PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1685223

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1685223

Hibiscus Flower Powder Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

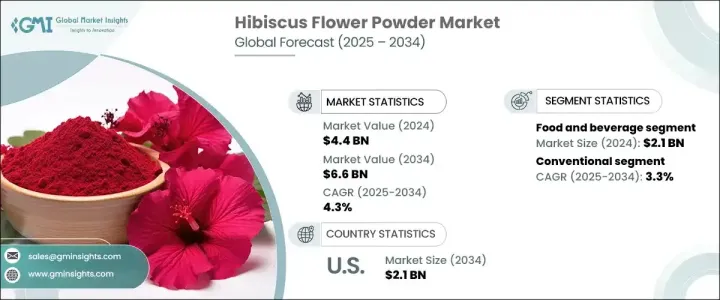

The Global Hibiscus Flower Powder Market reached an impressive USD 4.4 billion in 2024 and is projected to grow at a CAGR of 4.3% from 2025 to 2034. This growth trajectory is primarily driven by the increasing consumer awareness surrounding the health benefits of hibiscus powder, including its antioxidant-rich properties, potential heart health benefits, and its high vitamin C content. As consumers continue to favor natural and herbal alternatives over synthetic options, the demand for hibiscus-based products, ranging from food and beverages to supplements and skincare, is gaining momentum.

The rising popularity of plant-based and organic ingredients is also boosting the demand for hibiscus powder. With people becoming more health-conscious and eco-friendly, hibiscus is emerging as a key ingredient for those seeking wellness-boosting products. This trend is evident not only in food and beverages but also in skincare, where hibiscus is prized for its rejuvenating and anti-aging properties. The hibiscus flower powder market is benefiting from these changing consumer preferences, and as more individuals opt for holistic health and beauty products, hibiscus powder is positioning itself as an essential addition to a health-conscious lifestyle.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.4 Billion |

| Forecast Value | $6.6 Billion |

| CAGR | 4.3% |

The conventional hibiscus powder segment, which is expected to generate USD 4.2 billion in 2024, is set to grow at a steady 3.3% CAGR through 2034. This growth can be attributed to the increasing demand for natural, chemical-free products. Consumers are now more inclined to choose organic hibiscus powder, which is sourced from sustainably grown, pesticide-free flowers. With rising awareness about health and environmental sustainability, the shift toward organic products is expected to continue, further propelling market growth.

In the food and beverage sector, hibiscus powder holds a significant market share, accounting for 45.8% and valued at USD 2.1 billion in 2024. The sector is poised for further expansion, with a projected CAGR of 4.2% through 2034. The demand for hibiscus powder in food and beverages is fueled by its refreshing taste, vibrant color, and health-promoting benefits, such as aiding digestion and regulating blood pressure. It is becoming a popular ingredient in products like herbal teas, smoothies, beverages, and jams, thus increasing its presence across the food industry.

The U.S. hibiscus flower powder market is expected to reach USD 2.1 billion in 2024, with a CAGR of 3.2% from 2025 to 2034. This growth is largely driven by the rising consumer demand for natural and health-focused products, particularly in the beverage sector, where hibiscus powder is gaining popularity in herbal teas and functional drinks. Additionally, the cosmetics sector is embracing hibiscus powder for its anti-aging and skin-soothing properties, contributing to its growing market presence. As consumers increasingly seek natural alternatives in both food and skincare, hibiscus powder is poised to remain a highly sought-after ingredient.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.7 Industry impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Growing health awareness

- 3.7.1.2 Rising popularity of health and natural products

- 3.7.1.3 Growing popularity of hibiscus in the cosmetic and skincare industry

- 3.7.2 Market challenges

- 3.7.2.1 Seasonal nature of production

- 3.7.1 Growth drivers

- 3.8 Regulations & market impact

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Source, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Organic

- 5.3 Conventional

Chapter 6 Market Size and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Food and beverages

- 6.3 Cosmetics and personal care

- 6.4 Nutraceuticals and dietary supplements

- 6.5 Pharmaceutical

Chapter 7 Market Size and Forecast, By Function, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Tea and herbal infusions

- 7.3 Food products

- 7.4 Beverages

Chapter 8 Market Size and Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Online retail

- 8.3 Supermarkets/Hypermarkets

- 8.4 Specialty stores

- 8.5 Health food stores

- 8.6 Others

Chapter 9 Market Size and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Danone

- 10.2 Fage

- 10.3 General Mills

- 10.4 Greek Gods

- 10.5 La Yogurt

- 10.6 Lifeway Foods

- 10.7 Nestle

- 10.8 Stonyfield Farms

- 10.9 Valio

- 10.10 Yakult

- 10.11 Yoplait

- 10.12 Chobani