PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721424

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721424

Automotive Washer Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

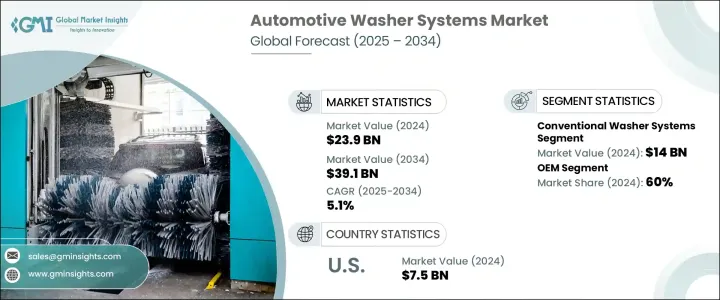

The Global Automotive Washer Systems Market was valued at USD 23.9 billion in 2024 and is estimated to grow at a CAGR of 5.1% to reach USD 39.1 billion by 2034. With the automotive landscape undergoing rapid transformation, the market for washer systems is gaining substantial traction worldwide. Vehicle owners and manufacturers alike are becoming increasingly attentive to the importance of regular maintenance and clear visibility for optimal driving safety. Washer systems have evolved from simple cleaning tools to sophisticated solutions integrated into modern vehicles. The integration of smart sensor-cleaning systems, compatibility with advanced driver assistance systems (ADAS), and the shift toward electric and autonomous vehicles are collectively accelerating the need for more efficient and innovative washer systems. This demand is further supported by government regulations focusing on vehicle safety and visibility, especially in regions with harsh weather conditions. As carmakers continue to prioritize safety, performance, and comfort, washer systems are becoming essential for ensuring unimpeded camera and sensor operation, particularly in next-generation vehicles.

In 2024, the conventional washer systems segment led the market, generating USD 14 billion in revenue. This segment's leadership stems from the wide-scale adoption of traditional systems due to their simplicity, reliability, and cost-effectiveness. Designed with mechanical activation and standard fluid nozzles, these systems offer a straightforward and budget-friendly solution for both passenger and commercial vehicle segments. Automakers often favor these washer systems for their proven performance and ease of integration into existing vehicle designs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $23.9 Billion |

| Forecast Value | $39.1 Billion |

| CAGR | 5.1% |

The market is segmented by sales channels into OEM and aftermarket, with the OEM segment capturing a 60% share in 2024. This dominance is primarily due to the rising volume of vehicle production across major economies and the increasing demand for factory-installed washer technologies. Manufacturers are equipping new models with headlight washers, advanced windshield cleaning systems, and ADAS-compatible technologies to enhance visibility, support sensor accuracy, and meet global safety standards.

The U.S. Automotive Washer Systems Market alone generated USD 7.5 billion in 2024, underlining its significance as a key revenue contributor. Demand in the U.S. continues to grow, driven by high vehicle production levels, a surge in ADAS-equipped and electric vehicles, and stringent regulations around automotive safety. These factors are pushing OEMs to integrate innovative washer technologies that ensure uninterrupted operation of critical systems such as sensors and onboard cameras, regardless of environmental conditions.

Key players shaping the Global Automotive Washer Systems Market include Valeo SA, Trico, Shihlin Electric, Magna, Mitsuba, Robert Bosch, HELLA, Kautex Textron, Denso, and Continental. These companies are focused on developing advanced washer solutions through high-pressure nozzles, fluid-efficient systems, and smart sensor-cleaning mechanisms. By investing in R&D and forming strategic partnerships with automakers, these manufacturers are enhancing their presence in the evolving automotive landscape.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material providers

- 3.1.1.2 Component providers

- 3.1.1.3 Manufacturers

- 3.1.1.4 Technology providers

- 3.1.1.5 Distribution channel analysis

- 3.1.1.6 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Technology & innovation landscape

- 3.3 Patent analysis

- 3.4 Regulatory landscape

- 3.5 Cost breakdown analysis

- 3.6 Key news & initiatives

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Increasing vehicle production & sales

- 3.7.1.2 Stringent safety & visibility regulations

- 3.7.1.3 Integration with ADAS & smart vehicle technologies

- 3.7.1.4 Advancements in eco-friendly & efficient washer fluids

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High initial costs for smart washer systems

- 3.7.2.2 Compatibility issues with electric & autonomous vehicles

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 Conventional washer systems

- 5.3 Rain-sensing washer systems

- 5.4 Heated washer systems

Chapter 6 Market Estimates & Forecast, By Vehicle Type, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.3 Commercial vehicles

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 Wiper blades

- 7.3 Pumps

- 7.4 Nozzles

- 7.5 Hoses & connectors

- 7.6 Reservoirs

Chapter 8 Market Estimates & Forecast, By Sale Channel 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 France

- 9.3.3 UK

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Asmo

- 10.2 Bowles Fluidics

- 10.3 Continental

- 10.4 Denso

- 10.5 Doga

- 10.6 DOGA

- 10.7 Exo-S

- 10.8 Federal-Mogul

- 10.9 HELLA

- 10.10 ITW

- 10.11 Kautex Textron

- 10.12 Magna

- 10.13 Mergon

- 10.14 Mitsuba

- 10.15 Mitsubishi

- 10.16 PIAA

- 10.17 Robert Bosch

- 10.18 Shihlin Electric

- 10.19 Trico

- 10.20 Valeo SA