PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1685201

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1685201

Multi Core Armored Cable Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

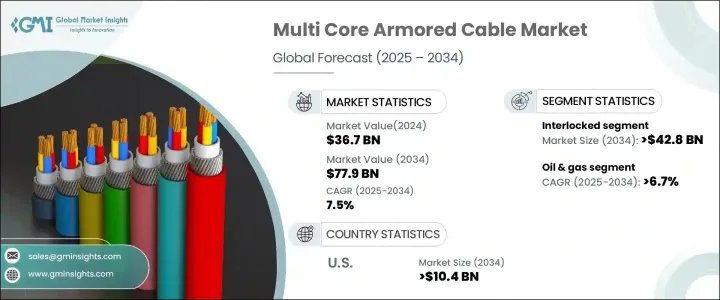

The Global Multi Core Armored Cable Market, with its valuation reaching USD 36.7 billion in 2024, is estimated to grow at a CAGR of 7.5% between 2025 and 2034. This growth is driven by the rising demand for durable and robust cable solutions across industries such as construction, energy, and telecommunications. Increasing urbanization and infrastructure development, particularly in emerging economies, are key contributors to this trend. As cities expand and industrial projects intensify, the need for reliable armored cables that offer protection against mechanical damage, moisture, and environmental stress has surged. Moreover, the transition toward renewable energy projects, including solar and wind farms, continues to play a pivotal role in propelling market demand. These cables ensure efficient and secure power transmission even in the most challenging environments. Furthermore, heightened safety standards and the critical need for high-performance wiring in hazardous locations, such as oil and gas facilities, are driving the adoption of multi-core armored cables.

The market is also benefiting from advancements in cable technology, which have led to the development of more flexible and resilient solutions tailored to meet specific industry demands. Multi-core armored cables are favored for their ability to safeguard against environmental and mechanical stresses while ensuring uninterrupted operations in mission-critical applications. Additionally, growing investments in smart grid infrastructure and the integration of advanced energy systems are further enhancing the demand for these cables. With industries worldwide emphasizing operational reliability and efficiency, the importance of high-performance armored cables is expected to continue growing over the next decade.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $36.7 Billion |

| Forecast Value | $77.9 Billion |

| CAGR | 7.5% |

The interlocked armor segment is projected to reach USD 42.8 billion by 2034, driven by its superior ability to withstand mechanical stress and environmental challenges. The unique interlocked construction of these cables offers enhanced flexibility and exceptional resistance to physical damage, making them indispensable in industries such as construction, power distribution, and oil and gas. These cables are particularly valuable in harsh operational environments, where their durability and reliability ensure consistent performance.

In the oil and gas sector, the multi-core armored cable market is expected to achieve a CAGR of 6.7% through 2034. This growth is fueled by the increasing demand for robust cable solutions capable of withstanding extreme mechanical stress, high temperatures, and chemical exposure. Offshore and onshore oil and gas exploration activities, including deep-sea drilling, refineries, and petrochemical plants, rely heavily on these cables to maintain safe and continuous operations.

The U.S. multi-core armored cable market is forecast to generate USD 10.4 billion by 2034, supported by rising demand for high-performance cable solutions across the construction, energy, and telecommunications sectors. With accelerating urbanization and industrial expansion in the U.S., the need for reliable power transmission systems has surged. Multi-core armored cables are increasingly preferred for their superior protection against mechanical damage, environmental stress, and electromagnetic interference, making them a critical component in modern infrastructure projects.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Armor Type, 2021 – 2034 (USD Million, ‘000 Tonnes)

- 5.1 Key trends

- 5.2 Interlocked

- 5.3 Continuously corrugated welded

Chapter 6 Market Size and Forecast, By End Use, 2021 – 2034 (USD Million, ‘000 Tonnes)

- 6.1 Key trends

- 6.2 Oil & gas

- 6.3 Manufacturing

- 6.4 Mining

- 6.5 Construction

- 6.6 Others

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (USD Million, ‘000 Tonnes)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 France

- 7.3.3 Germany

- 7.3.4 Italy

- 7.3.5 Russia

- 7.3.6 Spain

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Turkey

- 7.5.4 South Africa

- 7.5.5 Egypt

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 Anixter

- 8.2 AT&T

- 8.3 Atkore

- 8.4 Belden

- 8.5 Finolex

- 8.6 Furukawa Electric

- 8.7 Havells

- 8.8 Helukabel

- 8.9 KEI Industries

- 8.10 Leoni Cables

- 8.11 LS Cable & System

- 8.12 Nexans

- 8.13 NKT

- 8.14 Okonite

- 8.15 Omni Cables

- 8.16 Polycab

- 8.17 Prysmian

- 8.18 Riyadh Cables

- 8.19 RR Kabel

- 8.20 Southwire

- 8.21 Sumitomo Electric