PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1708147

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1708147

Automotive Load Floor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

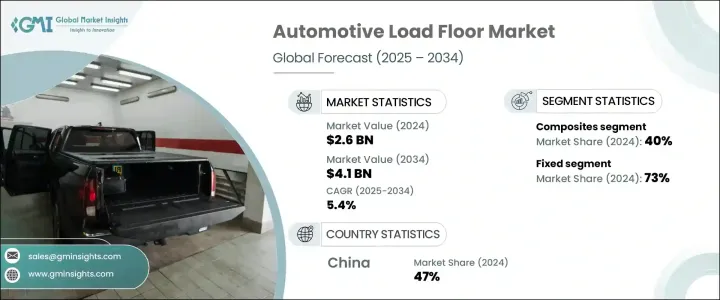

The Global Automotive Load Floor Market reached USD 2.6 billion in 2024 and is projected to grow at a CAGR of 5.4% during 2025-2034. This expansion is fueled by the rising demand for electric and autonomous vehicles (EVs and AVs), which require advanced designs and enhanced functionality. Automakers are increasingly focusing on ultra-lightweight yet durable load floors, as battery packs in electric vehicles are typically positioned beneath the floor. As a result, advanced materials like composites and thermoplastics are being adopted to improve space efficiency, optimize cargo capacity, and maintain structural integrity.

With a growing emphasis on fuel economy and sustainability, manufacturers are prioritizing lightweight materials to reduce carbon footprints. The integration of non-reinforced polymer composites, thermoplastics, and honeycomb structures into load floors plays a crucial role in lowering overall vehicle weight without sacrificing durability. This trend is gaining momentum as automakers work toward stringent emissions regulations and improved fuel efficiency. The shift toward sustainable solutions is further accelerated by increasing consumer awareness and regulatory mandates focusing on eco-friendly automotive components. The demand for high-performance materials is also driven by the rising production of premium and luxury vehicles, where lightweight yet robust load floor solutions are essential for enhanced functionality and comfort.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.6 billion |

| Forecast Value | $4.1 billion |

| CAGR | 5.4% |

The market is segmented by material type, including hardboard, honeycomb polypropylene, fluted polypropylene, and composites. Composites dominated the market in 2024 with a 40% share, driven by their lightweight, high-strength, and moisture-resistant properties. Carbon fiber reinforced plastic (CFRP) and glass fiber composite materials are gaining traction as they offer superior structural support while effectively reducing vehicle weight. These materials contribute significantly to fuel efficiency and lower carbon emissions, making them a preferred choice among automakers striving to meet sustainability goals.

Load floors are classified into fixed and sliding systems based on their operational characteristics. In 2024, fixed load floors accounted for 73% of the market share and are expected to continue experiencing robust growth. Fixed-load floors provide exceptional structural stability, durability, and cost-efficiency, making them the standard choice for passenger and commercial vehicles. These floors ensure optimal load distribution and enhanced security, making them more favorable than sliding alternatives.

China Automotive Load Floor Market generated USD 520 million in 2024, leading the global market due to the country's rapidly growing electric vehicle sector. Increasing demand for lightweight, high-performance load floor solutions is further reinforced by government incentives promoting the use of composites and environmentally friendly materials. The combination of supportive policies, technological advancements, and the expansion of domestic automakers strengthens China's position as a key player in the automotive load floor industry. As the global market moves toward greater sustainability and innovation, China's role is expected to remain pivotal in shaping the future landscape of automotive load floor solutions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Component manufacturers

- 3.2.3 Tier 1 suppliers

- 3.2.4 Original Equipment Manufacturers (OEMs)

- 3.2.5 Aftermarket suppliers

- 3.3 Profit margin analysis

- 3.4 Price trends

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rising demand for lightweight materials

- 3.9.1.2 Expansion of electric and autonomous vehicles

- 3.9.1.3 Increasing consumer demand for cargo management solutions

- 3.9.1.4 Stringent fuel efficiency and emission regulations

- 3.9.1.5 Advancements in manufacturing technologies

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Fluctuations in automotive production

- 3.9.2.2 Material cost volatility

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Material, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Hardboard

- 5.3 Fluted polypropylene

- 5.4 Honeycomb polypropylene

- 5.5 Composites

Chapter 6 Market Estimates & Forecast, By Operation, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Fixed

- 6.3 Sliding

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Passenger vehicles

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUV

- 7.3 Commercial vehicles

- 7.3.1 Light Commercial Vehicles (LCV)

- 7.3.2 Medium Commercial Vehicle (MCV)

- 7.3.3 Heavy Commercial Vehicles (HCV)

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 ABC Technologies

- 10.2 Applied Component Technology

- 10.3 Arlington Industries

- 10.4 ASG Group

- 10.5 Autoneum

- 10.6 CIE Automotive

- 10.7 Covestro

- 10.8 DS Smith

- 10.9 Gemini Group

- 10.10 Grudem

- 10.11 Huntsman

- 10.12 IDEAL Automotive

- 10.13 KRAIBURG TPE

- 10.14 Nagase America

- 10.15 Recticel

- 10.16 SA Automotive

- 10.17 Sonoco Products

- 10.18 Tricel Honeycomb

- 10.19 UFP Technologies

- 10.20 Woodbridge