PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716629

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716629

Europe Industrial Machinery Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

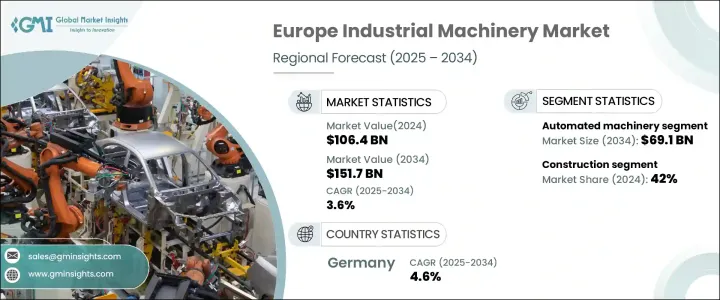

Europe Industrial Machinery Market was valued at USD 106.4 billion in 2024 and is projected to grow at a CAGR of 3.6% between 2025 and 2034. This growth is driven by rapid advancements in key industries such as automotive, semiconductor manufacturing, and construction, alongside the rising adoption of cutting-edge technologies. The integration of Industry 4.0 concepts, including IoT, AI, and machine learning, has redefined traditional manufacturing processes, making them more precise, efficient, and cost-effective. Additionally, the growing emphasis on sustainable manufacturing and renewable energy projects is pushing manufacturers to adopt innovative machinery that reduces environmental impact while optimizing operational efficiency. Countries across Europe are witnessing increased investments in infrastructure development and automation technologies, further propelling the industrial machinery market forward. As companies aim to stay competitive, the demand for high-tech machinery that enhances production capabilities and minimizes human error is expected to surge, fueling market expansion across multiple sectors.

The industrial machinery market in Europe is segmented based on operation type, including automated, semi-automated, manual, and robotic machinery. Automated machinery dominated the market, valued at USD 47.2 billion in 2024, and is expected to reach USD 69.1 billion by 2034. This segment is experiencing remarkable growth due to its ability to deliver higher precision and consistency, significantly reducing human error and improving overall product quality. Automation not only enhances operational efficiency but also reduces dependency on manual labor, allowing manufacturers to cut costs and streamline their production processes. With growing emphasis on achieving higher productivity and meeting rising demand for complex, high-quality products, automated machinery is poised to remain the driving force behind the region's industrial transformation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $106.4 Billion |

| Forecast Value | $151.7 Billion |

| CAGR | 3.6% |

In terms of end-use industries, the market is categorized into sectors such as agriculture, construction, packaging, food processing, mining, semiconductor manufacturing, and others. The construction sector accounted for a substantial 42% share of the market in 2024 and is expected to maintain its dominant position through 2034. This growth is attributed to increasing investments in public infrastructure, urban development projects, and smart city initiatives. Government-backed programs and private sector involvement in large-scale building projects continue to create a strong demand for advanced industrial machinery used in the construction sector. As European nations emphasize infrastructure modernization, the construction industry is anticipated to be a key growth driver for the industrial machinery market in the coming years.

Germany, a major player in the European industrial machinery landscape, is poised to witness substantial growth, with its market expected to grow at a CAGR of 4.6% from 2025 to 2034. Known for its engineering excellence and industrial expertise, Germany has established itself as a global leader in manufacturing and precision technology. The country's continuous focus on adopting emerging technologies and automation trends places it at the forefront of industrial innovation. With strong government support for Industry 4.0 initiatives and sustained investment in advanced manufacturing systems, Germany is setting a benchmark for other nations, driving growth across the European industrial machinery sector.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.5 Secondary

- 1.5.1.1 Paid sources

- 1.5.1.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.1.7 Retailers

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Expansion of automotive sector

- 3.2.1.2 Expanding technological advancements and integration of industry 4.0

- 3.2.1.3 Increasing investment in renewable energy projects.

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Supply chain disruptions

- 3.2.2.2 Strict environmental regulations

- 3.2.1 Growth drivers

- 3.3 Technological overview

- 3.4 Consumer buying behavior analysis

- 3.4.1 Demographic trends

- 3.4.2 Factors affecting buying decision

- 3.4.3 Consumer product adoption

- 3.4.4 Preferred distribution channel

- 3.4.5 Preferred price range

- 3.5 Growth potential analysis

- 3.6 Regulatory landscape

- 3.7 Pricing analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Operation, 2021 – 2034 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Automated machinery

- 5.3 Semi-Automated machinery

- 5.4 Manual machinery

- 5.5 Robotic machinery

Chapter 6 Market Estimates & Forecast, By End Use, 2021 – 2034, (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Agriculture

- 6.3 Construction

- 6.4 Packaging

- 6.5 Food processing

- 6.6 Mining

- 6.7 Semiconductor manufacturing

- 6.8 Others

Chapter 7 Market Estimates & Forecast, By Distribution Channel, 2021 – 2034, (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Direct

- 7.3 Indirect

Chapter 8 Market Estimates & Forecast, By Country, 2021 – 2034, (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Europe

- 8.2.1 Germany

- 8.2.2 UK

- 8.2.3 France

- 8.2.4 Italy

- 8.2.5 Spain

Chapter 9 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 9.1 ABB Ltd.

- 9.2 Alfa Laval AB

- 9.3 Atlas Copco AB

- 9.4 Bosch Rexroth AG

- 9.5 CNH Industrial N.V.

- 9.6 DMG Mori AG

- 9.7 Festo SE & Co. KG

- 9.8 GEA Group AG

- 9.9 Komatsu Europe International N.V.

- 9.10 KUKA AG

- 9.11 Liebherr Group

- 9.12 Sandvik AB

- 9.13 Schindler Group

- 9.14 Siemens AG

- 9.15 Trumpf GmbH + Co. KG