PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1708159

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1708159

Debt Settlement Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

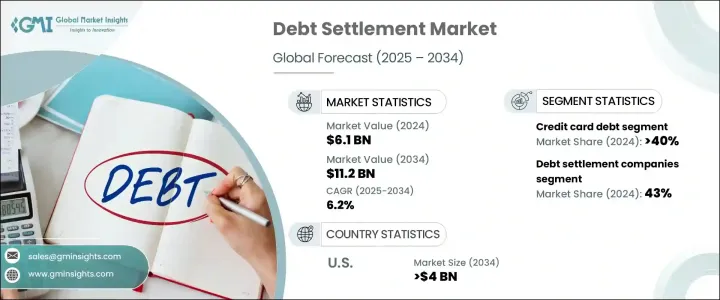

The Global Debt Settlement Market reached USD 6.1 billion in 2024 and is projected to expand at a CAGR of 6.2% between 2025 and 2034. The market is gaining significant momentum as consumers around the world continue to struggle with mounting financial obligations. With rising household debt levels and an increasing number of people turning to unsecured credit sources such as credit cards and personal loans, debt settlement has become a critical solution for those seeking financial relief. Consumers are facing growing challenges in managing their debt, largely driven by high interest rates, surging medical expenses, student loan burdens, and other essential costs of living. Inflationary pressures and stagnant wage growth across key employment sectors are further intensifying the need for effective debt resolution strategies.

As many individuals find it difficult to meet monthly repayment schedules, the demand for professional debt settlement services is witnessing a sharp upturn. These services not only help consumers avoid defaults but also enable them to negotiate substantial reductions in outstanding balances, offering a more sustainable way to manage and resolve debts. The growing adoption of technology-based financial services, along with increased consumer awareness about debt negotiation options, is accelerating the growth trajectory of the debt settlement market. Financial stress among younger populations, especially millennials and Gen Z facing student loan debt and rising living costs, is also contributing to the market's expansion, making debt settlement a preferred alternative to bankruptcy or prolonged delinquency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.1 Billion |

| Forecast Value | $11.2 Billion |

| CAGR | 6.2% |

The debt settlement market is primarily segmented based on the type of debt, including credit card debt, personal loan debt, medical debt, student loan debt, and business debt. Among these, credit card debt accounted for a dominant share of 40% in 2024. Credit card debt remains the most widespread form of unsecured debt, and its high interest rates make repayment a significant challenge for consumers. Debt settlement companies are actively working to negotiate favorable settlements with credit card issuers on behalf of clients, allowing borrowers to significantly reduce their overall debt burden. Due to the scale and frequency of credit card borrowing, this segment continues to hold the largest share of the global market and is expected to retain its dominance through the forecast period.

Service providers operating in the debt settlement market include debt settlement companies, law firms, and financial advisors. Debt settlement companies held a substantial 43% market share in 2024, as they are typically the first resource individuals approach when looking to manage or settle unsecured debts. These companies offer tailored repayment plans, negotiate directly with creditors, and provide structured solutions that help consumers avoid the complexities of credit counseling or legal actions. Their affordable and personalized services make them indispensable in today's debt-ridden economy.

The U.S. Debt Settlement Market alone is projected to generate USD 4 billion by 2034. Rising levels of credit card and personal loan debt, combined with increasing interest rates, are driving the need for structured settlement solutions across the country. Companies in the U.S. are adopting advanced digital platforms and personalized financial counseling services to engage consumers more effectively and deliver better debt resolution outcomes. Moreover, the regulatory framework, driven by agencies like the Consumer Financial Protection Bureau (CFPB), is reinforcing transparency, fair negotiation practices, and greater consumer protection, making the U.S. the largest and most influential market in the global debt settlement landscape.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Credit bureaus

- 3.1.2 Financial technology providers

- 3.1.3 Legal service providers

- 3.1.4 End use

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Case studies

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rising consumer debt

- 3.9.1.2 Increasing economic uncertainty

- 3.9.1.3 Growing small business debt

- 3.9.1.4 Increasing regulatory support & awareness

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Strict regulations and compliance requirements

- 3.9.2.2 Impact on credit scores

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Debt, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Credit card debt

- 5.3 Personal loans debt

- 5.4 Medical debt

- 5.5 Student loans

- 5.6 Business debt

Chapter 6 Market Estimates & Forecast, By Service Provider, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Debt settlement companies

- 6.3 Law firms

- 6.4 Others

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Individuals

- 7.3 Businesses

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 Accredited Debt Relief

- 9.2 American Debt Enders

- 9.3 Century Support Services

- 9.4 ClearOne Advantage

- 9.5 Credit Associates

- 9.6 CuraDebt

- 9.7 Debt Rx

- 9.8 Debtmerica Relief

- 9.9 DebtWave Credit Counseling

- 9.10 DMB Financial

- 9.11 Financial Rescue

- 9.12 FREED

- 9.13 Freedom Debt Relief

- 9.14 National Debt Relief

- 9.15 New Era Debt Solutions

- 9.16 Oak View Law Group

- 9.17 Pacific Debt Inc.

- 9.18 Rescue One Financial

- 9.19 Superior Debt Relief Services

- 9.20 United Debt Counselors