PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716596

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716596

Polyester Fiber Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

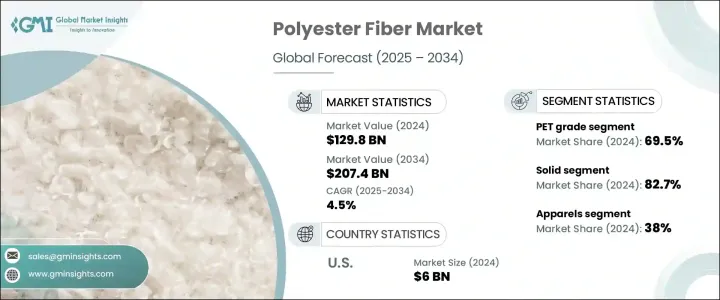

The Global Polyester Fiber Market, valued at USD 129.8 billion in 2024, is projected to grow at a CAGR of 4.5% from 2025 to 2034. Polyester fiber, synthesized from petrochemicals, remains one of the most versatile and widely used synthetic fibers worldwide, primarily due to its strength, durability, flexibility, and cost-effectiveness. As industries continuously seek high-performance materials that offer enhanced functionality and sustainability, polyester fiber emerges as a top contender across multiple verticals, including textiles, automotive, home furnishings, and industrial applications. The rising demand for low-maintenance, wrinkle-resistant, and quick-drying fabrics in the fashion and home decor segments is accelerating the use of polyester fibers.

Additionally, ongoing innovations in production technologies, such as eco-friendly and recycled fiber manufacturing, are driving the global market forward. Heightened consumer awareness about sustainable and durable materials, coupled with increasing demand for affordable synthetic alternatives to natural fibers, is reinforcing polyester fiber's dominance. Moreover, global market players are focusing on strategic collaborations, mergers, and acquisitions to strengthen their production capacities and product portfolios, further fueling market expansion. The shift toward circular economies and the rising incorporation of recycled polyester in textiles are also shaping the industry's growth trajectory.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $129.8 Billion |

| Forecast Value | $207.4 Billion |

| CAGR | 4.5% |

The polyester fiber market is segmented by grade into PET (polyethylene terephthalate) and PCDT (poly-1,4-cyclohexylene-dimethylene terephthalate). PET grade dominated the market with a 69.5% share in 2024, primarily due to its extensive use in clothing, packaging, and industrial fabrics. Known for its durability, lightweight nature, and excellent resistance to moisture and chemicals, PET fiber continues to be favored in fashion and industrial applications alike. The increasing consumer focus on eco-friendly products is driving the demand for PET fibers since they can be recycled into new materials, effectively supporting sustainability goals. As consumers prioritize long-lasting, low-maintenance garments and products that offer value and performance, PET fibers remain the preferred choice for manufacturers looking to meet evolving market demands.

By product type, the polyester fiber market is divided into solid and hollow fibers, with solid polyester fibers capturing an 82.7% share in 2024. Solid fibers continue gaining traction owing to their widespread use in apparel, bedding, upholstery, and other textile products that require strength, durability, and ease of care. The growing preference for wrinkle-resistant, fast-drying, and resilient fabrics in both home and commercial sectors is pushing the demand for solid polyester fibers higher. Additionally, trends in home decor and interior furnishings that emphasize aesthetic appeal along with functionality are contributing to the growth of this segment. Consumers and manufacturers alike are recognizing solid polyester fibers as a cost-effective and high-quality solution for various applications, making them an indispensable component of modern textiles.

U.S. polyester fiber market, valued at USD 6 billion in 2024, continues to hold a leading position, driven by robust industrial demand, advanced manufacturing capabilities, and favorable trade policies. The well-developed textile industry and growing emphasis on domestic manufacturing are reinforcing the country's stronghold in the global polyester fiber space. Increasing imports of synthetic fibers, especially polyester, highlight the rising need for these versatile materials in fashion, home textiles, and industrial uses across the U.S.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Merger and acquisitions

- 3.6.1.2 Technological advancements in production process

- 3.6.1.3 Growth in automotive and industrial applications

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Environmental regulations

- 3.6.2.2 Competition from alternative fibers

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Grade, 2021–2034 (USD Billion) (Tons)

- 5.1 Key trends

- 5.2 PET

- 5.3 PCDT

Chapter 6 Market Estimates and Forecast, By Product, 2021–2034 (USD Billion) (Tons)

- 6.1 Key trends

- 6.2 Solid

- 6.3 Hollow

Chapter 7 Market Estimates and Forecast, By Application, 2021–2034 (USD Billion) (Tons)

- 7.1 Key trends

- 7.2 Carpets & rugs

- 7.3 Non-woven fiber

- 7.4 Fiberfill

- 7.5 Apparel

- 7.6 Home textile

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021–2034 (USD Billion) (Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Alpek Polyester

- 9.2 Far Eastern Group

- 9.3 GreenFiber International

- 9.4 Indorama Ventures

- 9.5 Nan Ya Plastics Corporation

- 9.6 Reliance Industries Limited

- 9.7 Sinopec

- 9.8 Stein Fibers

- 9.9 Swicofil

- 9.10 Teijin Limited

- 9.11 Toray Industries

- 9.12 William Barnet and Son

- 9.13 Zhejiang Hengsheng Chemical Fiber Group