PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1685191

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1685191

Beta Alanine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

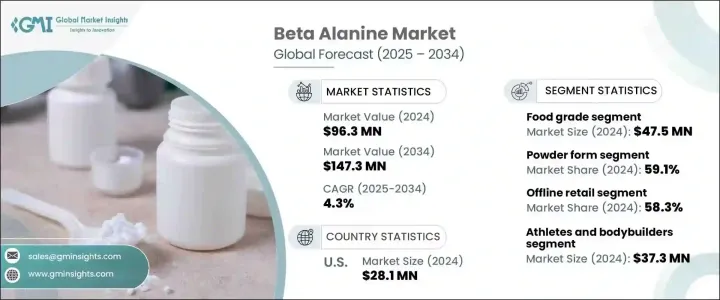

The Global Beta Alanine Market reached USD 96.3 million in 2024 and is projected to expand at a CAGR of 4.3% from 2025 to 2034. Beta alanine, a non-essential amino acid, plays a crucial role in boosting carnosine levels in the body, helping delay muscle fatigue by reducing lactic acid buildup during intense physical activity. This unique benefit has made beta alanine a highly sought-after ingredient in pre-workout supplements, driving its popularity in the fitness and sports nutrition markets. As more consumers turn to fitness routines to improve health, beta alanine has become a staple in their pursuit of better performance and faster recovery.

The market for beta alanine is experiencing steady growth across multiple industries. In the pharmaceutical sector, there's a growing demand for beta alanine due to its potential health benefits, particularly in managing chronic diseases. The increasing prevalence of health issues and a rising preference for natural and effective ingredients are pushing the adoption of beta alanine in supplements aimed at improving physical well-being. Additionally, the food and beverage industry is seeing a surge in the use of beta alanine as a functional ingredient, especially in energy drinks and dietary products. This growing shift towards organic, clean-label products has created new opportunities for beta alanine, with consumers looking for natural ways to enhance their energy and stamina.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $96.3 Million |

| Forecast Value | $147.3 Million |

| CAGR | 4.3% |

By grade, the beta alanine market is divided into food grade, feed grade, and pharmaceutical grade. The food grade segment dominated the market in 2024, generating USD 47.5 million, and it is expected to continue expanding due to the increased consumer demand for functional foods and beverages enriched with amino acids. The rising trend toward healthier eating habits and the shift towards more health-conscious consumer behavior has been instrumental in supporting this growth. As more people seek ways to optimize their health, the use of beta alanine in food products continues to rise.

The market is also segmented by form, with powder, capsules, tablets, and liquid being the primary categories. In 2024, the powder form segment accounted for the largest market share, holding 59.1% of the market. Its versatility and ease of use in sports nutrition and dietary supplements are key factors driving this dominance. Powdered beta alanine allows for easy customization of dosages, catering to a variety of consumer needs and preferences while also facilitating its incorporation into various product formulations.

In the U.S., the beta alanine market generated USD 28.1 million in 2024, driven by the booming demand for sports nutrition products. The growing fitness and wellness trends, coupled with increasing consumer awareness about the benefits of beta alanine in enhancing exercise performance and reducing fatigue, are expected to continue propelling market expansion in the region.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing popularity of energy drinks

- 3.6.1.2 Rising demand for sports nutrition and supplements

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High cost of beta-alanine

- 3.6.2.2 Competition from other sports nutrition supplements

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Grade, 2021-2034 (USD Million, Units)

- 5.1 Key trends

- 5.2 Food grade

- 5.3 Feed grade

- 5.4 Pharmaceutical grade

Chapter 6 Market Size and Forecast, By Type, 2021-2034 (USD Million, Units)

- 6.1 Key trends

- 6.2 Powder

- 6.3 Capsules

- 6.4 Tablets

- 6.5 Liquid

Chapter 7 Market Size and Forecast, By Application, 2021-2034 (USD Million, Units)

- 7.1 Key trends

- 7.2 Dietary supplements

- 7.3 Pharmaceuticals

- 7.4 Cosmetics

- 7.5 Food and beverages

- 7.6 Animal feed

Chapter 8 Market Size and Forecast, By Distribution Channel, 2021-2034 (USD Million, Units)

- 8.1 Key trends

- 8.2 Online retail

- 8.3 Offline retail

Chapter 9 Market Size and Forecast, By End Use, 2021-2034 (USD Million, Units)

- 9.1 Key trends

- 9.2 Athletes and bodybuilders

- 9.3 Patients with specific medical conditions

- 9.4 Food and beverage manufacturers

- 9.5 Cosmetics and skincare companies

- 9.6 Others

Chapter 10 Market Size and Forecast, By Region, 2021-2034 (USD Million, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Anhui Huaheng Biotechnology

- 11.2 Cellucor

- 11.3 Evlution Nutrition

- 11.4 Hi-Tech Pharmaceuticals

- 11.5 Natural Alternatives International

- 11.6 NOW Foods

- 11.7 Nutricost

- 11.8 Thorne Research

- 11.9 Ultimate Nutrition

- 11.10 Yuki Gosei Kogyo