PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928973

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928973

Autonomous Mobile Robots (AMR) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

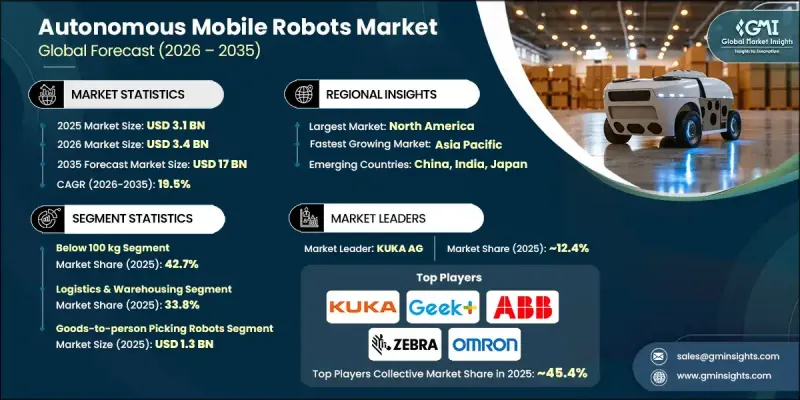

The Global Autonomous Mobile Robots (AMR) Market was valued at USD 3.1 billion in 2025 and is estimated to grow at a CAGR of 19.5% to reach USD 17 billion by 2035.

Market growth reflects the rising need for automation across logistics, manufacturing, healthcare, and service-oriented environments. Organizations are increasingly deploying autonomous mobile robots to improve workplace safety, enhance operational efficiency, and reduce dependency on manual labor. Expanding automation initiatives, combined with rising operational complexity, continue to strengthen demand for intelligent robotic solutions. Advances in load-handling capabilities allow robots to manage larger payloads, reducing task cycles and improving workflow efficiency across facilities. Artificial intelligence and machine learning are now core components of autonomous systems, enabling adaptive navigation, real-time decision-making, and advanced data processing. These capabilities allow robots to function effectively in dynamic settings while improving precision and reliability. As digital transformation accelerates globally, autonomous mobile robots are becoming an essential part of modern operational strategies across multiple industries.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $3.1 Billion |

| Forecast Value | $17 Billion |

| CAGR | 19.5% |

The below 100 kg payload category accounted for 42.7% share in 2025. Robots in this segment are designed for lightweight operations and are optimized for energy efficiency, precise navigation, and compact form factors. Manufacturers emphasize extended battery life, accurate movement control, secure payload handling, and cost-effective scalability to meet diverse operational requirements within this payload range.

The electronics and semiconductor segment is expected to grow at a CAGR of 20.8% during 2026-2035. Growth is supported by increasing automation requirements, demand for higher manufacturing precision, faster production cycles, and strict quality standards. Continuous innovation, flexible production capabilities, and sustained investment in research and development remain critical for manufacturers serving this segment.

North America Autonomous Mobile Robots (AMR) Market held a 33.5% share in 2025. Regional growth is driven by advanced manufacturing adoption, rising demand for automated logistics solutions, increasing labor costs, and strong investment in robotics innovation. The integration of smart manufacturing technologies and flexible automation systems continues to reinforce market leadership in the region.

Key companies operating in the Global Autonomous Mobile Robots (AMR) Market include ABB Ltd., Boston Dynamics, KUKA AG, Fanuc, Omron Corporation, Locus Robotics, Geekplus Technology Co., Ltd., GreyOrange, Mobile Industrial Robots, Zebra Technologies Corp., Teradyne Inc., Honda Motor Co., Ltd., Murata Machinery Ltd., ForwardX Robotics, Seegrid, Vecna Robotics, Aethon, Inc., JBT, Balyo, Onward Robotics, and YUJIN ROBOT Co., Ltd. Companies in the Global Autonomous Mobile Robots (AMR) Market strengthen their market position through continuous technological advancement, product diversification, and strategic partnerships. Investment in artificial intelligence, navigation software, and sensor integration enhances robot autonomy and adaptability. Manufacturers focus on modular and scalable platforms to address varied operational needs across industries. Geographic expansion and collaboration with logistics, manufacturing, and technology providers support broader market penetration.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Component trends

- 2.2.2 Type trends

- 2.2.3 Payload capacity trends

- 2.2.4 Navigation technology trends

- 2.2.5 Battery type trends

- 2.2.6 Application trends

- 2.2.7 End use industry trends

- 2.2.8 Regional trends

- 2.3 TAM Analysis, 2026-2035 (USD Million)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry ecosystem analysis

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Growth of e-commerce and warehouse automation

