PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1685206

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1685206

Satellite IoT Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

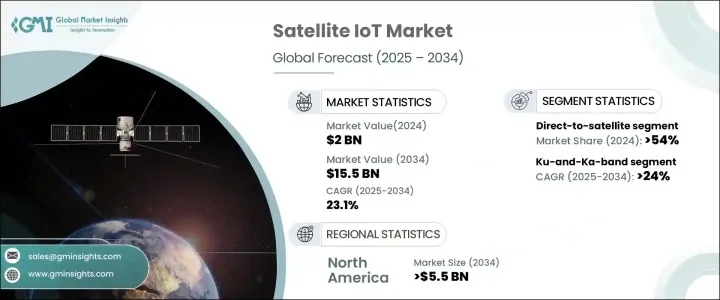

The Global Satellite IoT Market reached USD 2 billion in 2024 and is projected to grow at a remarkable CAGR of 23.1% between 2025 and 2034. The increasing reliance on uninterrupted IoT connectivity in remote and inaccessible regions is a key driver of this growth. Traditional communication networks often fail to provide reliable coverage in such areas, making satellite-based solutions indispensable for industries that depend on real-time data transmission. Companies in logistics, agriculture, and energy are leveraging satellite IoT to optimize operations, enhance efficiency, and improve decision-making through real-time analytics. The demand for seamless communication is rising as businesses prioritize asset tracking, environmental monitoring, and emergency response capabilities, further fueling market expansion.

Advancements in satellite technology, the increasing deployment of Low Earth Orbit (LEO) satellite networks, and the growing adoption of space-based IoT connectivity are accelerating the market's growth. Unlike conventional satellite networks, LEO satellites offer seamless, low-latency connectivity without requiring extensive ground infrastructure, making them a preferred choice for companies looking to expand coverage. The affordability and scalability of satellite IoT solutions are enabling enterprises of all sizes to integrate advanced communication systems into their operations. Governments and private space agencies are investing heavily in satellite constellations to enhance global connectivity, further boosting industry growth. Additionally, the rise of hybrid network models that combine satellite and terrestrial connectivity is creating new opportunities for businesses operating in remote locations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2 Billion |

| Forecast Value | $15.5 Billion |

| CAGR | 23.1% |

The market is segmented by service type into satellite IoT backhaul and direct-to-satellite. Direct-to-satellite services accounted for 54% of the market share in 2024 and are expected to grow significantly in the coming years. The growing deployment of LEO satellite networks is driving this trend, as these satellites provide reliable, uninterrupted connectivity without the need for extensive ground-based infrastructure. Businesses across multiple industries, including environmental monitoring, asset tracking, and emergency response, are increasingly adopting direct-to-satellite services for their efficiency and cost-effectiveness.

By frequency band, the market is categorized into Ku-and-Ka-band, L-band, S-band, and others. The Ku-and-Ka-band segment is poised to grow at a CAGR of 24% through 2034, driven by the need for high-speed data transfer and reliable long-distance communication. Industries such as maritime, aviation, and oil and gas are increasingly utilizing these frequency bands to ensure real-time monitoring and seamless operations in challenging environments. Enhanced bandwidth and connectivity reliability are making these bands the preferred choice for businesses that require uninterrupted communication.

North America satellite IoT market is expected to generate USD 5.5 billion by 2034, with the United States playing a leading role in driving adoption. The continuous advancements in LEO satellite technology are enhancing connectivity performance, while the shift toward hybrid satellite-terrestrial networks is ensuring seamless communication across industries. The growing focus on reducing latency and lowering operational costs through next-generation satellite networks is further accelerating adoption. As enterprises seek to overcome geographic barriers and expand their IoT capabilities, satellite-based solutions are becoming an integral part of modern communication infrastructure.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Expansion of Low Earth Orbit (LEO) satellite networks

- 3.6.1.2 Integration of satellite IoT with terrestrial networks enables seamless connectivity

- 3.6.1.3 Increasing demand for global connectivity

- 3.6.1.4 Growing incorporation of AI and edge computing into satellite IoT systems

- 3.6.1.5 Rise in IoT device penetration

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Data security concerns

- 3.6.2.2 High cost of maintenance

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Services Type, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Satellite IoT backhaul

- 5.3 Direct-to-Satellite

Chapter 6 Market Estimates & Forecast, By Frequency Band, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 L-Band

- 6.3 Ku-and-Ka-Band

- 6.4 S-Band

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Organization Size, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 Large enterprises

- 7.3 SME

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 Maritime

- 8.3 Oil & gas

- 8.4 Energy & utilities

- 8.5 Transportation & logistics

- 8.6 Healthcare

- 8.7 Agriculture

- 8.8 Military & defense

- 8.9 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AAC Clyde Space

- 10.2 Airbus

- 10.3 BAE Systems

- 10.4 Blue Origin

- 10.5 China Aerospace Science and Technology Corporation

- 10.6 Exolaunch

- 10.7 GomSpace

- 10.8 Lockheed Martin

- 10.9 Maxar Technologies

- 10.10 Millennium Space Systems

- 10.11 Mitsubishi Electric

- 10.12 Northrop Grumman

- 10.13 OHB

- 10.14 OneWeb

- 10.15 RTX

- 10.16 Sierra Nevada

- 10.17 SpaceX

- 10.18 Thales Alenia Space