PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1708163

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1708163

Automotive Crash Test Dummies Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

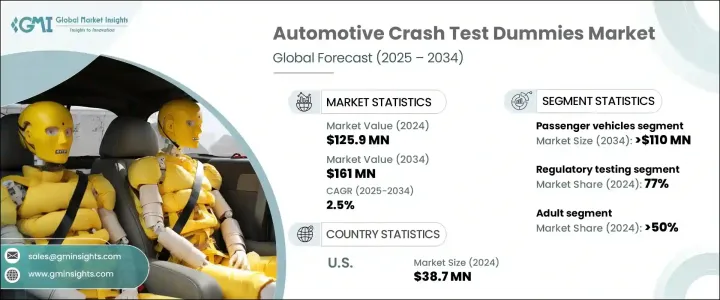

The Global Automotive Crash Test Dummies Market reached USD 125.9 million in 2024 and is projected to grow at a CAGR of 2.5% between 2025 and 2034. The market continues to expand as vehicle safety becomes a top priority for automakers, regulatory authorities, and consumers alike. With road safety incidents on the rise and increasing focus on reducing fatalities and serious injuries, the demand for highly advanced and accurate crash test dummies is surging. These dummies are pivotal in simulating real-world accident scenarios, helping manufacturers design vehicles that meet stringent safety standards. As governments and safety organizations push for better protection for drivers and passengers, automakers are investing heavily in crash testing to ensure compliance and boost consumer trust.

Growing public awareness around safety ratings and crash test performance is also influencing purchasing decisions, prompting manufacturers to rely on sophisticated crash test dummies to achieve higher safety scores. Furthermore, advancements in dummy technology, including enhanced sensor integration and improved biofidelity, are making them indispensable for modern vehicle development. As the automotive industry transitions towards electric and autonomous vehicles, new crash scenarios are emerging, creating additional demand for advanced dummies capable of evaluating unique impact conditions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $125.9 Million |

| Forecast Value | $161 Million |

| CAGR | 2.5% |

The market is segmented based on vehicle type into passenger and commercial vehicles, with passenger vehicles accounting for a 65% share in 2024. This segment is expected to generate USD 110 million by 2034, driven by high production volumes and the increasing pressure from regulatory bodies to meet evolving safety standards. The dominance of passenger vehicles in this space stems from the need to protect a wide range of occupants, including adults, children, and even pets, in various crash scenarios. As global safety benchmarks become more stringent, automakers are compelled to perform extensive crash testing to ensure compliance, keeping passenger vehicles at the forefront of crash test dummy utilization.

Based on application, the automotive crash test dummies market is divided into regulatory testing and research & development, with regulatory testing capturing a 77% share in 2024. Regulatory bodies across the globe require comprehensive crash tests before any vehicle can be introduced to the market, fueling ongoing demand for crash test dummies. Authorities such as the National Highway Traffic Safety Administration (NHTSA) and the European New Car Assessment Programme (Euro NCAP) enforce strict testing standards, pushing manufacturers to continuously update crash testing protocols. As safety regulations become increasingly complex and comprehensive, the need for reliable and accurate crash test dummies remains critical for automakers striving to meet these guidelines.

The U.S. Automotive Crash Test Dummies Market generated USD 38.7 million in 2024, supported by robust research and development activities focused on enhancing vehicle safety technologies. The U.S. is home to several leading crash test dummy manufacturers, reinforcing its leadership position in the global market. With the presence of major automotive brands, cutting-edge testing centers, and a proactive regulatory environment, the U.S. remains a key hub for innovation and supply in the crash test dummies space.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Technology providers

- 3.1.1.2 Insurance providers

- 3.1.1.3 Distributors

- 3.1.1.4 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Technology & innovation landscape

- 3.3 Patent analysis

- 3.4 Regulatory landscape

- 3.5 Impact forces

- 3.5.1 Growth drivers

- 3.5.1.1 Stringent vehicle safety regulations

- 3.5.1.2 Rising consumer awareness and demand for safer vehicles

- 3.5.1.3 Advancements in sensor technology and biofidelic dummies

- 3.5.1.4 Growth of autonomous and electric vehicles requiring new crash testing

- 3.5.2 Industry pitfalls & challenges

- 3.5.2.1 High cost of advanced crash test dummies

- 3.5.2.2 Complexity in replicating diverse human body types and crash scenarios

- 3.5.1 Growth drivers

- 3.6 Growth potential analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Dummy Type, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Adult male

- 5.3 Child

- 5.4 Infant

Chapter 6 Market Estimates & Forecast, By vehicle, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.3 Commercial vehicles

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Regulatory testing

- 7.3 Research & development

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 4activeSystems GmbH

- 9.2 Autoliv

- 9.3 Calspan Corporation

- 9.4 Cellbond

- 9.5 Continental AG

- 9.6 CTS Corporation

- 9.7 Denton ATD

- 9.8 Diversified Technical Systems

- 9.9 FTSS

- 9.10 G.R.A.S. Sound & Vibration

- 9.11 HORIBA MIRA

- 9.12 Humanetics Innovative Solutions

- 9.13 JASTI

- 9.14 Kistler Group

- 9.15 MGA Research Corporation

- 9.16 Robert Bosch

- 9.17 Siemens Digital Industries

- 9.18 TASS International

- 9.19 Transportation Research Center

- 9.20 ZF Friedrichshafen