PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1708180

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1708180

Bacterial and Viral Specimen Collection Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

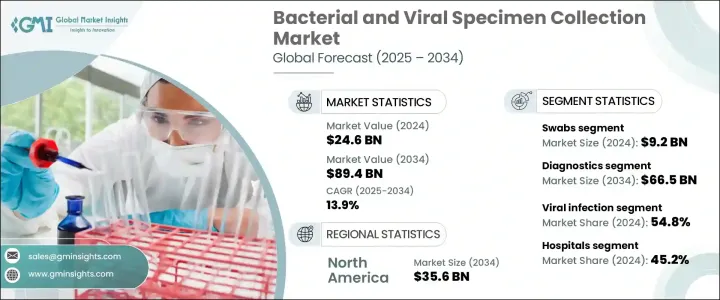

The Global Bacterial and Viral Specimen Collection Market generated USD 24.6 billion in 2024 and is projected to grow at a CAGR of 13.9% between 2025 and 2034. Specimen collection is a crucial step in diagnosing bacterial and viral infections, involving the collection of biological materials such as fluids, tissues, and swabs from patients or environmental sources. As the prevalence of infectious diseases continues to escalate worldwide, the demand for effective and timely diagnostic methods is growing rapidly. Healthcare systems across the globe are witnessing an increased need for accurate specimen collection processes to facilitate early diagnosis, better treatment outcomes, and effective disease management.

Technological advancements in healthcare diagnostics, coupled with the growing awareness regarding early disease detection, are fueling market growth. Moreover, rising government investments in healthcare infrastructure and diagnostic innovations, along with the persistent threat of emerging infectious diseases, including potential pandemics, are further accelerating the demand for advanced specimen collection tools. With an increasing focus on preventive healthcare and early detection, hospitals, diagnostic labs, and research institutions are adopting highly efficient specimen collection kits to improve diagnostic accuracy and clinical outcomes. The continuous emergence of novel pathogens and the global push for better preparedness against infectious outbreaks are also driving the market to new heights, reinforcing the need for advanced specimen collection techniques.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $24.6 Billion |

| Forecast Value | $89.4 Billion |

| CAGR | 13.9% |

The market is segmented by product types, including swabs, bacterial transport media, blood collection kits, and other related products. Among these, swabs generated USD 9.2 billion in revenue in 2024, emerging as the leading product segment. Swabs remain highly preferred due to their simplicity, convenience, and non-invasive nature, requiring minimal training for use in both clinical and non-clinical environments. Their ability to collect samples from sensitive areas like the nasal cavity and throat with reduced patient discomfort makes them an ideal choice for large-scale testing and diagnostics. As healthcare providers seek more user-friendly and efficient diagnostic solutions, swabs are anticipated to maintain robust demand throughout the forecast period.

From an application perspective, the bacterial and viral specimen collection market is primarily classified into diagnostics and research. The diagnostics segment accounted for a dominant 75.2% market share in 2024 and is projected to reach USD 66.5 billion by 2034. The growing reliance on advanced diagnostic tools for accurate pathogen identification plays a vital role in ensuring appropriate treatment plans and reducing risks of misdiagnosis. With continuous innovations in diagnostic technologies, this segment remains pivotal in addressing the rising burden of infectious diseases and is set to witness sustained growth in the coming years.

Regionally, the North America bacterial and viral specimen collection market generated USD 10 billion in 2024, driven by an increasing number of infectious disease cases in the U.S. and robust support for the development of cutting-edge specimen collection kits. While the region operates under a stringent regulatory framework, consistent advancements in healthcare solutions and strong R&D initiatives are fueling market expansion across North America.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidence of infectious diseases

- 3.2.1.2 Growing need for accurate diagnostics

- 3.2.1.3 Advancements in diagnostic technologies

- 3.2.1.4 Rising awareness of preventive healthcare

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High risk of contamination

- 3.2.2.2 Lack of standardized protocols

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Swabs

- 5.2.1 Nasal swabs

- 5.2.2 Throat swabs

- 5.2.3 Other swabs

- 5.3 Bacterial transport media

- 5.4 Blood collection kits

- 5.5 Other products

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Diagnostics

- 6.3 Research

Chapter 7 Market Estimates and Forecast, By Indication, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Bacterial infection

- 7.2.1 Tuberculosis

- 7.2.2 Pneumonia

- 7.2.3 Cholera

- 7.2.4 Salmonella

- 7.2.5 Sexually transmitted infections (STIs)

- 7.2.6 Other bacterial infections

- 7.3 Viral infection

- 7.3.1 Influenza

- 7.3.2 COVID-19

- 7.3.3 HIV

- 7.3.4 Hepatitis B

- 7.3.5 Dengue

- 7.3.6 Zika virus

- 7.3.7 Other viral infections

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Diagnostic laboratories

- 8.4 Home testing

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Becton, Dickinson And Company

- 10.2 BIOMÉRIEUX

- 10.3 COPAN Italia

- 10.4 DiaSorinGroup

- 10.5 Hardy Diagnostics

- 10.6 HiMedia Laboratories

- 10.7 Longhorn Vaccines and Diagnostics

- 10.8 Medical Wire & Equipment

- 10.9 Puritan Medical Products

- 10.10 Pretium Packaging

- 10.11 Quidel Corporation

- 10.12 Thermo Fisher Scientific

- 10.13 Trinity Biotech

- 10.14 Vircell S.L.

- 10.15 Wuxi Nest Biotechnology