PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716531

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716531

Power Device Analyzer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

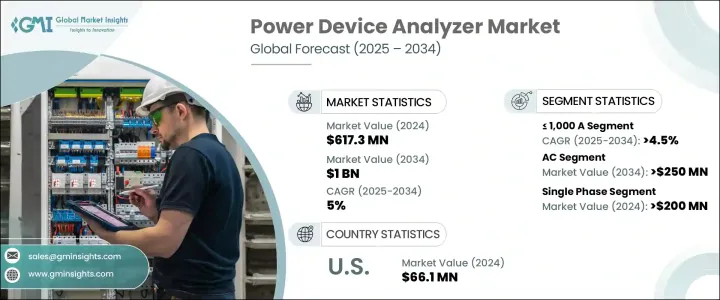

The Global Power Device Analyzer Market reached USD 617.3 million in 2024 and is estimated to depict a CAGR of 5% from 2025 to 2034. As industries seek to optimize energy use and reduce wastage, the demand for advanced tools to analyze power systems is rising rapidly. This surge is particularly noticeable across various industrial sectors where energy efficiency and sustainability are becoming critical. The integration of renewable energy sources, such as solar and wind, into power systems is also driving the need for these devices. Alongside, government policies and investments in renewable energy infrastructure are playing a crucial role in pushing the adoption of power measurement systems.

There is a growing emphasis on maintaining grid stability, managing fluctuating power inputs, and enhancing system efficiency, all of which further support the expansion of the power device analyzer market. These tools are crucial in ensuring power devices are functioning optimally and meeting regulatory standards. Industries are increasingly adopting automation and electrification processes, which is creating a greater demand for precision power measurement systems to ensure reliable system performance and mitigate inefficiencies. Additionally, stricter government mandates aimed at improving grid stability and energy efficiency are boosting the market for power analyzers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $617.3 Million |

| Forecast Value | $1 Billion |

| CAGR | 5% |

The automotive, healthcare, and telecommunications sectors are driving the demand for these analyzers, as maintaining power quality and reliability is critical in these industries. Moreover, as the transition to renewable energy sources continues, power device analyzers play an essential role in monitoring and improving the efficiency of energy devices used in these systems.

The market is currently segmented into devices rated <= 1,000 A and those rated > 1,000 A. The <= 1,000 A devices are expected to experience a CAGR of over 4.5% through 2034. This growth is attributed to the increasing focus on energy efficiency, which is spurring demand for accurate power testing to ensure compliance with energy norms. Moreover, the rise in electric vehicle adoption and the increasing use of power electronics in various industrial applications are also fueling this market.

The industry is also segmented by phase, with single-phase and three-phase power device analyzers. The single-phase market was valued at over USD 200 million in 2024, with its demand primarily driven by industries like automotive, renewable energy, and consumer electronics.

In the U.S., the market for power device analyzers was valued at USD 60.7 million in 2022, increasing to USD 66.1 million in 2024. By 2034, it is expected to exceed USD 100 million, as the shift to clean energy solutions like wind, solar, and energy storage systems intensifies the need for precise power measurement tools to ensure optimal grid stability and efficiency.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Current, 2021 – 2034 (Units & USD Million)

- 5.1 Key trends

- 5.2 ≤ 1,000 A

- 5.3 > 1,000 A

Chapter 6 Market Size and Forecast, By Product, 2021 – 2034 (Units & USD Million)

- 6.1 Key trends

- 6.2 Both AC & DC

- 6.3 AC

- 6.4 DC

Chapter 7 Market Size and Forecast, By Phase, 2021 – 2034 (Units & USD Million)

- 7.1 Key trends

- 7.2 Single phase

- 7.3 Three phase

Chapter 8 Market Size and Forecast, By Application, 2021 – 2034 (Units & USD Million)

- 8.1 Key trends

- 8.2 Automotive

- 8.3 Consumer electronics

- 8.4 Energy

- 8.5 Telecom

- 8.6 Healthcare

- 8.7 Others

Chapter 9 Market Size and Forecast, By Region, 2021 – 2034 (Units & USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 France

- 9.3.3 Russia

- 9.3.4 UK

- 9.3.5 Italy

- 9.3.6 Spain

- 9.3.7 Netherlands

- 9.3.8 Austria

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 South Korea

- 9.4.4 India

- 9.4.5 Australia

- 9.4.6 New Zealand

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 UAE

- 9.5.3 Qatar

- 9.5.4 Egypt

- 9.5.5 South Africa

- 9.5.6 Nigeria

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Argentina

Chapter 10 Company Profiles

- 10.1 ADVANTEST CORPORATION

- 10.2 Arbiter Systems

- 10.3 B&K Precision Corporation

- 10.4 Carlo Gavazzi

- 10.5 Chroma ATE

- 10.6 Circutor

- 10.7 Delta Electronics

- 10.8 Dewesoft

- 10.9 DEWETRON

- 10.10 Fluke Corporation

- 10.11 HIOKI E.E. CORPORATION

- 10.12 IWATSU ELECTRIC

- 10.13 Keysight Technologies

- 10.14 Magtrol

- 10.15 NATIONAL INSTRUMENTS

- 10.16 Rohde & Schwarz

- 10.17 TEKTRONIX

- 10.18 Texas Instruments

- 10.19 Vitrek

- 10.20 Yokogawa Test & Measurement Corporation