- 3.3.1.2 Expansion of AMRs in healthcare and pharmaceuticals

- 3.3.1.3 Adoption of AMRs in agriculture and food processing

- 3.3.1.4 Enhanced safety and efficiency in industrial and logistics operations

- 3.3.1.5 Increasing application of AMRs in the hospitality industry

- 3.3.2 Pitfalls and challenges

- 3.3.2.1 High cost associated with autonomous mobile robots

- 3.3.2.2 Challenges in integration and deployment of AMR technologies

- 3.3.3 Market opportunities

- 3.3.3.1 Expansion in last-mile delivery

- 3.3.3.2 Integration with smart factories

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.5.4 Latin America

- 3.5.5 Middle East & Africa

- 3.6 Porter';s analysis

- 3.7 PESTEL analysis

- 3.8 Technology and Innovation landscape

- 3.8.1 Current technological trends

- 3.8.2 Emerging technologies

- 3.9 Emerging Business Models

- 3.10 Compliance Requirements

- 3.11 Sustainability Measures

- 3.12 Consumer Sentiment Analysis

- 3.13 Patent and IP analysis

- 3.14 Geopolitical and trade dynamics

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.2 Market concentration analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Component, 2022 - 2035 (USD Million & Units)

- 5.1 Key trends

- 5.2 Hardware

- 5.3 Software & services

Chapter 6 Market Estimates and Forecast, By Type, 2022 - 2035 (USD Million & Units)

- 6.1 Key trends

- 6.2 Goods-to-person picking robots

- 6.3 Self-driving forklifts

- 6.4 Autonomous inventory robots

- 6.5 Unmanned aerial vehicles

Chapter 7 Market Estimates and Forecast, By Payload Capacity, 2022 - 2035 (USD Million & Units)

- 7.1 Key trends

- 7.2 Below 100 kg

- 7.3 100 kg - 500 kg

- 7.4 More than 500 kg

Chapter 8 Market Estimates and Forecast, By Navigation Technology, 2022 - 2035 (USD Million & Units)

- 8.1 Key trends

- 8.2 Laser/lidar

- 8.3 Vision guidance

- 8.4 Others

Chapter 9 Market Estimates and Forecast, By Battery Type, 2022 - 2035 (USD Million & Units)

- 9.1 Key trends

- 9.2 Lead battery

- 9.3 Lithium-ion battery

- 9.4 Nickel-based battery

- 9.5 Others

Chapter 10 Market Estimates and Forecast, By Application, 2022 - 2035 (USD Million & Units)

- 10.1 Key trends

- 10.2 Sorting

- 10.3 Transportation

- 10.4 Assembly

- 10.5 Inventory management

- 10.6 Others

Chapter 11 Market Estimates and Forecast, By End Use Industry, 2022 - 2035 (USD Million & Units)

- 11.1 Key trends

- 11.2 Logistics & warehousing

- 11.3 Retail

- 11.4 Automotive

- 11.5 Electronics & semiconductor

- 11.6 Pharmaceuticals & healthcare

- 11.7 Food & beverage

- 11.8 Aerospace & defense

- 11.9 Hospitality

- 11.10 Others

Chapter 12 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Million & Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Spain

- 12.3.5 Italy

- 12.3.6 Netherlands

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 Middle East and Africa

- 12.6.1 South Africa

- 12.6.2 Saudi Arabia

- 12.6.3 UAE

Chapter 13 Company Profiles

- 13.1 Global Key Players

- 13.1.1 ABB Ltd.

- 13.1.2 KUKA AG

- 13.1.3 Omron Corporation

- 13.1.4 Zebra Technologies Corp.

- 13.2 Regional key players

- 13.2.1 North America

- 13.2.1.1 Aethon, Inc.

- 13.2.1.2 Vecna Robotics

- 13.2.1.3 ForwardX Robotics

- 13.2.1.4 Mobile Industrial Robots

- 13.2.2 Asia Pacific

- 13.2.2.1 Geekplus Technology Co., Ltd.

- 13.2.2.2 YUJIN ROBOT Co., Ltd.

- 13.2.2.3 Honda Motor Co., Ltd.

- 13.2.3 Europe

- 13.2.3.1 Fanuc

- 13.2.3.2 GreyOrange

- 13.2.3.3 Locus Robotics

- 13.2.3.4 Murata Machinery, Ltd.

- 13.2.1 North America

- 13.3 Niche Players/Disruptors

- 13.3.1 Balyo

- 13.3.2 Boston Dynamics

- 13.3.3 Onward Robotics

- 13.3.4 Seegrid

- 13.3.5 Teradyne Inc.

- 13.3.6 JBT