 9.20 Zubie