PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716544

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716544

OTC Pet Medication Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

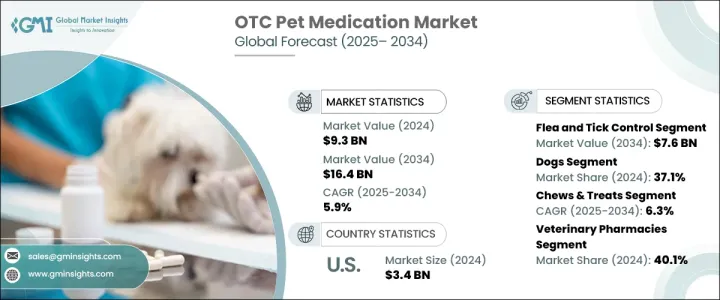

The Global OTC Pet Medication Market reached USD 9.3 billion in 2024 and is expected to grow at a CAGR of 5.9% between 2025 and 2034. The market's growth is primarily fueled by the increasing number of pet owners and the rising trend of pet humanization. This shift has led to heightened demand for better healthcare solutions and preventive wellness products. Pet owners are more proactive in seeking high-quality, accessible, and effective over-the-counter (OTC) medications to improve their pets' overall health. Growing awareness of preventive care and the availability of easy-to-administer medications have significantly contributed to the market expansion.

As pet owners become increasingly informed about potential health risks, they are investing in products that address common conditions such as arthritis, skin allergies, and digestive issues. This trend is particularly prominent in developed regions, where higher disposable income and a strong emphasis on pet well-being drive higher spending on pet healthcare. Moreover, innovations in medication formulations, including flavored tablets and chewables, are enhancing compliance and treatment effectiveness, further boosting market demand. The growing presence of e-commerce platforms has also made these products more accessible, offering convenience and a broader range of options for pet owners globally.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.3 Billion |

| Forecast Value | $16.4 Billion |

| CAGR | 5.9% |

As pets encounter a growing range of health issues, including parasitic infections, skin disorders, and joint pain, the need for OTC medications continues to rise. Osteoarthritis is one of the most prevalent conditions in pets, particularly in aging dogs and cats, affecting a significant portion of the pet population. The high incidence of joint-related health problems is expected to drive sustained demand for joint supplements and other therapeutic medications. Additionally, the increasing focus on preventative healthcare, such as parasite control and skin protection, is contributing to the growing market for OTC solutions. Pet owners are turning to natural and homeopathic remedies to address minor health concerns, further diversifying the range of available OTC products.

The flea and tick control segment accounted for USD 4.2 billion in 2024. The increasing prevalence of vector-borne diseases transmitted by fleas and ticks has fueled the demand for effective control medications. Rising pet adoption rates, coupled with growing concerns about disease prevention, are driving this segment's rapid growth. Manufacturers are developing advanced formulations that offer long-lasting protection while ensuring ease of application, contributing to the segment's continued dominance.

The OTC pet medication market is categorized based on pet type, including dogs, cats, birds, fish, reptiles, and others. Dogs accounted for 37.1% of the market share in 2024. The high prevalence of health issues in dogs, combined with increased healthcare spending and outdoor exposure that makes them more vulnerable to parasitic infections, has led manufacturers to prioritize developing medications tailored to canine health. Pet owners are increasingly seeking solutions to ensure their dogs remain healthy, driving sustained growth in this segment.

The U.S. OTC pet medication market was valued at USD 3.4 billion in 2024 and is expected to remain the largest market throughout the forecast period. Growing awareness about pet care and the humanization of pets are key drivers of market growth in the U.S. Pet owners are becoming more vigilant and proactive in seeking advanced solutions to maintain the health and well-being of their pets. The availability of innovative formulations and increasing access to e-commerce platforms are making OTC pet medications more accessible, ensuring strong market performance in the coming years.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising pet ownership rate

- 3.2.1.2 Growing emphasis on preventive healthcare for pets

- 3.2.1.3 Increasing prevalence of zoonotic diseases

- 3.2.1.4 Expansion of e-commerce & online retailing

- 3.2.1.5 Growing animal healthcare expenditure

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory standards

- 3.2.2.2 Potential side effects & misuse

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Future market trends

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Medication Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Flea and tick control

- 5.3 Dewormers & parasiticides

- 5.4 Pain relievers & allergy medications

- 5.5 Skin and coat care

- 5.6 Dental care

- 5.7 Nutritional supplements

- 5.8 Behavioral & anxiety relief medications

- 5.9 Other medication types

Chapter 6 Market Estimates and Forecast, By Pet Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Dogs

- 6.3 Cats

- 6.4 Birds

- 6.5 Fishes & reptiles

- 6.6 Other pet types

Chapter 7 Market Estimates and Forecast, By Dosage Form, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Chews & treats

- 7.3 Capsules

- 7.4 Sprays

- 7.5 Ointments

- 7.6 Other dosage forms

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Veterinary pharmacies

- 8.3 Pet specialty stores

- 8.4 Online retailers

- 8.5 Other distribution channels

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AdvaCare Pharma

- 10.2 Bimeda

- 10.3 Boehringer Ingelheim International

- 10.4 Ceva Sante Animale

- 10.5 Dechra

- 10.6 Elanco Animal Health

- 10.7 Heska Corporation

- 10.8 Merck & Co.

- 10.9 Norbrook

- 10.10 Nutramax Laboratories Consumer Care

- 10.11 PetIQ

- 10.12 Phibro Animal Health

- 10.13 Vetenex Animal Health

- 10.14 Vetoquinol

- 10.15 Virbac

- 10.16 Zoetis