PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716455

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716455

Intermittent Catheters Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

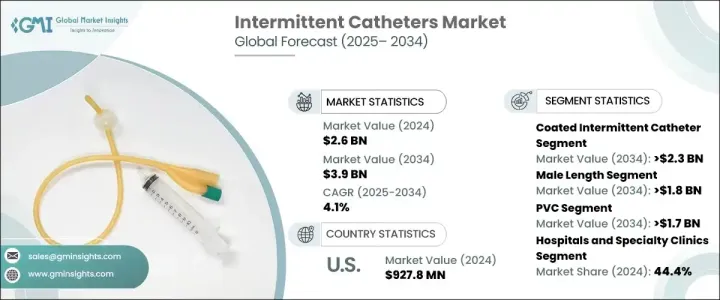

The Global Intermittent Catheters Market reached USD 2.6 billion in 2024 and is projected to grow at a CAGR of 4.1% between 2025 and 2034. The market is witnessing steady growth due to a rising prevalence of urinary incontinence, neurogenic bladder disorders, and a rapidly aging population that requires ongoing bladder management solutions. Increasing awareness regarding the benefits of self-catheterization, coupled with healthcare systems emphasizing safer alternatives to indwelling catheters, is pushing demand forward. As medical practitioners and patients alike seek more comfortable and hygienic options, intermittent catheters have emerged as a preferred solution. Innovations in catheter technology, such as hydrophilic and antimicrobial coatings, are playing a pivotal role in enhancing patient experience and safety.

These modern designs help reduce friction and minimize the risk of infections, encouraging long-term use among patients with chronic urinary conditions. Moreover, a growing focus on home healthcare and patient-centered care models has led to increased adoption of intermittent catheters as more individuals prefer self-managed solutions for better quality of life. Rising incidences of spinal cord injuries, multiple sclerosis, and prostate-related issues, particularly among the elderly, are fueling consistent demand across both developed and developing regions. The market is also benefiting from supportive reimbursement frameworks and healthcare initiatives aimed at improving the accessibility and affordability of intermittent catheters for patients globally.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.6 Billion |

| Forecast Value | $3.9 Billion |

| CAGR | 4.1% |

The market is primarily divided into coated and uncoated intermittent catheters, with coated catheters expected to witness stronger demand during the forecast period. The coated intermittent catheter segment is set to grow at a CAGR of 4.4% between 2025 and 2034, driven by its superior performance in terms of patient comfort, ease of use, and infection prevention. Coated catheters, especially those with hydrophilic layers, become slippery when moistened, significantly reducing insertion discomfort and urethral trauma. Patients requiring long-term catheterization are increasingly opting for these advanced versions due to their enhanced safety profile and convenience. The reduction in urinary tract infection (UTI) risks and smoother catheterization experience make coated catheters a preferred choice among healthcare providers and patients alike.

Additionally, the intermittent catheters market is segmented by length, including male, female, and pediatric versions to meet diverse anatomical needs. The male length catheter segment is projected to grow at a CAGR of 4% and generate USD 1.8 billion by 2034. Male-length catheters are designed to be longer and more suited for male anatomy, ensuring more effective bladder drainage with minimal risk of complications such as urinary retention or infections. These catheters offer ease of use and are widely recommended by urologists for male patients requiring intermittent catheterization.

The U.S. intermittent catheters market generated USD 927.8 million in 2024, driven by rising cases of urinary retention, spinal injuries, and other chronic urinary disorders, particularly among older adults. Growing acceptance of self-catheterization and advancements in catheter designs are contributing to the market's expansion. Favorable reimbursement policies and supportive government healthcare programs further enhance patient access to these essential devices, making intermittent catheterization a practical and widely adopted solution in the United States.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing prevalence of urinary diseases

- 3.2.1.2 Favourable reimbursement scenario

- 3.2.1.3 Growing demand for self-catheterization coupled with expansion of ambulatory surgical centers

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Complications associated with catheterization

- 3.2.2.2 Availability of alternative treatment options

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Pricing analysis

- 3.6 Technology landscape

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Coated intermittent catheter

- 5.2.1 Hydrophilic

- 5.2.2 Antimicrobial

- 5.2.3 Other coated intermittent catheters

- 5.3 Uncoated intermittent catheter

Chapter 6 Market Estimates and Forecast, By Category, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Male length

- 6.3 Female length

- 6.4 Pediatric length

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Urinary incontinence

- 7.3 General surgery

- 7.4 Spinal injuries

- 7.5 Other applications

Chapter 8 Market Estimates and Forecast, By Material, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 PVC

- 8.3 Silicone

- 8.4 Latex

- 8.5 Other materials

Chapter 9 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals and specialty clinics

- 9.3 Ambulatory surgical centers

- 9.4 Home care settings

- 9.5 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Adapta medical

- 11.2 ASID BONZ

- 11.3 B. Braun

- 11.4 Becton, Dickinson and Company

- 11.5 Coloplast

- 11.6 ConvaTec

- 11.7 Cook

- 11.8 Hollister

- 11.9 Hunter Urology

- 11.10 Pennine Healthcare

- 11.11 Romsons

- 11.12 Teleflex

- 11.13 Wellspect Healthcare