PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721436

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721436

Motorcycle Chain Sprocket Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

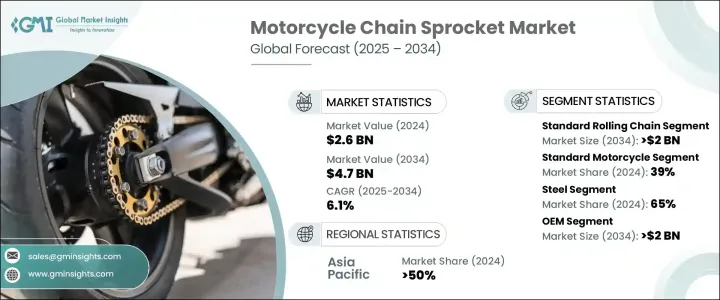

The Global Motorcycle Chain Sprocket Market was valued at USD 2.6 billion in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 4.7 billion by 2034. As global mobility trends shift toward affordable and fuel-efficient solutions, motorcycles continue to emerge as a primary mode of transport, particularly in developing regions. With the rapid pace of urbanization, coupled with expanding middle-class populations in countries across Asia-Pacific and Latin America, motorcycles are becoming essential for daily commuting. This surge in motorcycle usage directly drives the demand for reliable, durable, and cost-effective chain sprockets.

The industry is also gaining traction due to the robust aftermarket segment, where consumers frequently replace worn-out parts to enhance vehicle performance. Manufacturers are increasingly focusing on integrating improved materials and precision engineering to cater to this evolving demand. Additionally, rising environmental concerns and fuel efficiency mandates are compelling consumers to shift from four-wheelers to two-wheelers, further pushing the growth trajectory of the motorcycle chain sprocket market. The availability of a wide range of chain sprockets, catering to different motorcycle classes-from commuter bikes to performance motorcycles-continues to fuel demand across both OEM and aftermarket channels.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.6 Billion |

| Forecast Value | $4.7 Billion |

| CAGR | 6.1% |

The market is segmented based on chain type, motorcycle type, and material. Standard rolling chain sprockets captured more than 50% of the market share in 2024, mainly due to their low cost, simplicity, and wide usage in commuter motorcycles, especially in cost-sensitive regions. These sprockets offer basic yet effective performance and are ideal for short-distance commuting and delivery services, commonly found across developing economies. As motorcycles become the go-to transportation option for budget-conscious consumers, the need for rugged, low-maintenance sprockets continues to rise.

In terms of materials, steel sprockets dominated the market with a 65% share in 2024. Known for their strength, longevity, and affordability, steel sprockets are particularly preferred for motorcycles used in rigorous, everyday conditions. Their ability to withstand significant wear and tear while maintaining resistance to corrosion makes them a go-to choice for high-usage applications in commuter motorcycles.

Regionally, the Asia-Pacific Motorcycle Chain Sprocket Market accounted for a 50% share in 2024, with China leading the regional demand. The region's ongoing urbanization, increasing disposable incomes, and widespread motorcycle usage contribute heavily to the rising demand for sprockets. Challenging road conditions and high mileage usage create a sizable aftermarket, where frequent replacement of sprockets is common to ensure vehicle efficiency and longevity.

Key players in the market include Tsubakimoto Chain, Rockman, Regina Catene Calibrate, JT Sprockets, Daido Kogyo, Hengjiu, Renthal, L.G. Balakrishnan, TIDC India, and RK Japan. These companies are investing in material innovation and advanced production techniques to offer longer-lasting sprockets. Many are also tailoring product lines to suit various motorcycle segments, enhancing competitiveness across OEM and replacement markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Manufacturers

- 3.2.3 Service providers

- 3.2.4 Distributors

- 3.2.5 End use

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Price trends

- 3.9 Cost breakdown analysis

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Rising motorcycle sales in emerging markets

- 3.10.1.2 Growing demand for lightweight and high-performance sprockets

- 3.10.1.3 Expansion of e-commerce platforms

- 3.10.1.4 Increasing adoption of electric motorcycles

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 High maintenance and frequent replacement costs

- 3.10.2.2 Fluctuating raw material prices

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter’s analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Chain, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Standard rolling chain

- 5.3 X ring chain

- 5.4 O ring chain

Chapter 6 Market Estimates & Forecast, By Material, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Steel

- 6.3 Aluminum

- 6.4 Carbon fiber

- 6.5 Composite

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Motorcycle, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Standard

- 7.3 Sports

- 7.4 Cruiser

- 7.5 Off-road bikes

- 7.6 Mopeds

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Engine Capacity, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Up to 150 CC

- 8.3 151-300 CC

- 8.4 301-500 CC

- 8.5 Above 500 CC

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Acerbis

- 11.2 Adeline Group

- 11.3 Bajaj Auto Ltd.

- 11.4 Brembo

- 11.5 Daido Kogyo

- 11.6 Hengjiu

- 11.7 Jomthai Asahi

- 11.8 JT Sprockets

- 11.9 KTM AG

- 11.10 L.G.Balakrishnan

- 11.11 Molnar Sprockets

- 11.12 PBR Sprockets

- 11.13 Regina Catene Calibrate

- 11.14 Renthal

- 11.15 RK Japan

- 11.16 Rockman

- 11.17 Sunstar Engineering

- 11.18 TIDC India

- 11.19 Tsubakimoto Chain

- 11.20 Vortex Racing