PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716467

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716467

Animal Antibiotics and Antimicrobials Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

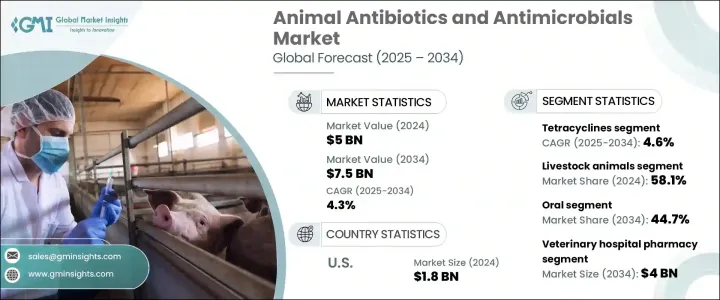

The Global Animal Antibiotics and Antimicrobials Market was valued at USD 5 billion in 2024 and is expected to grow at a CAGR of 4.3% between 2025 and 2034. This growth is primarily driven by the rising prevalence of zoonotic diseases that threaten animal health and the increasing need for food safety in a world where livestock consumption is escalating. Developing nations, in particular, are witnessing a surge in livestock farming, leading to greater adoption of infection prevention measures and improvements in animal health management. The growing global population and the corresponding rise in demand for animal-based protein have intensified the need for reliable antibiotics and antimicrobials to maintain livestock health and productivity. Additionally, rising investments in research and development have spurred innovations in drug formulations that enhance effectiveness while minimizing adverse side effects, further bolstering market expansion. Advancements in veterinary infrastructure and a greater emphasis on preventive animal healthcare have created lucrative opportunities for manufacturers to introduce cutting-edge antimicrobial solutions, driving consistent growth over the forecast period.

The market is segmented by product type into aminoglycosides, tetracyclines, penicillins, sulfonamides, lincosamides, fluoroquinolones, macrolides, cephalosporins, and other antibiotics and antimicrobial agents. Among these, tetracyclines are expected to grow at a CAGR of 4.6% during the forecast period. Their affordability and broad-spectrum efficacy make them a popular choice for managing a variety of infections, including respiratory and gastrointestinal conditions, across both livestock and companion animals.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5 Billion |

| Forecast Value | $7.5 Billion |

| CAGR | 4.3% |

The market is further divided by animal type into companion animals and livestock animals. The livestock segment held a 58.1% share in 2024. This segment encompasses cattle, swine, poultry, fish, and other livestock. With urbanization progressing and dietary patterns shifting globally, the consumption of animal-based products is increasing, driving demand for antibiotics to safeguard livestock from infections. As consumers become more aware of the importance of maintaining healthy animal populations to prevent disease outbreaks, the focus on enhancing livestock health services has intensified. The need for robust disease control measures has led to an uptick in the adoption of antibiotics, contributing significantly to market expansion.

In the U.S., the Animal Antibiotics and Antimicrobials Market generated USD 1.8 billion in 2024. The country's advanced veterinary infrastructure, high rates of pet ownership, and well-established livestock industry have fueled the demand for antibiotics and antimicrobials. Rising investments in animal healthcare, coupled with an increasing number of product registrations and approvals, continue to drive market growth. The U.S. remains a prominent player in the market due to its focus on enhancing animal health outcomes and preventing the spread of zoonotic diseases.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing pet ownership rate

- 3.2.1.2 Expanding livestock production

- 3.2.1.3 Rising research and development funding

- 3.2.1.4 Growing awareness of animal healthcare spurring demand for preventive treatment

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Adverse effects of treatments

- 3.2.2.2 Stringent regulatory requirements

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Future market trends

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Penicillins

- 5.3 Tetracyclines

- 5.4 Sulfonamides

- 5.5 Macrolides

- 5.6 Aminoglycosides

- 5.7 Lincosamides

- 5.8 Fluoroquinolones

- 5.9 Cephalosporins

- 5.10 Other antibiotics and antimicrobial products

Chapter 6 Market Estimates and Forecast, By Animal Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Companion animals

- 6.2.1 Dogs

- 6.2.2 Cats

- 6.2.3 Horses

- 6.2.4 Other companion animals

- 6.3 Livestock animals

- 6.3.1 Cattle

- 6.3.2 Swine

- 6.3.3 Poultry

- 6.3.4 Fish

- 6.3.5 Other livestock animals

Chapter 7 Market Estimates and Forecast, By Mode of Delivery, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Topical

- 7.4 Injections

- 7.5 Other modes of delivery

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Veterinary hospital pharmacy

- 8.3 Retail pharmacy

- 8.4 E-commerce

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AdvaCare Pharma

- 10.2 Boehringer Ingelheim International

- 10.3 Ceva

- 10.4 Dechra

- 10.5 Meiji Holdings

- 10.6 Merck & Co.

- 10.7 Vetoquinol

- 10.8 Virbac

- 10.9 Zoetis

- 10.10 Zovixpharma