PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698546

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698546

Commercial Loan Software Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

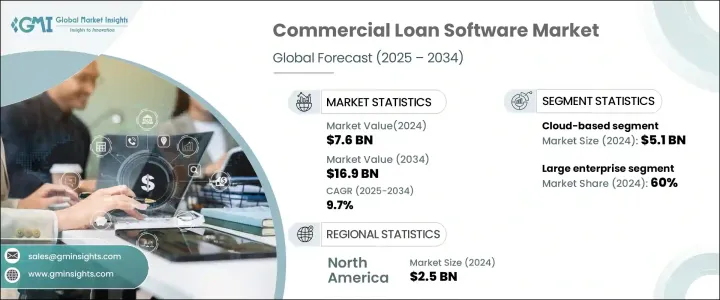

The Global Commercial Loan Software Market, valued at USD 7.6 billion in 2024, is set to expand at a CAGR of 9.7% from 2025 to 2034. The increasing need for financial institutions to comply with evolving regulations is driving the adoption of more sophisticated and adaptable software solutions. Advanced technologies such as AI and automation are transforming the industry by enhancing the speed and accuracy of loan processing, risk assessment, and credit decision-making. As economic conditions grow more complex, financial institutions are prioritizing credit risk management tools to mitigate lending risks effectively. This shift is accelerating market demand, as these tools help businesses assess and control risks associated with commercial lending.

Deployment-wise, the market is segmented into cloud-based and on-premises solutions. In 2024, cloud-based platforms led the sector with USD 5.1 billion in revenue and are expected to grow at a CAGR of around 10% throughout the forecast period. Institutions are rapidly transitioning to cloud-based systems due to their scalability, cost efficiency, and real-time data access. These platforms not only streamline operations but also foster better collaboration by providing seamless integration across departments. The ability to adapt quickly to market fluctuations and evolving customer needs further strengthens the appeal of cloud solutions in commercial lending.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.6 Billion |

| Forecast Value | $16.9 Billion |

| CAGR | 9.7% |

By enterprise size, the market is categorized into small and medium-sized enterprises (SMEs) and large enterprises. The latter accounted for 60% of the market share in 2024 and is anticipated to maintain steady growth with a CAGR of over 9% through 2032. Large organizations are leveraging automated platforms equipped with advanced analytics to manage complex loan contracts and optimize decision-making processes. These systems improve efficiency by offering data-driven insights that support financial risk management strategies, making them indispensable for enterprises handling extensive loan portfolios.

In terms of end use, the commercial loan software market is classified into banks, credit unions, mortgage lenders, brokers, and others. Banks remain the dominant segment, benefiting from expansive loan portfolios and strict regulatory requirements that necessitate automation. Financial institutions are increasingly integrating digital solutions to enhance loan origination, underwriting, and risk evaluation. The rise of digital banking, coupled with fintech collaborations, is further accelerating the adoption of such software within the banking sector.

The market is also segmented by product, including loan origination systems (LOS), loan servicing software, and credit analysis tools. Among these, LOS is projected to lead due to its critical role in automating loan approvals. These systems optimize borrower registration, document verification, and underwriting, significantly improving compliance and minimizing errors. Fintech firms are placing greater emphasis on LOS solutions, recognizing their efficiency in streamlining loan issuance processes.

Regionally, North America leads the market, contributing approximately 36% of the total share in 2024 and generating USD 2.5 billion in revenue. The integration of AI in loan servicing modules is gaining traction as financial institutions invest in automation to enhance loan underwriting and management processes. The region's focus on digital transformation and AI-driven lending solutions is reinforcing its market leadership.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Software developers

- 3.2.2 Technology providers

- 3.2.3 System integrators

- 3.2.4 End-users

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Rising demand for automated loan processing solutions

- 3.8.1.2 Increased adoption of cloud-based loan platforms

- 3.8.1.3 Growing need for enhanced credit risk management

- 3.8.1.4 Expanding digital transformation in financial institutions

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 High initial cost deterring small enterprises

- 3.8.2.2 Data security concerns with cloud-based solutions

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Loan origination systems (LOS)

- 5.2.1 Application processing

- 5.2.2 Loan approval & funding

- 5.3 Loan servicing software

- 5.3.1 Payment processing

- 5.3.2 Interest calculation

- 5.4 Credit analysis and underwriting tool

- 5.4.1 Credit scoring models

- 5.4.2 Risk assessment tools

- 5.4.3 Financial statement analysis

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Deployment Mode, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Cloud-based

- 6.3 On-premises

Chapter 7 Market Estimates & Forecast, By Enterprise Size, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 SME

- 7.3 Large Enterprise

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Banks

- 8.3 Credit unions

- 8.4 Mortgage lenders and brokers

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Abrigo

- 10.2 Automated Financial Systems

- 10.3 BankPoint

- 10.4 Bryt Software

- 10.5 Calyx Software

- 10.6 Comarch SA

- 10.7 Finastra

- 10.8 FIS

- 10.9 Fiserv

- 10.10 HiEnd Systems

- 10.11 ICE Mortgage Technology

- 10.12 Integra Software Systems

- 10.13 Linedata

- 10.14 LoanPro

- 10.15 nCino

- 10.16 Nortridge Software

- 10.17 Q2 Software

- 10.18 RealINSIGHT Software

- 10.19 Suntell

- 10.20 Turnkey Lender

- 10.21 Validis