PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1708143

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1708143

Automotive Belt Tensioner Pulleys Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

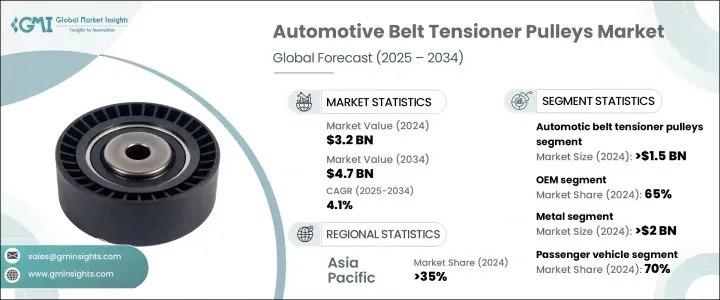

The Global Automotive Belt Tensioner Pulleys Market was valued at USD 3.2 billion in 2024 and is projected to grow at a CAGR of 4.1% between 2025 and 2034. This market is witnessing steady growth, driven by the increasing production of passenger and commercial vehicles worldwide. Automotive belt tensioner pulleys play a critical role in maintaining proper belt tension, reducing wear and tear, and optimizing engine efficiency. As vehicle manufacturers focus on high-performing, fuel-efficient, and durable engines, the demand for these components continues to rise.

The rapid expansion of the automotive industry, particularly in emerging economies, is further propelling market growth. Stringent regulatory standards aimed at reducing emissions and improving fuel efficiency have prompted automakers to integrate advanced tensioning solutions. Innovations in belt drive systems, including lightweight and high-durability materials, are enhancing the performance of belt tensioner pulleys. Additionally, the rising adoption of electric and hybrid vehicles is reshaping market dynamics, creating opportunities for specialized tensioning solutions tailored for advanced powertrain systems. With a shift towards sustainable mobility and modular engine designs, manufacturers are focusing on developing belt tensioner pulleys that ensure consistent performance under varying operating conditions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.2 Billion |

| Forecast Value | $4.7 Billion |

| CAGR | 4.1% |

The market is segmented into two primary product categories: automatic and manual belt tensioner pulleys. The automatic belt tensioner pulleys segment garnered a valuation of USD 1.5 billion in 2024, holding a significant market share. These self-adjusting pulleys are preferred across vehicle models as they maintain optimal belt tension without manual intervention, enhancing engine longevity and efficiency. The increasing demand for low-maintenance, high-precision components in modern vehicles is fueling the expansion of this segment.

The automotive belt tensioner pulleys market is also categorized by end-use applications, including original equipment manufacturers (OEM) and aftermarket sales. In 2024, the OEM segment accounted for 65% of the market share and is expected to grow steadily. Automakers are integrating custom-engineered belt tensioner pulleys to improve engine performance, meet fuel efficiency regulations, and enhance durability. The push for next-generation engine designs and modular belt drive systems in electric and hybrid vehicles is accelerating the adoption of advanced tensioner pulleys in the OEM sector.

China automotive belt tensioner pulleys market generated USD 332.5 million in 2024, cementing its position as a key regional player. With the country being one of the largest automotive manufacturers globally, rising vehicle production and increasing consumer demand for fuel-efficient automobiles are boosting the need for advanced belt tensioner pulley systems. The expansion of commercial vehicle fleets, driven by logistics growth and fleet management programs, is further driving demand for these components. As the automotive industry continues evolving, belt tensioner pulleys remain indispensable in ensuring seamless engine performance across various vehicle categories.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Manufacturers

- 3.2.2 Component suppliers

- 3.2.3 Service providers

- 3.2.4 Distributors

- 3.2.5 End use

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Cost analysis

- 3.7 Price trend

- 3.8 Comparative analysis of material performance

- 3.9 Patent analysis

- 3.10 Regulatory landscape

- 3.11 Impact forces

- 3.11.1 Growth drivers

- 3.11.1.1 Increasing vehicle production and aftermarket demand

- 3.11.1.2 Advancements in belt drive systems

- 3.11.1.3 Growing demand for electric and hybrid vehicles

- 3.11.1.4 Stringent emission and fuel efficiency regulations

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 Durability and performance limitations

- 3.11.2.2 Fluctuations in raw material prices

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Automatic belt tensioner pulleys

- 5.3 Manual belt tensioner pulleys

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger vehicle

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial vehicle

- 6.3.1 Light commercial vehicles (LCV)

- 6.3.2 Medium commercial vehicles (MCV)

- 6.3.3 Heavy commercial vehicles (HCV)

Chapter 7 Market Estimates & Forecast, By Material, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Metal

- 7.3 Plastic

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Engine timing system

- 8.3 Alternator system

- 8.4 Power steering system

- 8.5 Air conditioning system

- 8.6 Water pump system

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 ACDelco

- 11.2 Bando Chemical Industries

- 11.3 BorgWarner

- 11.4 Cloyes Gear & Products

- 11.5 Continental

- 11.6 Dayco Products

- 11.7 Fenner

- 11.8 Gates

- 11.9 Goodyear Belts

- 11.10 Hutchinson

- 11.11 INA Tensioner

- 11.12 JTEKT

- 11.13 Litens Automotive

- 11.14 Mitsuboshi Belting

- 11.15 NSK Automation

- 11.16 NTN

- 11.17 Pricol Limited

- 11.18 Schaeffler

- 11.19 SKF Group

- 11.20 Tsubakimoto Chain