PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716712

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716712

Outdoor Apparel and Accessories Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

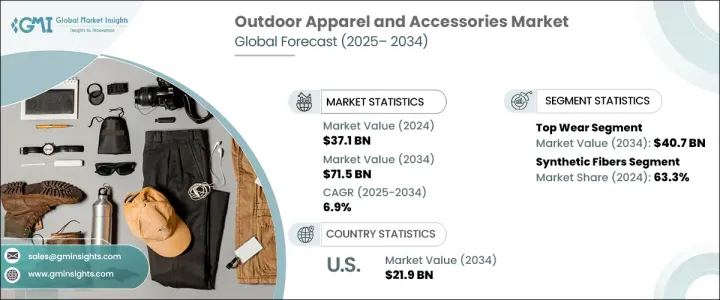

The Global Outdoor Apparel and Accessories Market was valued at USD 37.1 billion in 2024 and is projected to grow at a CAGR of 6.9% between 2025 and 2034. This growth reflects a dynamic shift in consumer preferences as outdoor lifestyles continue to gain widespread popularity worldwide. From casual hikers to seasoned trekkers, more individuals are embracing outdoor recreation as part of their daily lives. Increasing awareness about health and wellness, along with a rising interest in fitness and adventure sports, is pushing demand for high-quality, performance-driven outdoor gear.

Additionally, a growing trend toward experiential travel and eco-tourism is fueling market expansion as travelers seek durable and stylish products to enhance their outdoor experiences. As more people engage in activities like hiking, trekking, skiing, and camping, the need for innovative, functional, and weather-resistant clothing and accessories is rapidly increasing. The focus on sustainability and technological advancements in material science is also shaping product development as brands introduce gear that meets both performance and environmental standards. Outdoor brands are responding to evolving consumer demands by offering versatile apparel that can seamlessly transition from rugged trails to urban settings, ensuring both functionality and style.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $37.1 Billion |

| Forecast Value | $71.5 Billion |

| CAGR | 6.9% |

The market is broadly categorized into top wear, bottom wear, and accessories, with top wear leading the way and generating USD 20.8 billion in 2024. The heightened demand for outdoor clothing like jackets, hoodies, fleeces, and base layers stems from increasing participation in outdoor sports and recreational activities throughout the year, including extreme weather conditions. As consumers prioritize gear that can withstand varying climates, there is a notable shift toward high-performance products that offer both comfort and durability. The surge in environmentally conscious consumers is driving brands to adopt eco-friendly materials such as recycled polyester, organic cotton, and biodegradable fabrics, making sustainable products more mainstream. The online sales channel has emerged as a significant growth driver, offering customers a wide range of customization options and direct-to-consumer benefits like personalized shopping experiences, exclusive collections, and seamless returns.

Segmented by material, the market prominently features synthetic and natural fabrics, with synthetic materials accounting for a dominant 63.3% share in 2024. Synthetic fibers, including polyester, nylon, and spandex, continue to be the preferred choice for outdoor gear due to their superior performance, lightweight design, quick-drying capabilities, and enhanced durability. These materials provide critical benefits such as moisture-wicking, UV protection, and thermal insulation, essential for both high-altitude and extreme weather environments. As outdoor enthusiasts seek gear that balances functionality with comfort, synthetic fabrics remain a cornerstone in product innovation.

The U.S. Outdoor Apparel and Accessories Market generated USD 11.1 billion in 2024, maintaining its position as the largest contributor to regional demand. With a deeply rooted outdoor culture and increasing participation in hiking, cycling, camping, and winter sports, the U.S. market is thriving. A growing consumer shift toward premium, high-performance gear that can adapt to diverse climates is accelerating demand. Additionally, U.S. brands are emphasizing sustainable production practices and cutting-edge material technologies, reflecting the nation's broader commitment to environmental responsibility and innovation in the outdoor apparel space.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2018 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factors affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.1.7 Retailers

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing popularity in outdoor activities

- 3.2.1.2 Rise of eco-conscious customers

- 3.2.1.3 Rise in innovation in materials and technology

- 3.2.1.4 Expanding influence of athleisure and casual wear trends

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Evolving consumer demands

- 3.2.2.2 High-cost investment

- 3.2.1 Growth drivers

- 3.3 Technology & innovation landscape

- 3.4 Consumer buying behavior analysis

- 3.4.1 Demographic trends

- 3.4.2 Factors affecting buying decision

- 3.4.3 Consumer product adoption

- 3.4.4 Preferred distribution channel

- 3.5 Growth potential analysis

- 3.6 Regulatory landscape

- 3.7 Pricing analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021 – 2034, (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Top

- 5.2.1 T-shirts

- 5.2.2 Tank tops

- 5.2.3 Sports bras

- 5.2.4 Jackets

- 5.2.5 Sweatshirts

- 5.2.6 Others (track suits, swimmer suits)

- 5.3 Bottom

- 5.3.1 Leggings

- 5.3.2 Shorts

- 5.3.3 Sweatpants

- 5.3.4 Track pants

- 5.3.5 Others (yoga pants, skirts)

- 5.4 Accessories

- 5.4.1 Gloves & mittens

- 5.4.2 Backpacks

- 5.4.3 Sleeping bags

- 5.4.4 Tents

- 5.4.5 Helmet

- 5.4.6 Hydration gear

- 5.4.7 Eye wear

- 5.4.8 Gaiters

- 5.4.9 Hats

- 5.4.10 Others (scarves, first aid supplies etc.)

Chapter 6 Market Estimates & Forecast, By Material, 2021 – 2034, (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Synthetic fabrics

- 6.2.1 Polyester

- 6.2.2 Nylon

- 6.3 Natural fabrics

- 6.3.1 Cotton fabrics

- 6.3.2 Hemp

- 6.3.3 Bamboo

- 6.3.4 Wool

- 6.3.5 Others

Chapter 7 Market Estimates & Forecast, By Consumer Group, 2021 – 2034, (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Male

- 7.3 Female

- 7.4 Kids

Chapter 8 Market Estimates & Forecast, By Pricing, 2021 – 2034, (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Low

- 8.3 Medium

- 8.4 High

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 – 2034, (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Online retail

- 9.2.1 Ecommerce

- 9.2.2 Company website

- 9.3 Offline

- 9.3.1 Specialty stores

- 9.3.2 Mega retail stores

- 9.3.3 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 – 2034, (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Malaysia

- 10.4.7 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 11.1 Arc'teryx Equipment Inc.

- 11.2 Black Diamond Equipment Ltd.

- 11.3 Columbia Sportswear Company

- 11.4 Eddie Bauer LLC

- 11.5 Helly Hansen AS

- 11.6 Patagonia, Inc.

- 11.7 Prana Living, LLC

- 11.8 REI Co-op

- 11.9 Salomon S.A.

- 11.10 The North Face, Inc.