PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721414

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721414

Silicon Carbide Semiconductor Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

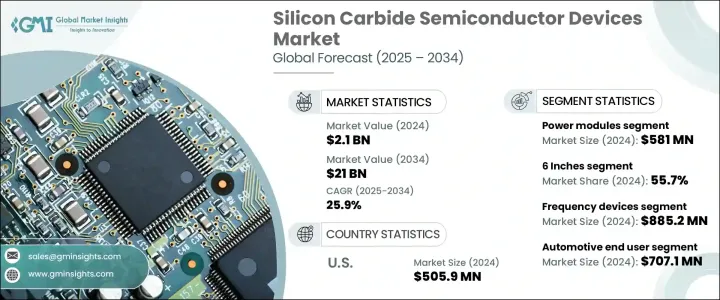

The Global Silicon Carbide Semiconductor Devices Market was valued at USD 2.1 billion in 2024 and is estimated to grow at a CAGR of 25.9% to reach USD 21 billion by 2034. This exceptional growth stems from a strong global push toward decarbonization and the adoption of clean energy technologies, especially in the transportation and power generation sectors. As industries and governments prioritize energy efficiency, sustainability, and long-term cost savings, silicon carbide (SiC) semiconductors are increasingly seen as the future of high-performance power electronics. Their superior thermal conductivity, high breakdown electric field, and ability to operate at higher frequencies make them critical in applications requiring reliability under harsh operating environments. From smart grids and renewable energy installations to industrial drives and fast-charging infrastructure, SiC-based devices are redefining operational standards and performance expectations.

Global demand continues to be fueled by the rising integration of SiC technology in electric vehicles (EVs), aerospace and defense systems, and large-scale grid modernization initiatives. The accelerating shift to EVs is particularly significant, as automakers are under pressure to deliver vehicles with extended driving ranges and reduced charging times. SiC devices help meet these demands by minimizing energy losses, improving power conversion efficiency, and enabling compact, lightweight systems. The role of SiC semiconductors is also expanding in solar inverters and wind turbines, where high efficiency and ruggedness are critical to optimize energy output and system durability. Meanwhile, defense and aerospace sectors increasingly favor SiC-based power systems for their robust performance in mission-critical and high-temperature environments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.1 Billion |

| Forecast Value | $21 Billion |

| CAGR | 25.9% |

The market is segmented based on components, with power modules leading the charge, accounting for USD 581 million in 2024. These modules are widely adopted for their compact architecture, reduced need for external cooling, and elevated efficiency across various end-use applications, including EV drivetrains, portable electronics, and industrial power supplies. The boom in EV sales has simultaneously heightened the need for ultra-fast charging solutions, a domain where SiC power modules excel thanks to their low switching losses and exceptional voltage handling.

Another pivotal segment is wafer size, with 6-inch wafers expected to dominate the market, capturing a 55.7% share in 2024. These wafers support higher throughput and improved production economics, making them a preferred choice for manufacturing high-voltage, energy-efficient devices across automotive and renewable energy industries.

The U.S. Silicon Carbide Semiconductor Devices Market reached USD 505.9 million in 2024, backed by the nation's strategic focus on clean energy transitions and cutting-edge mobility solutions. U.S.-based EV makers are adopting SiC-based systems to boost energy efficiency and vehicle performance, addressing growing consumer demand for faster charging and longer range.

Key players in this space include onsemi, STMicroelectronics, ROHM Semiconductor, Wolfspeed, and Infineon Technologies. These companies are heavily investing in R&D to enhance device performance while reducing manufacturing costs. Capacity expansions, partnerships with automotive OEMs, and collaborations with renewable energy firms remain central to their market strategies.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Emerging use of SiC semiconductor devices in consumer electronics

- 3.6.1.2 Surge in demand for electric vehicles

- 3.6.1.3 Rising inclination towards industrial automation

- 3.6.1.4 Increasing application of silicon carbide semiconductor devices in aerospace and defense applications

- 3.6.1.5 Growing number of grid modernization and renewable energy projects

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Limited awareness and adoption in emerging markets

- 3.6.2.2 Competition from silicon and gallium nitride (GaN)

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Schottky diodes

- 5.3 FET/MOSFET transistors

- 5.4 Integrated circuits

- 5.5 Rectifiers/diodes

- 5.6 Power modules

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Wafer Size, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 1 inch to 4 inches

- 6.3 6 inches

- 6.4 8 inches

Chapter 7 Market Estimates & Forecast, By Product, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 Optoelectronic devices

- 7.3 Power semiconductors

- 7.4 Frequency devices

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 Automotive

- 8.3 Energy & power

- 8.4 Consumer electronics

- 8.5 Aerospace & defense

- 8.6 Medical devices

- 8.7 Data & communication devices

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Alpha & Omega Semiconductor

- 10.2 Analog Devices

- 10.3 Bosch Semiconductors

- 10.4 Coherent Corp.

- 10.5 Diodes Incorporated

- 10.6 Fuji Electric

- 10.7 GeneSiC Semiconductor

- 10.8 Infineon Technologies

- 10.9 Littelfuse

- 10.10 Microchip Technology

- 10.11 Mitsubishi Electric

- 10.12 NXP Semiconductors

- 10.13 onsemi

- 10.14 Power Integrations

- 10.15 Qorvo

- 10.16 ROHM Semiconductor

- 10.17 Semikron Danfoss

- 10.18 Solitron Devices

- 10.19 STMicroelectronics

- 10.20 Toshiba Electronic Devices & Storage

- 10.21 Vishay Intertechnology

- 10.22 WeEn Semiconductors

- 10.23 Wolfspeed