PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721423

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721423

Small Molecule API Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

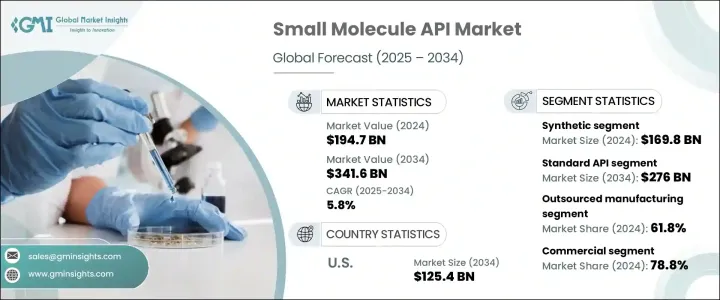

The Global Small Molecule API Market was valued at USD 194.7 billion in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 341.6 billion by 2034. Small molecule active pharmaceutical ingredients (APIs) continue to play a pivotal role in modern therapeutics due to their ease of formulation, oral bioavailability, and well-established manufacturing processes. These compounds, characterized by low molecular weight, easily penetrate cell membranes to deliver therapeutic benefits across a wide range of diseases. As the pharmaceutical industry intensifies its focus on precision medicine and rapid drug development, small molecule APIs are witnessing renewed interest. Pharmaceutical companies are increasingly leveraging artificial intelligence and high-throughput screening tools to optimize discovery and development processes. These innovations have shortened drug development timelines, improved targeting efficiency, and significantly reduced production costs. Additionally, global healthcare trends such as the increasing prevalence of chronic diseases, aging populations, and rising demand for cost-effective drugs are pushing pharmaceutical firms to scale up API production. Governments across key markets are also actively promoting generic drug availability, creating a favorable ecosystem for API manufacturing. The need for affordable, scalable, and effective treatments is further driving API manufacturers to invest in robust infrastructure, regulatory compliance, and R&D innovation.

The market is segmented by type into biotech and synthetic APIs, with the synthetic category generating USD 169.8 billion in 2024. Synthetic APIs dominate the landscape due to their scalability, affordability, and broad-spectrum therapeutic applications. Produced through chemical synthesis, these APIs offer consistent quality and stability, making them highly reliable during mass production. Their strong foothold in treatments for infections, cardiovascular diseases, metabolic conditions, and more has positioned them as the backbone of global pharmaceutical formulations. With healthcare systems under pressure to deliver effective solutions at lower costs, synthetic APIs are meeting the challenge by ensuring large-scale production without compromising on quality or efficacy.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $194.7 Billion |

| Forecast Value | $341.6 Billion |

| CAGR | 5.8% |

Based on potency, the small molecule API market is divided into standard APIs and high potency APIs (HPAPIs). The standard API segment held an 81.4% market share in 2024 and is forecasted to reach USD 276 billion by 2034. These APIs are crucial for manufacturing generic medications, which account for a significant portion of global drug consumption. Their cost-effective nature and adaptability across various therapeutic categories-from pain management to chronic disease treatment-allow pharmaceutical companies to maintain broad, profitable product pipelines. By delivering affordability and therapeutic versatility, standard APIs are ensuring consistent access to essential medications for global populations.

The U.S. Small Molecule API Market is projected to reach USD 125.4 billion by 2034. The country benefits from an advanced pharmaceutical ecosystem, a robust network of generic drug manufacturers, and a regulatory framework that supports accelerated drug approvals. Ongoing investments in healthcare infrastructure, rising demand for chronic illness treatments, and policy support for affordable medication access are propelling market growth.

Leading companies such as Bristol-Myers, Johnson Matthey, AstraZeneca, Novartis, GILEAD Sciences, Merck, Boehringer Ingelheim, Hoffmann-La Roche, Teva Pharmaceuticals, GlaxoSmithKline, Curia Global, BASF, Pfizer, EUROAPI, and Nanjing King-Friend Biochemical Pharmaceutical are prioritizing R&D expansion, advanced synthesis technologies, and AI-powered drug development. Many are pursuing licensing deals, acquisitions, and manufacturing expansions to scale operations and broaden therapeutic offerings. Regulatory compliance and sustainability are also at the forefront as companies strive to enhance global supply chains and meet escalating demand.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of chronic diseases

- 3.2.1.2 Advancements in drug development technologies

- 3.2.1.3 Expanding generic and biosimilar market

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High manufacturing costs

- 3.2.2.2 Stringent regulatory scenario

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Synthetic

- 5.3 Biotech

Chapter 6 Market Estimates and Forecast, By Potency, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Standard API

- 6.3 HPAPI

Chapter 7 Market Estimates and Forecast, By Manufacturing Type, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 In-house

- 7.3 Outsourced

Chapter 8 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Clinical

- 8.3 Commercial

Chapter 9 Market Estimates and Forecast, By Therapeutic Area, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Cardiovascular

- 9.3 Oncology

- 9.4 CNS and Neurology

- 9.5 Orthopedic

- 9.6 Endocrinology

- 9.7 Pulmonology

- 9.8 Gastroenterology

- 9.9 Nephrology

- 9.10 Ophthalmology

- 9.11 Other therapeutic areas

Chapter 10 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 Pharmaceutical companies

- 10.3 Biotechnology companies

- 10.4 Contract development and manufacturing organizations (CDMOs)

- 10.5 Other end users

Chapter 11 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 Saudi Arabia

- 11.6.2 South Africa

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 AstraZeneca

- 12.2 BASF

- 12.3 Boehringer Ingelheim

- 12.4 Bristol-Myers

- 12.5 Curia Global

- 12.6 EUROAPI

- 12.7 GILEAD Sciences

- 12.8 GlaxoSmithKline

- 12.9 Hoffmann-La Roche

- 12.10 Johnson Matthey

- 12.11 Merck

- 12.12 Nanjing King-Friend Biochemical Pharmaceutical

- 12.13 Novartis

- 12.14 Pfizer

- 12.15 Teva Pharmaceuticals