PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913474

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913474

Commercial Vehicle ADAS Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

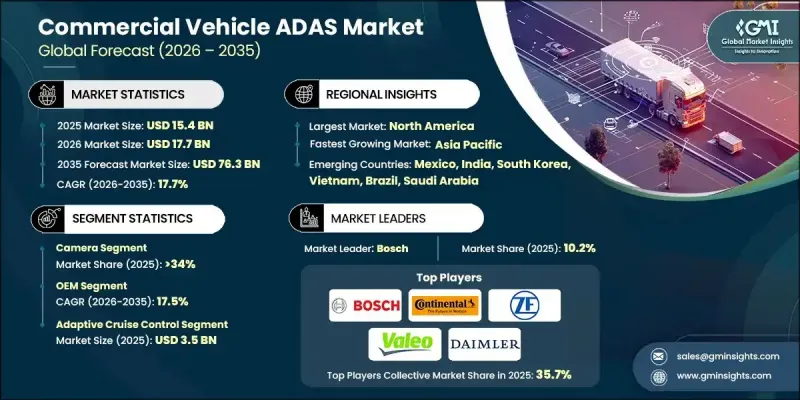

The Global Commercial Vehicle ADAS Market was valued at USD 15.4 billion in 2025 and is estimated to grow at a CAGR of 17.7% to reach USD 76.3 billion by 2035.

Strong momentum is driven by increasing regulatory focus on road safety and the growing emphasis on reducing accident-related costs within commercial fleets. Fleet owners and operators increasingly view advanced driver assistance technologies as essential tools for improving operational safety and efficiency. These systems support drivers by enhancing awareness, improving vehicle control, and reducing dependence on manual intervention. Adoption has accelerated as transportation companies prioritize risk mitigation and compliance with safety requirements. Technological progress has further strengthened demand, with artificial intelligence and machine learning enabling faster data processing and more accurate real-time decision-making. These innovations enhance vehicle responsiveness and improve overall system reliability. As commercial transport activity increases worldwide, the integration of ADAS continues to gain traction as a critical component of modern vehicle design and fleet management strategies.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $15.4 Billion |

| Forecast Value | $76.3 Billion |

| CAGR | 17.7% |

The OEM channel segment will grow at a CAGR of 17.5% from 2026 to 2035. Vehicle manufacturers integrate ADAS directly during production, allowing advanced safety features to be offered as built-in or configurable options. This approach improves system compatibility and performance while ensuring consistent quality standards, which explains the strong position of OEMs within the distribution landscape.

The adaptive cruise control segment reached USD 3.5 billion in 2025. This segment maintained its leadership due to its ability to support driver comfort and maintain consistent vehicle operation during extended driving conditions by automatically regulating speed based on traffic flow.

U.S. Commercial Vehicle ADAS Market reached USD 3.9 billion in 2025. Demand increased as fleet operators sought advanced safety technologies to address accident risks and rising operational expenses. The focus on reducing human-related driving errors continued to reinforce the importance of ADAS adoption across commercial fleets in the country.

Key companies operating in the Global Commercial Vehicle ADAS Market include Continental, Bosch, Magna, Mobileye, ZF Friedrichshafen, Denso, Volvo, Valeo, Ford, and Daimler. Companies active in the Global Commercial Vehicle ADAS Market strengthen their market position through continuous innovation, strategic partnerships, and large-scale production capabilities. Manufacturers invest heavily in research and development to enhance system accuracy, reliability, and real-time processing capabilities. Collaboration with vehicle manufacturers enables seamless integration of ADAS at the production stage. Firms also focus on expanding product portfolios to address diverse vehicle categories and fleet requirements. Cost optimization and scalable manufacturing help companies remain competitive while meeting growing demand.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 System

- 2.2.3 Sensor

- 2.2.4 Vehicle Category

- 2.2.5 Level

- 2.2.6 Propulsion

- 2.2.7 Distribution Channel

- 2.3 TAM analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Stringent government safety regulations for commercial vehicles

- 3.2.1.2 Rising road accidents involving heavy and commercial vehicles

- 3.2.1.3 Growing adoption of fleet safety and telematics solutions

- 3.2.1.4 Rapid growth of e-commerce and last-mile delivery fleets

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Reliability issues in harsh weather and road conditions

- 3.2.2.2 Complexity in retrofitting ADAS in existing vehicles

- 3.2.3 Market opportunities

- 3.2.3.1 Increasing demand for ADAS in electric commercial vehicles

- 3.2.3.2 Growth potential in emerging markets and developing economies

- 3.2.3.3 Integration of ADAS with V2X communication systems

- 3.2.3.4 Expansion of ADAS retrofitting solutions for aging fleets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 Federal Motor Vehicle Safety Standards (FMVSS)

