PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721438

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721438

BOPP Films Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

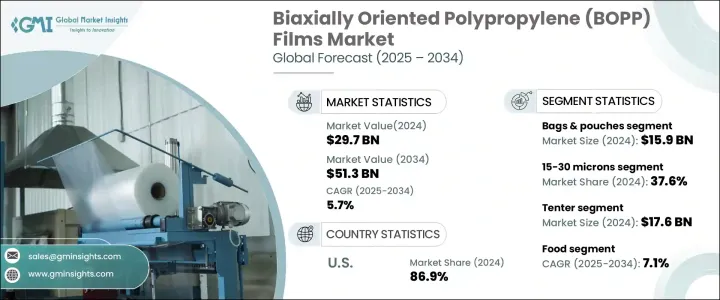

The Global BOPP Films Market was valued at USD 29.7 billion in 2024 and is estimated to grow at a CAGR of 5.7% to reach USD 51.3 billion by 2034. The market continues to witness robust growth as industries across the board recognize the superior performance and cost advantages of BOPP films in packaging applications. These films are gaining traction not only due to their affordability but also because of their exceptional strength, clarity, and versatility. Manufacturers across food and beverage, pharmaceutical, electronics, and personal care sectors are increasingly shifting toward BOPP films to meet changing consumer preferences for lightweight, durable, and sustainable packaging materials.

In an era where efficient supply chains and product shelf appeal are critical to business success, BOPP films offer an ideal solution that meets both functional and aesthetic demands. Their recyclability and compatibility with evolving sustainability goals have further strengthened their position in the flexible packaging market. As packaging requirements become more complex and global demand continues to rise, innovation in BOPP film production and coating technologies remains a key focus for manufacturers aiming to stay competitive.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $29.7 Billion |

| Forecast Value | $51.3 Billion |

| CAGR | 5.7% |

The primary driver of this market expansion is the increasing use of BOPP films across diverse industries due to their cost-effectiveness, high tensile strength, moisture resistance, and excellent printability. Advanced production methods like sequential and simultaneous stretching have significantly improved clarity and barrier properties. Metallization enhances visual appeal and shelf life, making these films a preferred choice for premium branding. Coated BOPP films, with heat-resistant capabilities, are especially suitable for microwaveable packaging, adding to their functional value.

The market is segmented by product into wraps, bags and pouches, tapes, and labels. In 2024, the bags and pouches segment alone accounted for USD 15.9 billion, driven largely by the exponential growth of e-commerce. Retailers and fulfillment centers increasingly prefer BOPP bags and pouches for their puncture resistance, lightweight structure, and ability to reduce logistics costs when compared to traditional rigid packaging formats.

When classified by thickness, the 15-30 microns segment commanded a 37.6% share in 2024. This category offers a perfect balance of strength, cost-efficiency, and material reduction-key attributes that align with the growing emphasis on eco-friendly and efficient packaging solutions. These films are widely used in food packaging, where durability and minimal material usage are essential.

The U.S. BOPP Films Market accounted for 86.9% of North American revenue in 2024. Its dominance stems from significant R&D investments by leading manufacturers aiming to enhance film strength, clarity, and versatility for broadening end-use applications. With the surge in e-commerce and demand for lightweight, sustainable packaging, the U.S. market continues to set the pace globally.

Key players like Uflex Ltd., Inteplast Group, and Jindal Poly Films are investing heavily in advanced production systems, product innovation, and sustainability initiatives to expand their market presence and cater to evolving industry demands.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research Approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rapid technological innovation and automation

- 3.2.1.2 Growing demand for sustainable and eco-friendly packaging solutions

- 3.2.1.3 Advancements in R&D enhance film quality and performance

- 3.2.1.4 Expanding applications in sectors like food, medical, and electronics

- 3.2.1.5 Regulatory changes

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Volatility in raw material costs

- 3.2.2.2 Intense market competition results in pricing pressures

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn & Kilo Tons)

- 5.1 Key trends

- 5.2 Wraps

- 5.3 Bags & pouches

- 5.4 Tapes

- 5.5 Labels

Chapter 6 Market Estimates and Forecast, By Thickness, 2021 – 2034 ($ Mn & Kilo Tons)

- 6.1 Key trends

- 6.2 Below 15 microns

- 6.3 15-30 microns

- 6.4 30-45 microns

- 6.5 More than 45 microns

Chapter 7 Market Estimates and Forecast, By Production Process, 2021 – 2034 ($ Mn & Kilo Tons)

- 7.1 Key trends

- 7.2 Tenter

- 7.3 Tubular

Chapter 8 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn & Kilo Tons)

- 8.1 Key trends

- 8.2 Food

- 8.3 Beverage

- 8.4 Tobacco

- 8.5 Personal care

- 8.6 Pharmaceutical

- 8.7 Electrical & electronics

- 8.8 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn & Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Australia

- 9.4.4 South Korea

- 9.4.5 Japan

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 U.A.E.

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 CCL Industries

- 10.2 Cosmo Films Limited

- 10.3 Gulf Packaging Industries Co.

- 10.4 Inteplast Group

- 10.5 Jindal Poly Films

- 10.6 Oben Group

- 10.7 Polibak

- 10.8 Polinas

- 10.9 Sibur Holdings

- 10.10 Taghleef Industries

- 10.11 TOPPAN Group

- 10.12 Toray Industries

- 10.13 Uflex Ltd.

- 10.14 Zhejiang Kinlead Innovative Materials