PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721441

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721441

Veterinary Cardiology Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

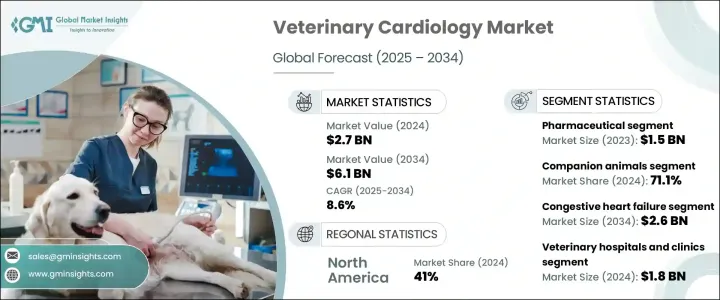

The Global Veterinary Cardiology Market was valued at USD 2.7 billion in 2024 and is estimated to grow at a CAGR of 8.6% to reach USD 6.1 billion by 2034. The rise in pet ownership and heightened awareness of animal health are playing a pivotal role in this expansion. As pets increasingly become integral family members, owners are more proactive in seeking timely and specialized care for chronic conditions, including cardiovascular diseases. Veterinarians are witnessing a notable surge in heart-related cases, especially among aging dogs and cats, prompting increased investments in cardiology services.

Moreover, pet insurance coverage is gradually expanding to include advanced diagnostic tests and treatments, which is further encouraging owners to opt for specialized care. The market is also gaining momentum with the growing presence of veterinary specialists, expanding infrastructure in animal healthcare, and rising R&D investments aimed at improving cardiology outcomes in companion animals. With the convergence of veterinary medicine and technology, the industry is undergoing a rapid transformation that is redefining how heart conditions in animals are diagnosed, monitored, and treated.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.7 Billion |

| Forecast Value | $6.1 Billion |

| CAGR | 8.6% |

This growth is driven by a rising number of pets with heart disease and advancements in diagnostic and treatment methods. Minimally invasive procedures, such as balloon valvuloplasty and pacemaker implantation, are gaining popularity due to reduced risks and quicker recovery times. Newer medications like pimobendan, ACE inhibitors, and beta-blockers are also helping extend the lifespan of pets diagnosed with heart conditions.

The market is divided into pharmaceuticals and diagnostics. The pharmaceuticals segment generated USD 1.5 billion in 2023. This notable performance is mainly attributed to ongoing innovation in treatment protocols and a growing incidence of cardiovascular conditions in senior pets. There is a rising demand for medications that can regulate heart function, manage fluid buildup, and control blood pressure in animals, leading to increased investments and product development in this space.

The companion animal segment in the veterinary cardiology market held a 71.1% share in 2024. This category, which includes dogs, cats, and other domestic pets, continues to dominate due to increasing adoption rates and the higher likelihood of pets developing heart issues as they age. Pet owners today are far more conscious about the early detection of diseases, prompting them to pursue specialized cardiology services. Advanced diagnostics such as echocardiograms and electrocardiograms (ECGs) are seeing growing demand.

North America Veterinary Cardiology Market held a 41% share in 2024. The region's dominance is supported by a large population of companion animals, advancements in diagnostic tools, and the expansion of specialty veterinary hospitals. The U.S. market, in particular, is seeing growing integration of artificial intelligence and wearable heart monitors, which are changing how cardiac health is monitored in pets.

Major players involved in the veterinary cardiology market include TriviumVet, ESAOTE, Bionet America, Medtronic, Jurox, Siemens Healthineers, Fujifilm, Zoetis, Antech Diagnostics, General Electric Company, IDEXX, Merck, Boehringer Ingelheim International, Ceva, and GSK among others. Companies are focusing on innovative product development, introducing advanced diagnostic tools like echocardiograms and catheter-based therapies. Strategic collaborations with veterinary clinics, research bodies, and tech firms are helping them expand their reach and influence across global markets.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising pet adoption and increasing expenditure on animal healthcare

- 3.2.1.2 Advancements in veterinary cardiology diagnostics and treatment technologies

- 3.2.1.3 Increasing prevalence of cardiovascular diseases in companion animals

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced veterinary cardiology treatments and devices

- 3.2.2.2 Limited availability of specialized veterinary cardiologists

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Future market trends

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Pharmaceuticals

- 5.2.1 Pimobendan

- 5.2.2 Spironolactone and benazepril hydrochloride

- 5.2.3 Other pharmaceuticals

- 5.3 Diagnostics

- 5.3.1 Physical exam

- 5.3.2 Chest X-rays

- 5.3.3 Electrocardiogram (ECG)

- 5.3.4 Other diagnostics

Chapter 6 Market Estimates and Forecast, By Animal Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Companion animals

- 6.2.1 Dogs

- 6.2.2 Cats

- 6.2.3 Other companion animals

- 6.3 Livestock animals

- 6.3.1 Cattle

- 6.3.2 Poultry

- 6.3.3 Other livestock animals

Chapter 7 Market Estimates and Forecast, By Indication, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Congestive heart failure

- 7.3 Myocardial (heart muscle) disease

- 7.4 Arrhythmias

- 7.5 Other indications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Veterinary hospitals and clinics

- 8.3 Academic and research institutions

- 8.4 Other end users

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Antech Diagnostics

- 10.2 Boehringer Ingelheim International

- 10.3 Jurox

- 10.4 Ceva

- 10.5 Merck

- 10.6 IDEXX

- 10.7 General Electric Company

- 10.8 FUJIFILM

- 10.9 ESAOTE

- 10.10 Medtronic

- 10.11 Siemens Healthineers

- 10.12 TriviumVet

- 10.13 Zoetis

- 10.14 Bionet America