PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928912

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928912

Self-driving Cars Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

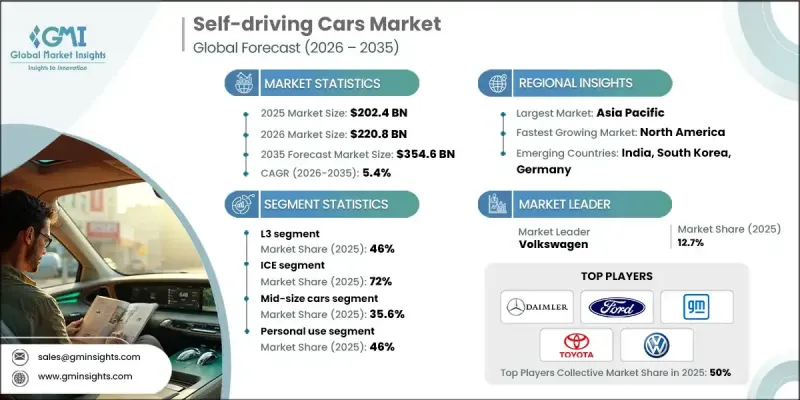

The Global Self-driving Cars Market was valued at USD 202.4 billion in 2025 and is estimated to grow at a CAGR of 5.4% to reach USD 354.6 billion by 2035.

Increased focus on minimizing traffic-related risks and improving travel efficiency continues to accelerate adoption. Regulatory frameworks that support controlled testing and early deployment are opening new commercialization opportunities for autonomous technologies. Advancements in artificial intelligence, sensing systems, and high-performance computing are improving system reliability and real-world performance. Integration of autonomous vehicles with intelligent urban infrastructure is strengthening market momentum through connected traffic platforms, vehicle-to-infrastructure communication, and adaptive routing capabilities. These technologies are improving traffic flow, lowering congestion levels, and supporting reduced energy consumption. Growth is further supported by the expansion of autonomous mobility platforms, which are reshaping urban transportation economics and improving fleet efficiency while enabling scalable automated transport models. The autonomous mobility as a service platform market continues to expand as fleet operators report operational cost reductions of at least 30% following the adoption of automation-focused systems. These platforms are proving commercially viable and scalable, reinforcing long-term confidence in automated transportation services.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $202.4 Billion |

| Forecast Value | $354.6 Billion |

| CAGR | 5.4% |

The Level 3 automation segment held a 46% share in 2025 and is forecast to grow at a CAGR of 5.2% from 2026 to 2035. Level 3 vehicles allow partial disengagement from driving tasks while ensuring driver readiness, making them widely adopted across multiple vehicle categories. A significant portion of autonomous development programs continues to focus on Level 3 functionality, supporting sustained demand.

The internal combustion engine vehicles segment accounted for 72% share in 2025 and is expected to grow at a CAGR of 4.8% through 2035. These vehicles benefit from established manufacturing platforms that simplify automation integration. Electric autonomous vehicles represent the second-largest segment due to their compatibility with software-driven architectures, advanced sensor arrays, and centralized computing systems, while ICE platforms rely more heavily on mechanical performance characteristics.

United States Self-driving Cars Market held an 83% share and generated USD 33.6 billion in 2025. Strong investment activity, favorable policy initiatives, and accelerating commercial deployment continue to position the country as a central hub for autonomous vehicle development and long-term market growth.

Key companies active in the Global Self-driving Cars Market include Tesla, Toyota Motor, Hyundai Motor, Volkswagen, General Motors, BMW, Ford Motor Company, Daimler (Mercedes-Benz), Honda Motor, and BYD. Companies in the Global Self-driving Cars Market are strengthening their market position through aggressive investment in artificial intelligence, advanced driver assistance software, and proprietary autonomous platforms. Strategic partnerships with technology providers are enabling faster innovation cycles and improved system integration. Automakers are prioritizing scalable architectures that support multiple autonomy levels across vehicle portfolios. Continuous real-world testing and data-driven optimization remain central to product refinement. Firms are also focusing on regulatory alignment and safety validation to accelerate approvals. Expansion into fleet-based and mobility service models is helping companies diversify revenue streams.

Table of Contents

Chapter 1 Methodology

- 1.1 Research approach

- 1.2 Quality Commitments

- 1.2.1 GMI AI policy & data integrity commitment

- 1.2.1.1 Source consistency protocol

- 1.2.1 GMI AI policy & data integrity commitment

- 1.3 Research Trail & Confidence Scoring

- 1.3.1 Research Trail Components

- 1.3.2 Scoring Components

- 1.4 Data Collection

- 1.4.1 Partial list of primary sources

- 1.5 Data mining sources

- 1.5.1 Paid sources

- 1.5.1.1 Sources, by region

- 1.5.1 Paid sources

- 1.6 Base estimates and calculations

- 1.6.1 Base year calculation for any one approach

- 1.7 Forecast model

- 1.7.1 Quantified market impact analysis

- 1.7.1.1 Mathematical impact of growth parameters on forecast

- 1.7.1 Quantified market impact analysis

- 1.8 Research transparency addendum

- 1.8.1 Source attribution framework

- 1.8.2 Quality assurance metrics

- 1.8.3 Our commitment to trust

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Level of Autonomy

- 2.2.3 Propulsion

- 2.2.4 Technology

- 2.2.5 Vehicle

- 2.2.6 Application

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1.1 Growth drivers

- 3.2.1.2 Road safety and accident reduction

- 3.2.1.3 Advancements in artificial intelligence and sensors

- 3.2.1.4 Government testing approvals and regulations

- 3.2.1.5 Growth of autonomous mobility services

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High development and validation costs

