PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698293

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698293

Earwax Removal Products Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

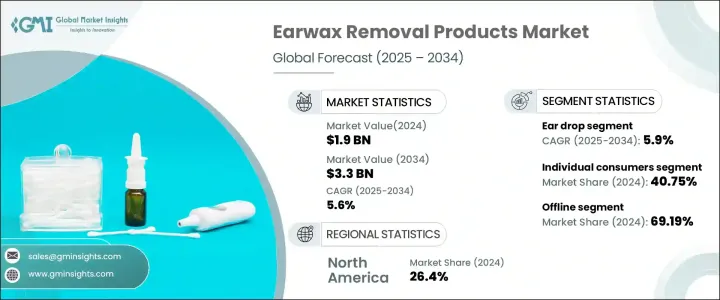

The Global Earwax Removal Products Market was valued at USD 1.9 billion in 2024 and is projected to grow at a CAGR of 5.6% from 2025 to 2034. The increasing prevalence of ear-related conditions is driving this market expansion as more individuals experience earwax buildup, infections, tinnitus, and hearing loss. Factors such as frequent use of earbuds and headphones, an aging population, and evolving lifestyle habits are contributing to excessive earwax accumulation, fueling the demand for at-home earwax removal solutions. Consumers are becoming increasingly aware of ear hygiene, leading to a strong preference for non-invasive, easy-to-use products that offer effective relief without requiring professional intervention. The shift toward self-care solutions, supported by greater accessibility of over-the-counter (OTC) earwax removal products, is further propelling market growth. Advancements in ear-cleaning technologies, such as smart earwax removal tools and automated irrigation systems, are also gaining traction, particularly among tech-savvy consumers seeking innovative and safer alternatives.

The market encompasses a range of products, including ear drops, ear candles, ear sprays, cotton swabs, and advanced tools like micro-suction devices and ear picks. The ear drops segment generated USD 800 million in 2024 and is expected to grow at a CAGR of 5.9% during the forecast period. The strong demand for ear drops is driven by their ease of use, affordability, and widespread availability. Medical professionals, including doctors and pharmacists, frequently recommend ear drops as a safe and effective solution for individuals who suffer from recurrent earwax buildup. Older adults and hearing aid users are particularly reliant on these products for regular ear hygiene maintenance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.9 billion |

| Forecast Value | $3.3 billion |

| CAGR | 5.6% |

The market is categorized based on end-users, including individual consumers, healthcare professionals, hospitals and clinics, and other facilities such as nursing homes. In 2024, individual consumers accounted for 40% of the market share, reflecting a growing awareness of ear hygiene and a preference for self-care. With aging-related hearing concerns, genetic predispositions, and increased use of hearing aids and earbuds, more individuals are turning to at-home earwax removal solutions. The rising trend of telehealth consultations and online pharmacy purchases has further enhanced consumer access to these products, making it easier to manage earwax concerns without professional medical visits.

North America earwax removal products market held a 26.4% share, generating USD 510 million in 2024. Earwax-related issues are particularly prevalent in the region, especially among the elderly population. Instead of seeking clinical treatments, many consumers prefer home-based solutions such as ear drops, irrigation kits, and high-tech cleaning tools. The adoption of smart earwax removal devices, including endoscopic cleaners, is on the rise, providing users with a more precise and effective way to manage earwax accumulation. The availability of OTC products without stringent regulatory restrictions further encourages consumers to try these solutions based on recommendations from healthcare providers, boosting overall market expansion.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research Approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier Landscape

- 3.3 Pricing analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Manufacturers

- 3.8 Distributors

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rising ear related issues

- 3.9.1.2 Growing awareness of ear health

- 3.9.1.3 Innovations in ear wax removal products

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Risks of damage associated with the use of these products

- 3.9.2.2 High Competition

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Consumer buying behavior

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn) (Thousand Units)

- 5.1 Key trends

- 5.2 Ear drops

- 5.2.1 Oil-based

- 5.2.2 Water-based

- 5.2.3 Chemical-based

- 5.3 Ear candles

- 5.4 Ear spray

- 5.5 Cotton Swabs & Buds

- 5.6 Others (Micro suction Devices, Ear Picks/Curettes, etc.)

Chapter 6 Market Estimates & Forecast, By Price, 2021 - 2034 ($Bn) (Thousand Units)

- 6.1 Key trends

- 6.2 Low

- 6.3 Medium

- 6.4 High

Chapter 7 Market Estimates & Forecast, By End-use, 2021 - 2034 ($Bn) (Thousand Units)

- 7.1 Key trends

- 7.2 Individual consumers

- 7.3 Healthcare professionals

- 7.3.1 ENT specialists

- 7.3.2 General practitioners

- 7.3.3 Audiologists

- 7.4 Hospitals and Clinics

- 7.5 Others (Nursing Homes, Assisted Living Facilities, etc.)

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn) (Thousand Units)

- 8.1 Key trends

- 8.2 Online

- 8.2.1 E-Commerce site

- 8.2.2 Company website

- 8.3 Offline

- 8.3.1 Specialty stores

- 8.3.2 Mega retail stores

- 8.3.3 Pharma

- 8.3.4 Others (Individual Stores, etc.)

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MAMEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Bausch + Lomb

- 10.2 Black Wolf Nation

- 10.3 Cerumol (Reckitt Benckiser)

- 10.4 Doctor Easy Medical Products

- 10.5 Eosera Inc.

- 10.6 Hear Right Technologies LLC

- 10.7 Hydro-Clean (EarTech)

- 10.8 Johnson & Johnson

- 10.9 Murine Ear

- 10.10 Neil Med Pharmaceuticals, Inc.

- 10.11 Prestige Consumer Healthcare Inc.

- 10.12 Shenzhen Bebird Technology Co., Ltd.

- 10.13 Similasan AG

- 10.14 WaxBGone