PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716483

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716483

Bipolar Disorder Drugs and Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

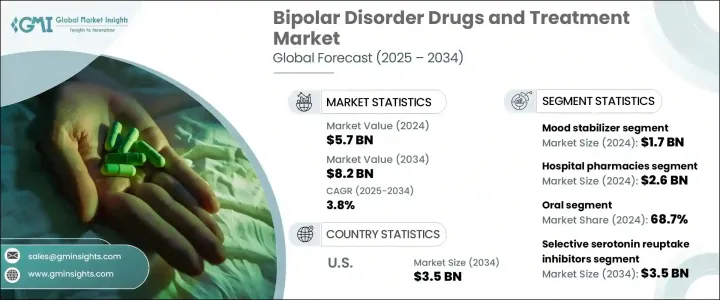

The Global Bipolar Disorder Drugs and Treatment Market was valued at USD 5.7 billion in 2024 and is projected to grow at a CAGR of 3.8% from 2025 to 2034. As mental health awareness continues to gain traction worldwide, the demand for medications to effectively manage bipolar disorder is on the rise. Bipolar disorder affects millions of individuals globally, leading to significant emotional, social, and occupational challenges. Increased public education initiatives, government funding, and advocacy efforts have driven a surge in early diagnosis and intervention. The growing acceptance of mental health as an essential component of overall well-being is motivating individuals to seek professional help, thus boosting the demand for effective treatment options. Furthermore, continuous advancements in pharmacological research are paving the way for the development of innovative therapies that cater to the diverse needs of patients. These treatments include atypical antipsychotics, mood stabilizers, and adjunctive therapies. Emerging trends such as artificial intelligence in drug discovery and wearable technology to monitor patient progress are enhancing treatment approaches, promising a future where data-driven and personalized care becomes the norm.

The market is segmented based on drug class, which includes anticonvulsants, antipsychotic drugs, mood stabilizers, antidepressant drugs, and anti-anxiety drugs. Among these, mood stabilizers dominate the segment, valued at USD 1.7 billion in 2024. These drugs play a crucial role in controlling mood swings and preventing manic or depressive episodes, which are essential for managing bipolar disorder. With continued improvements in drug efficacy and better dosage formulations, such as extended-release versions, patient adherence to treatment plans has significantly improved. Healthcare providers can now tailor dosages more effectively to meet individual patient needs, ultimately enhancing overall health outcomes. The demand for mood stabilizers continues to grow, reflecting the increasing awareness of bipolar disorder and the need for more effective and patient-friendly treatment options.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.7 Billion |

| Forecast Value | $8.2 Billion |

| CAGR | 3.8% |

In terms of administration route, the market is categorized into oral, parenteral, and other methods. The oral segment accounted for 68.7% of the market share in 2024, primarily due to the convenience and effectiveness of oral medications. Oral treatments remain the preferred choice for managing bipolar disorder, as they are easy to administer and promote higher patient compliance. Advances in oral drug formulations, such as extended-release and combination therapies, have improved the effectiveness of these treatments, making them an attractive option for long-term maintenance therapy. The growing preference for oral medications, combined with continuous innovation in dosage forms, is expected to drive sustained growth in this segment.

The United States bipolar disorder drugs and treatment market is poised to generate USD 3.5 billion by 2034. The growth of the U.S. market is driven by high levels of awareness, an advanced healthcare infrastructure, and the increasing prevalence of bipolar disorder. Policies such as the Affordable Care Act have expanded access to mental health services, enabling more individuals to seek treatment and manage their conditions effectively. As healthcare providers adopt advanced technologies like telepsychiatry and AI-based tools for diagnosis and treatment, the demand for innovative therapies is expected to grow steadily. Additionally, U.S.-based pharmaceutical companies are leading the way in personalized medicine through genetic testing, allowing for more precise treatment options tailored to individual genetic profiles. This ongoing innovation is positioning the U.S. as a key player in the global bipolar disorder drugs and treatment market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing awareness of mental health conditions

- 3.2.1.2 Rising prevalence of bipolar disorders

- 3.2.1.3 Expanding government support for mental health

- 3.2.1.4 Integration of technological advancements

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Side effects of bipolar medication

- 3.2.2.2 Misdiagnosis of bipolar disorder

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Future market trends

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Drug Class, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Mood stabilizers

- 5.3 Anticonvulsants

- 5.4 Anti-psychotic drugs

- 5.5 Anti-depressant drugs

- 5.6 Anti-anxiety drugs

- 5.7 Other drug classes

Chapter 6 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Oral

- 6.3 Parenteral

- 6.4 Other routes of administration

Chapter 7 Market Estimates and Forecast, By Mechanism of Action, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Selective serotonin reuptake inhibitors

- 7.3 Serotonin norepinephrine reuptake inhibitors

- 7.4 Tricyclic antidepressant drugs

- 7.5 Beta blockers

- 7.6 Other mechanisms of actions

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacies

- 8.3 Retail pharmacies

- 8.4 Online pharmacies

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AbbVie

- 10.2 AstraZeneca

- 10.3 Bristol-Myers Squibb

- 10.4 Eli Lilly

- 10.5 GlaxoSmithKline

- 10.6 Janssen Pharmaceuticals

- 10.7 Novartis

- 10.8 Otsuka Holdings

- 10.9 Pfizer

- 10.10 Sunovion Pharmaceuticals

- 10.11 Teva Pharmaceutical

- 10.12 Validus Pharmaceuticals