PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1685135

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1685135

Bumper Sensor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

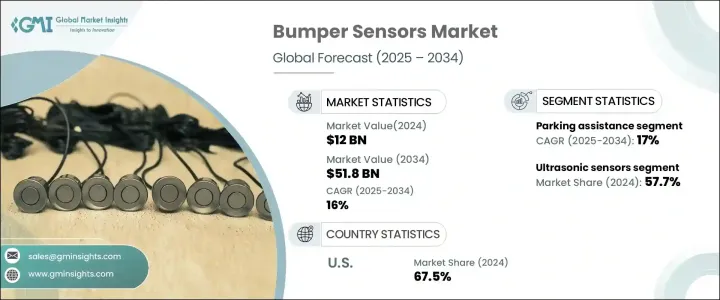

The Global Bumper Sensor Market was valued at USD 12 billion in 2024 and is projected to grow at a CAGR of 16% from 2025 to 2034. This growth is driven by the increasing integration of bumper sensors with Advanced Driver Assistance Systems (ADAS), which enhance vehicle safety through automated braking and accident prevention. The ability of these sensors to collect real-time data improves driving experiences, minimizes accidents, and strengthens the demand for advanced safety features. The widespread adoption of ADAS in modern vehicles is fueling the demand for bumper sensors, creating a synergy that accelerates technological innovation and market expansion.

Bumper sensors play a crucial role in preventing collisions and reducing insurance claims by automatically detecting obstacles and sending alerts or activating brakes. These sensors help ensure passenger safety while also making vehicles more attractive to insurance companies and manufacturers. As automakers prioritize safety, the integration of bumper sensors in vehicles continues to increase, further supporting market growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12 billion |

| Forecast Value | $51.8 billion |

| CAGR | 16% |

By technology, the bumper sensor market includes ultrasonic sensors, electromagnetic sensors, infrared sensors, and others. In 2024, ultrasonic sensors led the market with a 57.7% share. These sensors accurately detect nearby objects by emitting ultrasonic waves and measuring the time it takes for the waves to return. Their reliability in determining proximity makes them essential in modern vehicles, particularly for parking assistance and ADAS features. Due to their cost-effectiveness, versatility, and efficiency, ultrasonic sensors have become the preferred choice for automakers, further driving the expansion of the bumper sensor industry.

Based on application, the market is segmented into parking assistance, blind spot detection, collision avoidance, and others. The parking assistance segment is projected to grow at a CAGR of 17% during the forecast period. Increasing consumer demand for convenience and safety is propelling the adoption of bumper sensors in parking assistance systems. These systems help vehicles identify obstacles and provide real-time feedback, ensuring drivers can park more accurately and safely. This feature is particularly valuable in urban areas with limited parking space, where maneuvering can be challenging.

With ADAS becoming more prevalent, parking assistance is now a key feature in both premium and mass-market vehicles. Automakers are prioritizing parking assistance systems powered by bumper sensors to enhance vehicle safety and comply with evolving safety standards. As a result, these systems are being widely integrated into new vehicle models, supporting the rapid growth of the market.

In North America, the United States dominated the bumper sensor market in 2024, holding a 67.5% share. The country's focus on automotive innovation and consumer demand for high-tech safety systems is driving market expansion. The incorporation of bumper sensors in vehicles for ADAS features, such as collision avoidance and parking assistance, is becoming standard across the industry. Additionally, the rise in electric and autonomous vehicle production, along with stringent safety regulations, is further increasing the adoption of these sensors. With leading automotive manufacturers and technology providers advancing sensor technologies, the United States remains a significant player in the global bumper sensor market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Combination of advanced driver assistance systems (ADAS)

- 3.6.1.2 Reduction in accidents and insurance claims

- 3.6.1.3 Regulatory requirements boosting bumper sensor consumption

- 3.6.1.4 Expanding automotive sector boosting demand for bumper sensors

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Limited integration with older vehicles

- 3.6.2.2 Complex repair procedures

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Technology, 2021-2034 (USD Billion) (Volume Units)

- 5.1 Key trends

- 5.2 Ultrasonic sensors

- 5.3 Electromagnetic sensors

- 5.4 Infrared sensors

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Volume Units)

- 6.1 Key trends

- 6.2 Parking assistance

- 6.3 Collision avoidance

- 6.4 Blind spot detection

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Vehicle Type, 2021-2034 (USD Billion) (Volume Units)

- 7.1 Key trends

- 7.2 Passenger cars

- 7.3 Commercial vehicles

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021-2034 (USD Billion) (Volume Units)

- 8.1 Key trends

- 8.2 Original Equipment Manufacturers (OEMs)

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Volume Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Analog Devices, Inc.

- 10.2 Aptiv (Formerly Delphi Technologies)

- 10.3 Continental AG

- 10.4 Denso Corporation

- 10.5 Gentex Corporation

- 10.6 HELLA GmbH & Co. KGaA

- 10.7 Heraeus Sensor Technology

- 10.8 Hitachi Automotive Systems

- 10.9 Hyundai Mobis

- 10.10 Infineon Technologies AG

- 10.11 Leddartech

- 10.12 Magna International Inc.

- 10.13 Murata Manufacturing Co., Ltd.

- 10.14 NXP Semiconductors

- 10.15 Proxel

- 10.16 Robert Bosch GmbH

- 10.17 Steelmate Automotive

- 10.18 Texas Instruments Incorporated

- 10.19 Valeo

- 10.20 ZF Friedrichshafen AG