- 3.4.1.2 IIHS Commercial Vehicle Safety Evaluation Programs

- 3.4.1.3 SAE International ADAS and Automated Driving Standards

- 3.4.1.4 Transport Canada Motor Vehicle Safety Regulations

- 3.4.2 Europe

- 3.4.2.1 EU General Safety Regulation (EU)

- 3.4.2.2 UNECE Vehicle Regulations

- 3.4.2.3 Euro NCAP Commercial Vehicle Safety Rating Protocols

- 3.4.2.4 EU Road Safety Policy Framework

- 3.4.3 Asia Pacific

- 3.4.3.1 Japan MLIT Safety Regulations for ADAS

- 3.4.3.2 China GB Standards for Intelligent and Connected Vehicles

- 3.4.3.3 China NCAP (C-NCAP) ADAS Evaluation Guidelines

- 3.4.3.4 India AIS Standards for Commercial Vehicle Safety

- 3.4.4 Latin America

- 3.4.4.1 Latin NCAP Safety Assessment Protocols

- 3.4.4.2 Brazil CONTRAN Vehicle Safety Resolutions

- 3.4.4.3 Argentina National Traffic Safety Regulations

- 3.4.4.4 Mexico NOM Vehicle Safety Standards

- 3.4.5 Middle East & Africa

- 3.4.5.1 UAE Federal Traffic Safety Regulations

- 3.4.5.2 South Africa National Road Traffic Act Vehicle Standards

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Cost breakdown analysis

- 3.10 Sustainability and environmental impact

- 3.10.1 Environmental impact assessment

- 3.10.2 Social impact & community benefits

- 3.10.3 Governance & corporate responsibility

- 3.10.4 Sustainable finance & investment trends

- 3.11 Risk Assessment

- 3.11.1 Market risks

- 3.11.2 Technological risks

- 3.11.3 Regulatory and compliance risks

- 3.11.4 Cybersecurity and data privacy risks

- 3.11.5 Risk mitigation strategies

- 3.12 Case studies

- 3.13 Future outlook & opportunities

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By System, 2022 - 2035 ($Bn, units)

- 5.1 Key trends

- 5.2 Adaptive cruise control

- 5.3 Blind spot detection

- 5.4 Lane departure warning system

- 5.5 Automatic emergency braking (AEM)

- 5.6 Forward collision warning

- 5.7 Night vision system

- 5.8 Driver monitoring

- 5.9 Tire pressure monitoring system

- 5.10 Head-up display

- 5.11 Park assist system

- 5.12 Others

Chapter 6 Market Estimates & Forecast, By Sensor, 2022 - 2035 ($Bn, units)

- 6.1 Key trends

- 6.2 Radar

- 6.3 Lidar

- 6.4 Ultrasonic

- 6.5 Camera

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Vehicle Category, 2022 - 2035 ($Bn, units)

- 7.1 Key trends

- 7.2 LCV

- 7.3 MCV

- 7.4 HCV

Chapter 8 Market Estimates & Forecast, By Level, 2022 - 2035 ($Bn, units)

- 8.1 Key trends

- 8.2 Level-1

- 8.3 Level-2

- 8.4 Level-3

- 8.5 Level-4

Chapter 9 Market Estimates & Forecast, By Propulsion, 2022 - 2035 ($Bn, units)

- 9.1 Key trends

- 9.2 ICE

- 9.3 EV

- 9.4 Hybrid

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035 ($Bn, units)

- 10.1 Key trends

- 10.2 OEM

- 10.3 Aftermarket

Chapter 11 Market Estimates & Forecast, By Region, 2022 - 2035 ($Bn, units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 US

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.3.8 Benelux

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 ANZ

- 11.4.6 Singapore

- 11.4.7 Malaysia

- 11.4.8 Indonesia

- 11.4.9 Vietnam

- 11.4.10 Thailand

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.5.4 Colombia

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Global companies

- 12.1.1 Bosch

- 12.1.2 Continental

- 12.1.3 ZF Friedrichshafen

- 12.1.4 Valeo

- 12.1.5 Denso

- 12.1.6 Mobileye

- 12.1.7 Magna

- 12.1.8 Autoliv

- 12.1.9 Hyundai Mobis

- 12.1.10 Aptiv

- 12.1.11 Knorr-Bremse

- 12.1.12 Forvia (Hella)

- 12.1.13 Daimler

- 12.1.14 Volvo

- 12.1.15 Ford

- 12.2 Regional companies

- 12.2.1 Stoneridge

- 12.2.2 Brigade Electronics

- 12.2.3 Seeing Machines

- 12.2.4 MAN Truck & Bus

- 12.2.5 Iveco

- 12.2.6 Gauzy

- 12.2.7 Renault

- 12.3 Emerging companies

- 12.3.1 Huawei

- 12.3.2 Horizon Robotics

- 12.3.3 Black Sesame

- 12.3.4 Applied Intuition