- 3.2.2.2 Regulatory uncertainty across regions

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of robotaxi and autonomous fleet services

- 3.2.3.2 Autonomous logistics and freight transport

- 3.2.3.3 Integration with smart city infrastructure

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 US National Highway Traffic Safety Administration (NHTSA) FMVSS Updates for Automated Vehicles

- 3.4.1.2 US Department of Transportation (DOT) Automated Vehicles Comprehensive Plan (AVCP)

- 3.4.1.3 State-Level Autonomous Testing Permits (California DMV & Nevada DMV Guidelines)

- 3.4.1.4 Transport Canada Guidelines for Testing Automated Driving Systems (ADS)

- 3.4.2 Europe

- 3.4.2.1 UNECE Regulation No. 157 on Automated Lane Keeping Systems (ALKS)

- 3.4.2.2 European Union General Safety Regulation (GSR) for Type Approval of ADS

- 3.4.2.3 Germany Federal Motor Transport Authority (KBA) Level 4 Operating Permits

- 3.4.2.4 UK Automated Vehicles Act and Liability Frameworks

- 3.4.3 Asia Pacific

- 3.4.3.1 China Ministry of Industry and Information Technology (MIIT) ICV Market Access Guide

- 3.4.3.2 Japan Ministry of Land, Infrastructure, Transport and Tourism (MLIT) Level 4 Licensing

- 3.4.3.3 South Korea MOLIT Safety Standards for Autonomous Vehicle Commercialization

- 3.4.3.4 Singapore Technical Reference 68 (TR 68) for Autonomous Vehicles

- 3.4.3.5 India Ministry of Road Transport and Highways (MoRTH) Emerging ADAS Guidelines

- 3.4.4 Latin America

- 3.4.4.1 Brazil National Traffic Council (CONTRAN) Resolutions on Assisted Driving

- 3.4.4.2 Mexico Mobility & Road Safety General Law (LGMSV) Implications for Automation

- 3.4.4.3 Chile Ministry of Transport Regulations on Autonomous Pilot Testing

- 3.4.4.4 Regional Alignment with UN World Forum for Harmonization of Vehicle Regulations (WP.29)

- 3.4.5 Middle East & Africa

- 3.4.5.1 UAE Roads and Transport Authority (RTA) Regulations for Autonomous Transport

- 3.4.5.2 Saudi Arabia SASO Technical Standards for Electric and Autonomous Vehicles

- 3.4.5.3 Israel Ministry of Transport Guidelines for Driverless Vehicle Trials

- 3.4.5.4 South Africa Standards for Intelligent Transport Systems (ITS) Deployment

- 3.4.1 North America

- 3.5 Porter';s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 AV System Architecture & Software Stack

- 3.13.1 Autonomous driving system architecture & stack analysis

- 3.13.2 Compute, sensor, and software orchestration models

- 3.14 Autonomous Software, AI & Data Flywheel

- 3.15 Validation, Testing & Safety Assurance Framework

- 3.16 AV Business Models & Monetization

- 3.17 HD Mapping, V2X & Infrastructure Dependency

- 3.18 Consumer Trust & Adoption Barriers

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Level of Autonomy, 2022 - 2035 (USD Mn, Units)

- 5.1 Key trends

- 5.2 L1

- 5.3 L2

- 5.4 L3

- 5.5 L4

- 5.6 L5

Chapter 6 Market Estimates & Forecast, By Propulsion, 2022 - 2035 (USD Mn, Units)

- 6.1 Key trends

- 6.2 ICE

- 6.3 Electric

- 6.4 Hybrid vehicle

Chapter 7 Market Estimates & Forecast, By Technology, 2022 - 2035 (USD Mn, Units)

- 7.1 Key trends

- 7.2 Camera-Based Systems

- 7.3 Radar-Based Systems

- 7.4 LiDAR-Based Systems

- 7.5 Sensor Fusion Systems

Chapter 8 Market Estimates & Forecast, By Vehicle, 2022 - 2035 (USD Mn, Units)

- 8.1 Key trends

- 8.2 Compact cars

- 8.3 Mid-size cars

- 8.4 SUVs & luxury cars

Chapter 9 Market Estimates & Forecast, By Application, 2022 - 2035 (USD Mn, Units)

- 9.1 Key trends

- 9.2 Personal use

- 9.3 Shared mobility

- 9.4 Logistics & delivery

- 9.5 Public transport

- 9.6 Others

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035 (USD Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.3.8 Netherlands

- 10.3.9 Sweden

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Singapore

- 10.4.7 Thailand

- 10.4.8 Indonesia

- 10.4.9 Vietnam

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

- 10.6.4 Turkey

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 BMW

- 11.1.2 Daimler (Mercedes-Benz)

- 11.1.3 Ford Motor Company

- 11.1.4 General Motors (GM)

- 11.1.5 Honda Motor

- 11.1.6 Hyundai Motor

- 11.1.7 Stellantis

- 11.1.8 Tesla

- 11.1.9 Toyota Motor

- 11.1.10 Volkswagen

- 11.2 Regional Players

- 11.2.1 BYD

- 11.2.2 Geely

- 11.2.3 Renault-Nissan-Mitsubishi Alliance

- 11.2.4 SAIC Motor

- 11.2.5 Tata Motors

- 11.3 Emerging Players / Disruptors

- 11.3.1 Aurora Innovation

- 11.3.2 Baidu

- 11.3.3 NIO

- 11.3.4 Waymo

- 11.3.5 XPeng Motors