PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721434

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721434

Fermented Beverages Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

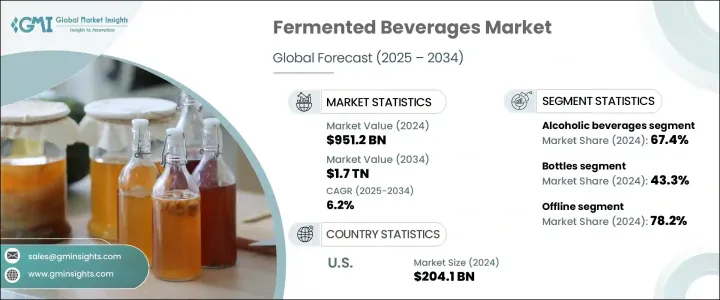

The Global Fermented Beverages Market was valued at USD 951.2 billion in 2024 and is estimated to grow at a CAGR of 6.2% to reach USD 1.7 trillion by 2034. Fermented beverages are witnessing rapid traction worldwide as consumers continue to prioritize functional wellness and gut health. These drinks, developed through controlled microbial fermentation and enzymatic processes, are naturally enriched with probiotics, organic acids, and essential vitamins that support digestive and immune health. Increasing awareness around clean-label ingredients and the shift away from sugary carbonated drinks are further accelerating the market momentum.

With wellness trends shaping consumer preferences, fermented beverages such as kombucha, kefir, and cultured teas are finding favor not just among health enthusiasts but also among mainstream consumers. These drinks offer a combination of bold, tangy flavors and scientifically backed health benefits, making them an attractive alternative to traditional soft drinks. As innovation in the beverage industry continues to blur the lines between health supplements and everyday refreshments, fermented drinks are becoming a staple in modern diets across global households.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $951.2 Billion |

| Forecast Value | $1.7 Trillion |

| CAGR | 6.2% |

The market is segmented into alcoholic and non-alcoholic beverages, with alcoholic beverages commanding a dominant 67.4% share in 2024. Beer remains the most widely consumed product in this category, driving strong growth across international markets. The rising demand for premium and craft alcoholic beverages, particularly in countries with rich brewing heritages, is creating space for independent breweries and boutique wineries to flourish. The popularity of artisanal flavors, coupled with consumer interest in authenticity and local ingredients, is encouraging innovation and variety in this space.

In terms of packaging, bottles accounted for a leading 43.3% market share in 2024. Glass bottles remain the packaging of choice for premium offerings such as wine, beer, and probiotic-rich kombucha, as they preserve flavor integrity, carbonation, and the activity of live cultures. The appeal of sustainable packaging is also influencing consumer buying behavior, with glass offering a recyclable and non-reactive alternative that aligns with eco-conscious trends.

The U.S. Fermented Beverages Market alone generated USD 204.1 billion in 2024. Strong consumer demand, high disposable income levels, and a well-established ecosystem of breweries, dairies, and fermentation facilities underpin this performance. Ongoing government support for local brewers and startups, along with product innovations like low-alcohol, plant-based, and probiotic-enhanced beverages, continue to shape the market landscape and fuel growth.

Major players in the global fermented beverages industry include Biotiful Dairy, Dohler, Chr. Hansen, Diageo, Heineken, Danone, Kirin Holdings, Lifeway Foods, Sula Vineyards, PepsiCo, Suntory Holdings Limited, The Coca-Cola Company, and Yakult Honsha. These companies are investing in product diversification, scaling up marketing campaigns that emphasize wellness benefits, and expanding distribution networks to tap into growing demand across new geographies.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising consumer preference for functional and probiotic-rich beverages

- 3.6.1.2 Expanding product innovation and new flavor offering

- 3.6.1.3 Increasing demand for natural and organic fermented drinks

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High production costs and supply chain complexities

- 3.6.2.2 Regulatory hurdles and labeling compliance issues

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Alcoholic beverages

- 5.2.1 Beer

- 5.2.2 Wine

- 5.2.3 Cider

- 5.2.4 Wine coolers

- 5.2.5 Alcopops

- 5.2.6 Others

- 5.3 Non-alcoholic beverages

- 5.3.1 Fermented tea drinks

- 5.3.2 Fermented dairy-based drinks

- 5.3.3 Fermented fruit-based drinks

- 5.3.4 Fermented cereal-based drinks

- 5.3.5 Others

Chapter 6 Market Estimates and Forecast, By Packaging, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Bottles

- 6.3 Cans

- 6.4 Sachets

- 6.5 Cartons

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Online

- 7.2.1 Brand websites

- 7.2.2 E-commerce platforms

- 7.3 Offline

- 7.3.1 Supermarkets & hypermarkets

- 7.3.2 Convenience stores

- 7.3.3 Specialty stores

- 7.3.4 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Dohler

- 9.2 Biotiful Dairy

- 9.3 Chr. Hansen

- 9.4 Danone

- 9.5 Diageo

- 9.6 Heineken

- 9.7 Kirin Holdings

- 9.8 Lifeway Foods

- 9.9 PepsiCo

- 9.10 Sula Vineyards

- 9.11 Suntory Holdings Limited

- 9.12 The Coca-Cola Company

- 9.13 Yakult Honsha