PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721426

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721426

Dog Training Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

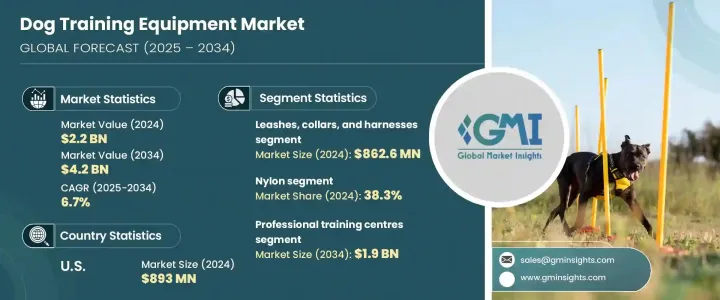

The Global Dog Training Equipment Market was valued at USD 2.2 billion in 2024 and is estimated to grow at a CAGR of 6.7% to reach USD 4.2 billion by 2034. The market's consistent growth is largely driven by the expanding population of dog owners and the increasing emphasis on responsible pet ownership. As pet parenting becomes more widespread, there is a stronger focus on canine training, obedience, and behavior management. Dog training is no longer limited to professionals; everyday pet owners are now investing in training tools to ensure better control and communication with their pets. Growing urbanization and tighter housing regulations have also added pressure on dog owners to manage their pets' behavior in public and private spaces. Moreover, the emotional connection between pets and owners is fostering more spending on high-quality products that enhance training outcomes. Social media trends, pet influencers, and increased media visibility around pet care are also shaping consumer awareness and fueling market demand. This shift is prompting both startups and established brands to introduce innovative and easy-to-use training equipment to capture consumer interest.

Increased concerns over safety and rising crime rates have further contributed to the market's growth, particularly in law enforcement and security sectors. Trained dogs are now integral to detecting drugs and explosives, tracking suspects, and supporting public safety initiatives. This, in turn, has triggered a sharp rise in demand for specialized training tools across various professional segments. The influence of working dogs in police, military, and rescue operations is reinforcing the need for performance-driven training equipment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.2 Billion |

| Forecast Value | $4.2 Billion |

| CAGR | 6.7% |

The segment for leashes, collars, and harnesses remained dominant in 2024, with a valuation of USD 862.6 million. These products are widely used for improving dog behavior, ensuring control, and enhancing safety during training or everyday walks. Trainers, veterinarians, and pet owners rely heavily on these essentials. The market is seeing a wave of innovation, with smart collars that monitor health and behavior, and GPS-enabled options that help track pets in real-time. These advancements are meeting the rising demand for multipurpose, technology-enabled training gear.

Material selection also plays a pivotal role in market dynamics. In 2024, nylon-based equipment accounted for 38.3% of the global share. Nylon's superior strength, durability, and resistance to various weather conditions make it ideal for leashes, collars, and harnesses. Its adaptability to different training needs and its availability in a wide range of styles further enhance its popularity among dog owners and trainers.

The U.S. Dog Training Equipment Market alone generated USD 893 million in 2024. A surge in pet ownership and increasing awareness about behavioral training are driving domestic demand. The government's investment in advanced canine training programs, combined with the popularity of professional training services, is fueling market expansion.

Key players in the global market include Collar Company, Von Wolf K9, Heads Up For Tails, Petarchi, EzyDog, Wayfair, Alpha K9, Leeburg, Ray Allen Manufacturing, Hanyang, Supertails, Mid-State K9, and Pets Like. These companies are enhancing their offerings through innovation, smart product development, and strategic collaborations with trainers and veterinarians. By focusing on tech-driven features and expanding e-commerce presence, market leaders are engaging modern pet owners while boosting their brand value.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising pet ownership and humanization of pets

- 3.2.1.2 Advancements in training technology

- 3.2.1.3 Increased spending on pet care

- 3.2.1.4 Growing demand for professional training services

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lack of standardization and effectiveness concerns

- 3.2.2.2 High cost of specialized equipment

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Leashes, collars, and harnesses

- 5.3 Clickers and whistles

- 5.4 Treat bags

- 5.5 Agility equipment

- 5.6 Muzzles

- 5.7 Other product types

Chapter 6 Market Estimates and Forecast, By Material Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Nylon

- 6.3 Leather

- 6.4 Plastic

- 6.5 Other materials

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Professional training centers

- 7.3 Military and service organizations

- 7.4 Dog training schools and academics

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Alpha K9

- 9.2 Collar company

- 9.3 EzyDog

- 9.4 Hanyang

- 9.5 Heads up for tails

- 9.6 Leeburg

- 9.7 Mid-State K9

- 9.8 Petarchi

- 9.9 Pets Like

- 9.10 Ray Allen Manufacturing

- 9.11 Supertails

- 9.12 Von Wolf K9

- 9.13 Wayfair