PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684809

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684809

Areca Nuts Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

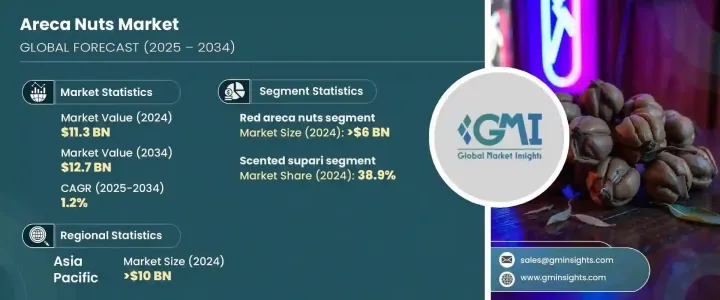

The Global Areca Nuts Market reached USD 11.3 billion in 2024 and is projected to grow at a steady CAGR of 1.2% from 2025 to 2034. This growth can be attributed to the deep-rooted cultural and traditional significance of areca nuts, particularly in the Asia-Pacific region. The role of areca nuts in social and religious ceremonies, especially in countries like India, Malaysia, Bangladesh, and Indonesia, has kept demand high over the years. As these countries continue to integrate areca nuts into daily life and celebrations, the market remains resilient. Additionally, the growing recognition of areca nuts for their potential health benefits, such as their use in traditional medicine and natural supplements, has spurred interest from health-conscious consumers. The increasing focus on wellness and organic living worldwide has only strengthened the demand for products like areca nuts, further boosting the market's potential.

As consumer preferences shift towards healthier alternatives and a more globalized market emerges, the areca nut industry is seeing significant changes. Innovations catering to modern lifestyles are helping to appeal to a broader consumer base. Globalization, alongside the rise of e-commerce, has made these products more accessible than ever before, increasing their availability beyond traditional regions. Health-conscious buyers are particularly drawn to areca nuts for their natural properties, as the nuts are being marketed as beneficial for digestive health, skincare, and more. This increasing awareness has made the areca nut an increasingly popular ingredient in both wellness products and food and beverage offerings.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11.3 Billion |

| Forecast Value | $12.7 Billion |

| CAGR | 1.2% |

The red areca nut segment dominated the market in 2024, reaching USD 6 billion. Renowned for its superior quality, the red areca nut benefits from traditional sun-drying techniques that enhance its flavor and aroma. These nuts are not just a product; they are a cultural symbol with deep roots in Southeast Asia, where they hold particular importance in both ceremonial and everyday life. As a result, their demand remains consistently strong, further driving the overall market growth. Additionally, the market for scented supari, a flavored variety of areca nut, continues to grow, accounting for 38.9% of the market share in 2024. Infused with spices and fragrances, scented supari caters to those seeking a more aromatic and flavorful experience, making it a popular choice for a wider range of consumers.

The Asia-Pacific region was the dominant market for areca nuts, generating USD 10 billion in 2024. India, in particular, was a major contributor, accounting for USD 6.1 billion of the market share. Areca nuts play a significant role in daily life and rituals across the region, ensuring strong domestic demand. Additionally, the growing export market from countries like India, Indonesia, and Malaysia continues to expand, reinforcing the Asia-Pacific region's central position in the global areca nut market. With the cultural importance of these nuts in the region and increasing health-driven consumer interest, the Asia-Pacific market is expected to maintain its leadership throughout the forecast period.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Cultural significance

- 3.6.1.2 Health and medicinal perceptions.

- 3.6.1.3 Innovative product offerings

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Health concerns and regulatory challenges

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Red

- 5.3 White areca nuts

Chapter 6 Market Size and Forecast, By Product, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Scented supari

- 6.3 Tannin

- 6.4 Pan masala

Chapter 7 Market Size and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Pan and pan masala products

- 7.3 Chewing tobacco products

- 7.4 Pharmaceutical and healthcare products

- 7.5 Other

Chapter 8 Market Size and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Ashapura Agrocomm

- 9.2 GM Group

- 9.3 Godrej Agrovet

- 9.4 KRBL

- 9.5 Mangalam Group

- 9.6 PT. Ruby Privatindo

- 9.7 Saaha Agro Industries

- 9.8 Surya Exim

- 9.9 The Campco

- 9.10 VIETDELTA INDUSTRIAL

- 9.11 Vimal Agro Products