PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716620

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716620

Biomedical Warming and Thawing Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

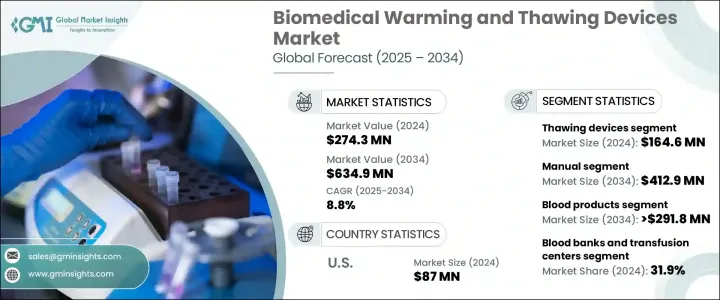

The Global Biomedical Warming And Thawing Devices Market reached USD 274.3 million in 2024 and is projected to grow at a CAGR of 8.8% between 2025 and 2034. The market is expanding due to the rising number of blood banks, increasing stem cell research, and the growing use of IVF procedures that rely on cryopreserved sample handling. The prevalence of chronic diseases, advancements in regenerative medicine, and the broader application of cryopreservation in healthcare are contributing to market growth. The use of cryopreservation techniques in cell therapy, gene therapy, and personalized medicine has fueled the demand for warming and thawing devices. These devices are essential in blood banks and biobanks to maintain the quality of cryopreserved samples such as blood products, stem cells, and embryos, which are critical for research and treatment. The rising incidence of chronic conditions such as cancer and cardiovascular diseases has further increased demand for these devices in hospitals and transfusion centers.

Investments in stem cell research and regenerative medicine are also contributing to market growth. Private and government entities are funding the development of advanced thawing devices to improve sample preservation and utilization. Additionally, the increasing cases of infertility have led to a growing demand for IVF procedures, where warming and thawing devices play a crucial role in handling oocytes, embryos, and semen samples. Maintaining strict control over sample handling during these processes is essential, which drives the continued demand for these devices.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $274.3 Million |

| Forecast Value | $634.9 Million |

| CAGR | 8.8% |

Thawing devices, in particular, have a significant role in the market, generating USD 164.6 million in revenue in 2024. These devices ensure the viability of cryopreserved samples and are extensively used in blood banks for thawing plasma and platelets required for transfusions and surgical procedures. Advanced thawing systems with temperature control features provide effective and safe thawing of sensitive samples such as stem cells and embryos. With the growth of regenerative medicine and stem cell therapies, the demand for thawing devices is expected to remain strong. Their increasing use in biobanks and IVF clinics also supports the leading position of this segment.

The manual segment, which is more cost-effective and suitable for small-scale operations, is expected to grow at a CAGR of 8.6%, reaching over USD 412.9 million by 2034. Manual devices are widely used in developing regions where automation is less accessible. These devices, which are easy to operate and require minimal infrastructure, are ideal for small laboratories and clinics. They are also preferred for handling samples that need close attention during thawing or warming, such as semen and tissue samples.

Blood products dominate the market by sample type, with this segment expected to grow at a CAGR of 8.7%, reaching over USD 291.8 million by 2034. Blood products such as plasma, platelets, and red blood cells require precise handling during transfusion and surgical procedures. These devices ensure the safety and efficacy of blood products used in emergency and routine medical procedures. Increasing surgical procedures and cancer treatments further drive the need for these devices in hospitals and biobanks.

Blood banks and transfusion centers held a dominant market position with a 31.9% revenue share in 2024. These facilities handle large volumes of plasma and platelet thawing necessary for emergency and surgical transfusions. The adoption of automated and rapid thawing systems is improving operational efficiency in these settings.

In the U.S., the biomedical warming and thawing devices market was valued at USD 87 million in 2024 and is projected to grow at a CAGR of 8.4% through 2034. The U.S. market holds a significant share in North America due to the increasing prevalence of chronic diseases and a high volume of surgical procedures. Hospitals and healthcare institutions in the U.S. are integrating modern thawing systems to manage the growing demand for blood products in emergencies and surgical settings. The emphasis on applied research and development in regenerative medicine and IVF has further bolstered the adoption of these devices.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing number of blood banks and blood infusion centers worldwide

- 3.2.1.2 Increased development of sample analysis and studies in the biotechnology sector

- 3.2.1.3 Rising number of road accidents and trauma cases leading to blood transfusions

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Strict regulations for thawed biomedical products and samples

- 3.2.2.2 Issues related to large batch sizes

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Pricing analysis

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Thawing devices

- 5.3 Warming devices

Chapter 6 Market Estimates and Forecast, By Mode, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Manual

- 6.3 Automatic

Chapter 7 Market Estimates and Forecast, By Sample Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Blood products

- 7.3 Ovum/embryo

- 7.4 Semen

- 7.5 Other sample types

Chapter 8 Market Estimates and Forecast, By End Use 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Blood banks and transfusion centers

- 8.3 Hospitals

- 8.4 Research laboratories

- 8.5 Pharmaceutical companies

- 8.6 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Arctiko

- 10.2 Barkey

- 10.3 BioCision

- 10.4 BioLife Solutions

- 10.5 BOEKEL

- 10.6 Cytiva

- 10.7 eppendorf

- 10.8 Haier Biomedical

- 10.9 Helmer SCIENTIFIC

- 10.10 IVF tech

- 10.11 LABCOLD

- 10.12 PHCbi

- 10.13 SARTORIUS

- 10.14 Thermo Fisher