PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698506

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698506

Wi-Fi Chipset Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

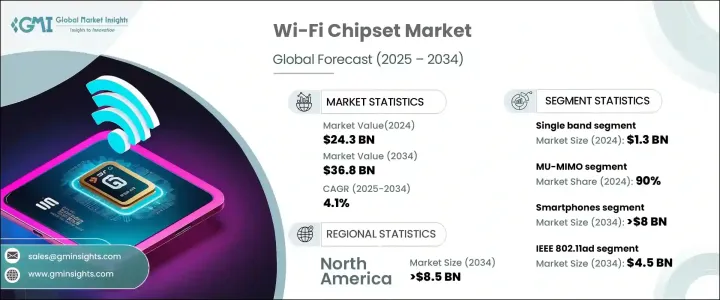

The Global Wi-Fi Chipset Market reached USD 24.3 billion in 2024 and is projected to grow at a CAGR of 4.1% from 2025 to 2034. The increasing adoption of IoT and connected devices, along with the growing deployment of public Wi-Fi, is driving demand. As digital transformation accelerates, the need for high-speed connectivity continues to rise. Consumers rely on seamless wireless communication for applications like streaming, gaming, and smart home technologies, fueling the expansion of the industry.

The Wi-Fi chipset market is segmented by band into single, dual, and tri-band. Dual-band Wi-Fi chipsets are witnessing significant demand due to their ability to support high-definition streaming, gaming, and emerging digital applications. Single-band Wi-Fi chipsets were valued at USD 1.3 billion in 2024 due to their affordability and energy efficiency. The rising adoption of IoT and smart home devices drives demand for single-band chipsets, as they provide reliable connectivity for applications like security cameras, smart lighting, and industrial sensors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $24.3 Billion |

| Forecast Value | $36.8 Billion |

| CAGR | 4.1% |

The market is further categorized by applications, including smartphones, tablets, desktops, laptops, and connected home devices. Wi-Fi chipsets in smartphones are projected to generate USD 8 billion by 2034, driven by increasing smartphone adoption and high-speed internet access worldwide. Consumers demand faster and more stable connections for everyday tasks, reinforcing the need for advanced Wi-Fi technology in mobile devices. As emerging economies witness a surge in smartphone users, reliance on Wi-Fi networks for internet access is expanding.

North American Wi-Fi chipset market is expected to reach USD 8.5 billion by 2034, driven by increasing demand for high-speed internet and digital transformation. The region's well-established 5G infrastructure supports the adoption of Wi-Fi 6 and Wi-Fi 6E chipsets, improving overall wireless connectivity. Rapid advancements in smart home technologies and enterprise digitalization are fueling industry expansion. The presence of key chipset manufacturers is accelerating innovation, ensuring the steady adoption of next-generation Wi-Fi solutions across consumer and business applications.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing IoT adoption

- 3.2.1.2 Advancements in Wi-Fi technology

- 3.2.1.3 Expansion of smart devices

- 3.2.1.4 Rise in smart city initiatives

- 3.2.1.5 Growing trend of 5G integration

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High production cost

- 3.2.2.2 Security concerns

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Band, 2021 – 2034 (USD Mn & Units)

- 5.1 Key trends

- 5.2 Single

- 5.3 Dual

- 5.4 Tri band

Chapter 6 Market Estimates and Forecast, By MIMO Configuration, 2021 – 2034 (USD Mn & Units)

- 6.1 Key trends

- 6.2 SU-MIMO

- 6.3 MU-MIMO

- 6.3.1 1x1 MU-MIMO

- 6.3.2 2x2 MU-MIMO

- 6.3.3 3x3 MU-MIMO

- 6.3.4 4x4 MU-MIMO

- 6.3.5 8x8 MU-MIMO

Chapter 7 Market Estimates and Forecast, By Standards, 2021 – 2034 (USD Mn & Units)

- 7.1 Key trends

- 7.2 IEEE 802.11ay

- 7.3 IEEE 802.11ad

- 7.4 IEEE 802.11ax (Wi-Fi 6 & Wi-Fi 6E)

- 7.5 IEEE 802.11ac

- 7.6 IEEE 802.11n (SB and DB)

- 7.7 EEE 802.11b/G

Chapter 8 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Mn & Units)

- 8.1 Key trends

- 8.2 Smartphones

- 8.3 Tablet

- 8.4 Desktop PC

- 8.5 Laptop

- 8.6 Connected home devices

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Mn & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Broadcom

- 10.2 ESPRESSIF SYSTEMS (SHANGHAI) CO., LTD

- 10.3 HiSilicon

- 10.4 I&C Technology

- 10.5 Infineon Technologies

- 10.6 Intel Corporation

- 10.7 MediaTek, Inc.

- 10.8 Microchip Technology Inc.

- 10.9 MORSE MICRO

- 10.10 Newracom

- 10.11 NXP Semiconductors

- 10.12 ON Semiconductors

- 10.13 PERASO TECHNOLOGIES INC.

- 10.14 Qualcomm Technologies, Inc.

- 10.15 Realtek Semiconductor Corp.

- 10.16 Renesas Electronics Corporation

- 10.17 Samsung Electronics Co., Ltd.

- 10.18 Silicon Laboratories

- 10.19 STMicroelectronics N.V.

- 10.20 Telit

- 10.21 Texas Instruments Incorporated.