PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1685131

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1685131

Active Speaker Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

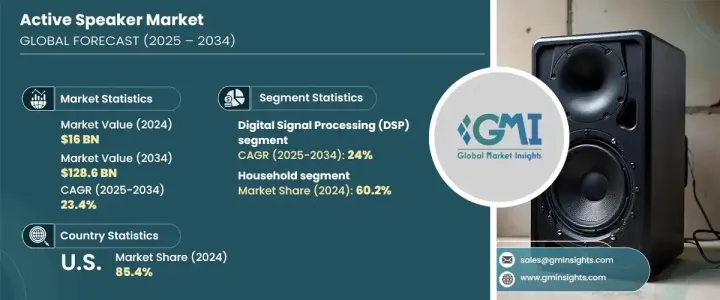

The Global Active Speaker Market, valued at USD 16 billion in 2024, is set to experience remarkable growth, with projections showing a CAGR of 23.4% from 2025 to 2034. Active speakers have become increasingly popular due to their integrated design that combines both amplification and signal processing within the speaker unit. This built-in approach makes them more convenient than traditional passive speakers, which require external amplifiers. With seamless integration and enhanced sound control, active speakers have evolved into essential components of modern audio systems, simplifying installation and enhancing overall sound quality. These speakers are used across various settings, from personal households to commercial applications, and their demand continues to rise, driven by technological advancements, growing consumer preferences, and the expanding smart home market.

The active speaker market is divided into two primary segments: household and commercial applications. As of 2024, the household segment holds a dominant 60.2% market share, largely fueled by the rapid rise in smart home adoption and the growing popularity of connected devices. Consumers are increasingly seeking audio solutions that not only deliver exceptional sound quality but also integrate seamlessly with home automation systems and voice assistants. This trend has made active speakers an attractive choice for households looking to enhance convenience and control within their living spaces. As the demand for integrated, user-friendly technology grows, the household segment of the active speaker market will likely continue to thrive in the coming years.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $16 Billion |

| Forecast Value | $128.6 Billion |

| CAGR | 23.4% |

When it comes to technology, the market is divided into analog active speakers and Digital Signal Processing (DSP) models. The DSP segment is anticipated to grow at an impressive CAGR of 24% through 2034. DSP technology is gaining significant traction because it allows for greater customization of audio performance. By adjusting parameters such as equalization, compression, and spatial processing, DSP-powered active speakers provide consumers with the ability to personalize their audio experience. This is especially appealing to both home audio enthusiasts and professional users who demand superior sound quality and flexibility. As demand for high-fidelity, tailored audio systems grows, the DSP segment is poised to play a pivotal role in shaping the market outlook.

In terms of geography, the U.S. active speaker market dominated in 2024, capturing 85.4% of the market share. This dominance can be attributed to the widespread use of smart home technologies and premium audio products across the nation. The increasing interest in voice-activated, connected devices in home automation systems is contributing significantly to the demand for active speakers. Additionally, the U.S. has a vibrant entertainment culture where consumers prioritize high-quality audio systems for home theaters, gaming setups, and music streaming services. This cultural emphasis on high-end audio solutions is helping drive the ongoing expansion of the active speaker market in the U.S.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for high-quality audio solutions in commercial venues

- 3.6.1.2 Growing adoption of active speakers in home entertainment systems

- 3.6.1.3 Rising popularity of wireless and Bluetooth-enabled active speakers for convenience and flexibility

- 3.6.1.4 Expansion of the automotive industry

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Market saturation and competition

- 3.6.2.2 Quality control issues

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Online

- 5.3 Electronics stores

- 5.4 Audio retailers

- 5.5 Brand outlets

Chapter 6 Market Estimates & Forecast, By Technology, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Analog active speakers

- 6.3 Digital Signal Processing (DSP)

Chapter 7 Market Estimates & Forecast, By Type, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 Wired

- 7.3 Wireless

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 Household

- 8.2.1 Smart homes

- 8.2.2 TVs

- 8.2.3 Computers

- 8.2.4 Music players

- 8.3 Commercial

- 8.3.1 Retail stores

- 8.3.2 Restaurants and bars

- 8.3.3 Conference rooms

- 8.3.4 Public transportation

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Audioengine

- 10.2 Beijing Edifier Technology Company, Ltd.

- 10.3 Bose Corporation

- 10.4 Creative Technology Ltd.

- 10.5 Georg Neumann GmbH

- 10.6 Harman International Industries, Incorporated

- 10.7 Highland Technologies

- 10.8 Klipsch Audio Technologies

- 10.9 KRK Systems, Inc.

- 10.10 Logitech International S.A.

- 10.11 Mackie Thump

- 10.12 Pyle Audio

- 10.13 Rockville

- 10.14 Sonos

- 10.15 Sony Group Corporation

- 10.16 Ultimate Ears

- 10.17 Yamaha