PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716515

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716515

4K Satellite Broadcasting Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

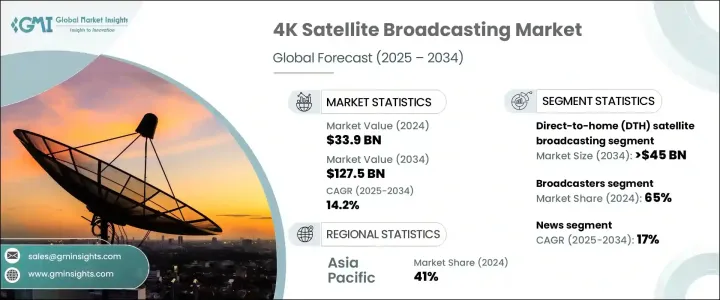

The Global 4K Satellite Broadcasting Market was valued at USD 33.9 billion in 2024 and is projected to grow at a CAGR of 14.2% between 2025 and 2034. The increasing demand for ultra-high-definition (UHD) content continues to drive the widespread adoption of 4K satellite broadcasting as consumers seek an unparalleled viewing experience. With the rapid advancements in display technologies, 4K resolution has transitioned from a luxury to a necessity, setting a new standard for high-quality content consumption. Enhanced picture clarity, higher frame rates, and superior details are making UHD content indispensable for entertainment platforms worldwide. As television screen sizes continue to expand and demand for high-resolution visuals intensifies, broadcasters and satellite operators are scaling up their 4K offerings to meet consumer expectations.

Major players in the industry are leveraging technological innovations to improve content transmission efficiency, ensuring seamless UHD streaming across various platforms. Furthermore, the rising penetration of 4K-enabled smart TVs, along with advancements in satellite communication technologies, is fueling the adoption of UHD content on a global scale. Emerging markets, particularly in Asia-Pacific and Latin America, are witnessing rapid growth in 4K broadcasting services, driven by increasing disposable incomes and a growing appetite for premium content. Governments and industry stakeholders are actively investing in satellite infrastructure to expand UHD content distribution, further propelling the industry's growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $33.9 Billion |

| Forecast Value | $127.5 Billion |

| CAGR | 14.2% |

The direct-to-home (DTH) satellite broadcasting segment accounted for 40% of the market share in 2024, as more consumers opt for 4K-ready set-top boxes to enjoy superior picture quality. With its ability to deliver uninterrupted 4K content even in regions with limited broadband access, DTH broadcasting remains the preferred choice for UHD content delivery. Major service providers are expanding their DTH offerings to cater to a wider audience, ensuring seamless content availability across national and international markets. The increasing adoption of 4K-enabled DTH services in emerging economies is reinforcing the segment's dominance, with Asia-Pacific, Latin America, and Africa leading the way in market expansion.

Based on service providers, the broadcasters segment held a commanding 65% share in 2024, owing to exclusive rights over premium 4K content, including international sports events, blockbuster movies, and live concerts. As the demand for high-quality content surges, broadcasters are capitalizing on their market influence by expanding UHD offerings. Consumers continue to turn to leading broadcasters for immersive, high-resolution experiences, further solidifying the segment's role in the 4K satellite broadcasting landscape. With the growing number of live events being streamed in UHD, broadcasters are intensifying their investments in cutting-edge transmission technologies to enhance content delivery and retain viewer engagement.

China 4K satellite broadcasting market generated USD 5.3 billion in 2024, emerging as a dominant force in the global UHD content ecosystem. The country's strong demand for UHD content, bolstered by government initiatives and widespread adoption of smart TVs, positions it as a leading market for 4K media consumption. As more consumers embrace UHD technology, China continues to play a crucial role in driving satellite broadcasting expansion. Government-backed initiatives and increasing consumer interest in high-resolution content are accelerating 4K adoption, making China a key player in the global 4K content distribution and viewing sector.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Platform Providers

- 3.1.1.2 Channel Partners

- 3.1.1.3 Distributors/Logistics

- 3.1.1.4 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Technology & innovation landscape

- 3.3 Patent analysis

- 3.4 Regulatory landscape

- 3.5 Price trends

- 3.6 Cost breakdown

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Increasing consumer demand for 4K content

- 3.7.1.2 Technological advancements in satellite systems

- 3.7.1.3 Partnerships between content creators and satellite operators

- 3.7.1.4 Government initiatives and regulations

- 3.7.1.5 Increasing popularity of live sports & events

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High costs of production and transmission

- 3.7.2.2 Limited 4K content availability

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Broadcasting Platform, 2021-2034 ($Bn)

- 5.1 Key trends

- 5.2 Direct-to-Home (DTH) satellite broadcasting

- 5.3 Direct Broadcast Satellite (DBS)

- 5.4 Cable headend

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Content, 2021-2034 ($Bn)

- 6.1 Key trends

- 6.2 Sports

- 6.3 Movies

- 6.4 News

- 6.5 Music

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Service Provider, 2021-2034 ($Bn)

- 7.1 Key trends

- 7.2 Satellite operators

- 7.3 Broadcasters

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 ($Bn)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Amazon Prime

- 10.2 ARRIS International

- 10.3 ATEME

- 10.4 Canal+ Group

- 10.5 Charter Communications

- 10.6 Cisco Systems

- 10.7 DirecTV

- 10.8 DISH Network

- 10.9 Ericsson Media Solutions

- 10.10 Eutelsat Communications

- 10.11 Globecast

- 10.12 Harmonic

- 10.13 Hispasat

- 10.14 Intelsat

- 10.15 Netflix

- 10.16 SES

- 10.17 Sky Group

- 10.18 Telesat

- 10.19 Verizon Communications

- 10.20 Viasat