PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716588

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716588

Data Center Robotics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

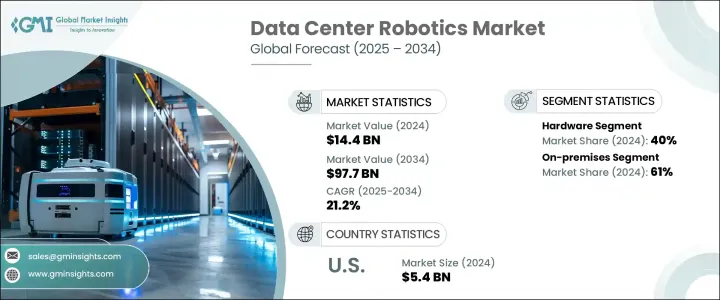

The Global Data Center Robotics Market, with a valuation of USD 14.4 billion in 2024, is expected to grow at a CAGR of 21.2% from 2025 to 2034, driven by the increasing need for automation in data centers. The demand for robotics is being fueled by the necessity for improved productivity, reduced human labor, and enhanced operational efficiency. By automating essential tasks such as server maintenance, cable management, and environmental monitoring, robotics are minimizing human errors and reducing downtime, enabling smoother, more efficient operations with minimal supervision.

As data centers continue to grow in number and scale, particularly with the rise of hyperscale and edge facilities, the role of robotics becomes increasingly vital. These automated systems are essential for managing the vast array of tasks that need to be handled, including equipment handling, server supervision, and cooling optimization. The automation of these processes helps to minimize downtime and idle time, improving productivity in the face of rising data demands. This expanding need for more efficient and scalable robotic solutions reflects the growing reliance on data centers and the need to maintain their complex infrastructure.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $14.4 Billion |

| Forecast Value | $97.7 Billion |

| CAGR | 21.2% |

The market is segmented into hardware, software, and services, with hardware currently leading the market, accounting for approximately 40% of the share in 2024. This segment is expected to continue its strong growth, expanding at a CAGR of over 19.5%. Automation technologies such as autonomous mobile robots (AMRs) and robotic arms are gradually replacing manual labor, enabling faster, more accurate maintenance and equipment handling.

Data center robotics are also categorized based on deployment model, with the market divided between on-premises and cloud-based models. In 2024, the on-premises segment holds the majority share, representing 61% of the market. This segment is expected to grow at a CAGR of more than 20.5% through 2034. On-premises deployment offers significant advantages, including greater control over robotic systems, which helps improve performance and reduces reliance on external networks, minimizing latency and enabling quicker responses for tasks like server monitoring and automation.

Within the robot type segment, service robots are poised to dominate, thanks to their pivotal role in automating operations and improving system reliability. These robots are increasingly utilized for monitoring tasks such as heating, cooling, and security patrols, enhancing the overall performance of data centers. Service robots also provide remote management, allowing IT staff to oversee operations from a distance, which further boosts operational efficiency.

In North America, the U.S. leads the market with a substantial 93% market share in the region. The U.S. continues to drive growth through its tech hubs, with major corporations investing in robotics to maintain server infrastructure and optimize energy consumption. As demand for high-performance computing, AI, and cloud operations grows, data center robotics are becoming a critical part of ensuring reliable, efficient operations.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Component suppliers

- 3.2.2 Manufacturers

- 3.2.3 System integrators

- 3.2.4 Technology providers

- 3.2.5 End use

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Rising demand for automation

- 3.8.1.2 Increasing data center expansion

- 3.8.1.3 Growth in cloud computing and AI workloads

- 3.8.1.4 Growing need for enhanced security

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 High initial investment costs

- 3.8.2.2 Complex integration with existing infrastructure

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Sensor

- 5.2.2 Actuator

- 5.2.3 Motors

- 5.2.4 Vision systems

- 5.2.5 AI processors

- 5.2.6 Others

- 5.3 Software

- 5.4 Services

Chapter 6 Market Estimates & Forecast, By Robot, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Collaborative robots

- 6.3 Industrial robots

- 6.4 Service robots

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Deployment Model, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 On-premises

- 7.3 Cloud-based

Chapter 8 Market Estimates & Forecast, By Enterprise Size, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 SME

- 8.3 Large enterprises

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 BFSI

- 9.3 Colocation

- 9.4 Energy

- 9.5 Government

- 9.6 Healthcare

- 9.7 Manufacturing

- 9.8 IT & telecom

- 9.9 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 365 Data Centers

- 11.2 ABB

- 11.3 Amazon Web Services

- 11.4 Boston Dynamics

- 11.5 China Telecom

- 11.6 Cisco Systems

- 11.7 ConnectWise

- 11.8 Digital Realty

- 11.9 Equinix

- 11.10 Fanuc

- 11.11 Google

- 11.12 Hewlett Packard Enterprise Development

- 11.13 Huawei Technologies

- 11.14 IBM

- 11.15 Microsoft Corporation

- 11.16 NTT Communications

- 11.17 Rockwell Automation

- 11.18 Siemens

- 11.19 SoftBank Robotics

- 11.20 Verizon