PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716498

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716498

Vegan Protein Powder Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

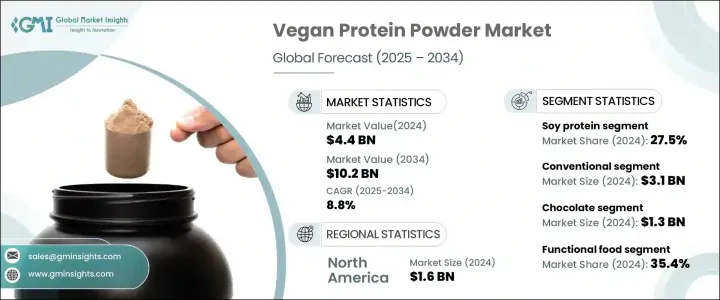

The Global Vegan Protein Powder Market reached USD 4.4 billion in 2024 and is projected to grow at a CAGR of 8.8% between 2025 and 2034. This robust growth is fueled by the increasing preference for plant-based protein alternatives, especially among athletes, health-conscious individuals, and those adhering to vegan or vegetarian diets. As consumers embrace more ethical and sustainable eating habits, the demand for non-animal-based protein sources has skyrocketed. Additionally, growing concerns about environmental sustainability and the adverse effects of traditional livestock farming have pushed consumers to explore alternative protein sources that align with their values. Companies in the vegan protein powder market are capitalizing on this trend by offering innovative products with enhanced amino acid profiles, improved digestibility, and additional health benefits, catering to a broader audience.

The rise of fitness culture and the growing awareness of the health advantages associated with plant-based proteins have further bolstered the market. Plant-based protein powders, often fortified with essential vitamins and minerals, appeal to consumers seeking healthier lifestyles. As the demand for functional foods grows, manufacturers are increasingly focusing on creating protein powders that not only meet nutritional requirements but also provide benefits such as muscle recovery, weight management, and enhanced immunity. This ongoing innovation continues to attract a diverse consumer base, ranging from fitness enthusiasts and professional athletes to individuals simply looking to improve their overall well-being.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.4 Billion |

| Forecast Value | $10.2 Billion |

| CAGR | 8.8% |

The market is categorized by the source of protein, including pea, soy, rice, hemp, and other varieties. Soy protein concentrate, which holds a substantial share of the market, is expected to grow at a CAGR of 9.7% by 2034. Its widespread popularity is due to its superior amino acid profile, excellent solubility, and affordability, making it an ideal choice for sports nutrition and functional foods. Additionally, soy protein concentrate's versatility and accessibility enhance its dominance, positioning it as a pivotal driver of growth in the vegan protein powder industry.

In terms of nature, the market is segmented into organic and conventional categories. The conventional segment generated USD 3.1 billion in 2024 and is projected to grow at a CAGR of 8.4% through 2034. Conventional vegan protein powders remain the preferred choice due to their affordability and widespread availability. Manufacturers favor conventional protein sources because of their lower production costs and high functional content. These products enjoy a strong presence in mainstream food and beverage applications, supported by robust retail networks that drive continued market expansion.

North America accounted for USD 1.6 billion of the vegan protein powder market in 2024 and is expected to grow at a CAGR of 3.6% by 2034. The region's strong demand for plant-based nutrition, coupled with a well-established health and wellness sector, has made it the largest market globally. Canada's growing preference for organic and clean-label products, along with government initiatives supporting plant-based industries, contributes significantly to the region's leadership in the market. The rise in veganism, fitness culture, and the demand for functional foods further strengthens North America's dominant position in the vegan protein powder market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising demand for plant-based food & beverages due to growing vegan population is driving market growth

- 3.6.1.2 Increasing demand for functional food and healthy products with high protein content

- 3.6.1.3 Growing market for sports nutrition

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High production costs

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Product, 2021 - 2034 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Hemp protein

- 5.3 Soy protein isolate

- 5.4 Soy protein concentrate

- 5.5 Rice protein isolate

- 5.6 Rice protein concentrate

- 5.7 Pea protein isolate

- 5.8 Pea protein concentrate

- 5.9 Spirulina protein

- 5.10 Quinoa protein

- 5.11 Protein blends

Chapter 6 Market Size and Forecast, By Nature, 2021 - 2034 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 Organic

- 6.3 Conventional

Chapter 7 Market Size and Forecast, By Flavor, 2021 - 2034 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 Unflavoured

- 7.3 Chocolate

- 7.4 Vanilla

- 7.5 Strawberry

- 7.6 Other

Chapter 8 Market Size and Forecast, By Application, 2021 - 2034 (USD Billion, Kilo Tons)

- 8.1 Key trends

- 8.2 Sports nutrition

- 8.3 Beverages

- 8.4 Functional food

- 8.5 Others

Chapter 9 Market Size and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion, Kilo Tons)

- 9.1 Key trends

- 9.2 Hypermarkets & supermarkets

- 9.3 Specialty stores

- 9.4 Online retail

- 9.5 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Archer-Daniels-Midland Company

- 11.2 AMCO Proteins

- 11.3 Bunge Global SA

- 11.4 Cargill, Incorporated

- 11.5 Garden Of Life

- 11.6 Glanbia plc

- 11.7 Ingredion Incorporated

- 11.8 Now Foods

- 11.9 Orgain

- 11.10 PlantFusion

- 11.11 Vitaco Health Group

- 11.12 Wilmar International Limited