PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698280

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698280

Incretin-based Drugs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

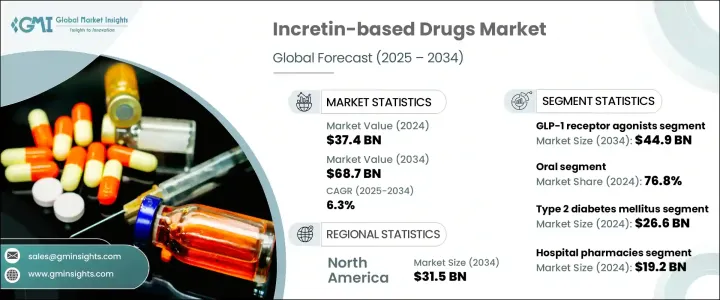

The Global Incretin-Based Drugs Market was valued at USD 37.4 billion in 2024 and is predicted to grow at a CAGR of 6.3% from 2025 to 2034. Incretin-based drugs help manage type 2 diabetes by stimulating insulin secretion through gut hormones, which regulate blood sugar levels after meals. The growing prevalence of diabetes, primarily due to obesity, aging populations, and sedentary lifestyles, is a key factor driving market expansion. Increasing patient awareness, advancements in drug formulations, and improved accessibility to diabetes treatments further support this growth.

The market is categorized by drug type into GLP-1 receptor agonists and DPP-4 inhibitors, with a market size of USD 35.5 billion in 2023. The rising demand for GLP-1 receptor agonists is driven by their ability to enhance insulin secretion and suppress glucagon levels, effectively managing blood sugar. These drugs also promote weight loss by controlling appetite and slowing digestion, making them a preferred option for diabetes patients. Extended-release formulations, such as once-weekly injections, improve patient adherence and expand market reach.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $37.4 Billion |

| Forecast Value | $68.7 Billion |

| CAGR | 6.3% |

The market is also segmented by the route of administration into oral and injectable drugs. The oral segment accounted for USD 28.7 billion in 2024, with a market share of 76.8%. Oral formulations offer a convenient alternative to injections, leading to higher patient compliance. Continuous research efforts have led to improved efficacy and safety profiles, making oral medications increasingly preferred. These formulations are easy to distribute, store, and administer, reducing the burden on healthcare providers and enhancing accessibility across various healthcare settings.

By indication, the market includes type 2 diabetes mellitus, obesity and weight management, and other metabolic disorders. The type 2 diabetes mellitus segment held the largest share, generating USD 26.6 billion in revenue in 2024. The rising global incidence of type 2 diabetes, attributed to poor dietary habits and lifestyle factors, fuels the demand for incretin-based drugs. These medications effectively lower blood sugar levels while reducing the risk of hypoglycemia, offering a safer treatment option for aging populations and those prone to severe blood sugar fluctuations.

The distribution channel segment comprises hospital pharmacies, retail pharmacies, and e-commerce. Hospital pharmacies led the market with USD 19.2 billion in revenue in 2024. These settings ensure secure access to medications, particularly for newly diagnosed patients or those requiring specialized care. Pharmacists provide guidance on dosage, side effects, and formulation differences, enhancing treatment adherence. Comprehensive support services, including medication management programs and close monitoring of treatment responses, further contribute to market growth.

North America dominated the market, accounting for USD 17.1 billion in 2024, with the U.S. leading at USD 15.5 billion. The rising prevalence of diabetes, cardiovascular diseases, and obesity continues to drive demand for incretin-based drugs. Supportive regulatory frameworks and rapid advancements in drug development contribute to the region's market expansion.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 Synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of type 2 diabetes mellitus

- 3.2.1.2 Shift toward non-insulin therapies

- 3.2.1.3 Advancements in drug delivery technologies

- 3.2.1.4 Cardiovascular and weight management benefits

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High treatment costs

- 3.2.2.2 Adverse effects and contraindications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Gap analysis

- 3.6 Pipeline analysis

- 3.7 Porter’s analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Drug Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 GLP-1 receptor agonists

- 5.3 DPP-4 inhibitors

Chapter 6 Market Estimates and Forecast, By Route of Administration, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Oral

- 6.3 Injectable

Chapter 7 Market Estimates and Forecast, By Indication, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Type 2 diabetes mellitus

- 7.3 Obesity and weight management

- 7.4 Other metabolic disorders

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacies

- 8.3 Retail pharmacies

- 8.4 E-commerce

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AstraZeneca

- 10.2 Boehringer Ingelheim

- 10.3 Eli Lilly and Company

- 10.4 GlaxoSmithKline

- 10.5 Lupin Limited

- 10.6 Merck

- 10.7 Novo Nordisk

- 10.8 Pfizer

- 10.9 Sanofi

- 10.10 Takeda Pharmaceutical Company

- 10.11 Viatris