PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721442

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721442

MEMS Sensors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

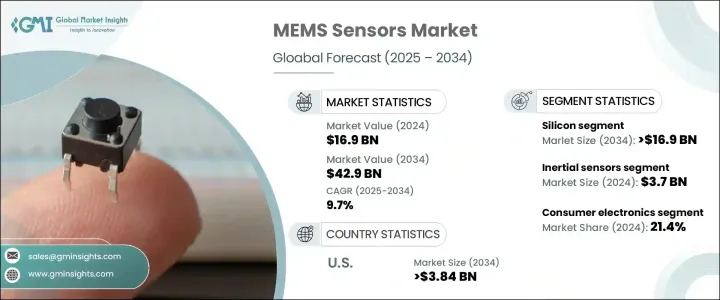

The Global MEMS Sensors Market was valued at USD 16.9 billion in 2024 and is estimated to grow at a CAGR of 9.7% to reach USD 42.9 billion by 2034. The market is witnessing robust momentum, driven by the accelerating adoption of connected technologies across industries. From next-gen smartphones and smartwatches to autonomous vehicles and industrial automation systems, the demand for intelligent, miniaturized sensors has never been higher. MEMS (Micro-Electro-Mechanical Systems) sensors are gaining prominence for their ability to collect precise data while maintaining low power consumption and compact form factors.

As consumer expectations for smarter, more responsive devices continue to rise, manufacturers are integrating MEMS technology to elevate user experiences and enable real-time analytics. Additionally, the rapid evolution of Industry 4.0, growing investments in electric vehicles, and the expanding footprint of the Internet of Things (IoT) ecosystem are reinforcing the role of MEMS sensors in reshaping technological infrastructures. Global OEMs are also focusing on multi-functional sensor integration to enhance device efficiency and minimize component redundancy, further boosting market growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $16.9 Billion |

| Forecast Value | $42.9 Billion |

| CAGR | 9.7% |

MEMS sensors play an increasingly critical role in both consumer electronics and automotive applications. In the automotive sector, the growing demand for advanced driver-assistance systems (ADAS) and safety technologies is fueling the integration of MEMS sensors. These systems rely on precise and real-time data, and MEMS sensors ensure accuracy and responsiveness as global regulations around automotive safety tighten. In electronics, MEMS sensors enhance device performance by enabling features like gesture recognition, motion tracking, and environmental monitoring, thus aligning with consumer expectations for intelligent, multifunctional gadgets.

The materials used in manufacturing MEMS sensors include silicon, polymers, ceramics, and metals. Among these, silicon continues to dominate, with the segment projected to generate USD 16.9 billion by 2034. Silicon's compatibility with CMOS fabrication processes, along with its superior mechanical and thermal stability, makes it a preferred material across high-performance applications. Its adoption is expanding rapidly in healthcare, wearables, and consumer electronics as demand for lightweight, durable components increases.

The market is segmented by sensor types such as inertial sensors, pressure sensors, microphones, environmental sensors, optical sensors, and ultrasonic sensors. Inertial sensors alone accounted for USD 3.7 billion in 2024, with applications spanning industrial automation, robotics, drones, and automotive systems, including self-driving vehicles. These sensors are vital for motion detection, orientation, and stabilization, key requirements for emerging smart technologies.

The U.S. MEMS sensors market is on an upward trajectory, projected to reach USD 3.84 billion by 2034. Growth in the U.S. is attributed to increasing deployment across aerospace, defense, healthcare, and autonomous systems. Progress in AI, robotics, and medical innovations further reinforces demand. Leading players such as Robert Bosch GmbH, STMicroelectronics, Broadcom Inc., Texas Instruments, and Qorvo Inc. are focusing on expanding product lines, advancing R&D, and forming strategic alliances to strengthen their global market presence.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for consumer electronics

- 3.2.1.2 Advancements in automotive applications

- 3.2.1.3 Expansion of industrial automation and iot

- 3.2.1.4 Growth in healthcare and biomedical applications

- 3.2.1.5 Miniaturization and energy efficiency innovations

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High manufacturing complexity and costs

- 3.2.2.2 Integration and standardization challenges

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Sensor Type, 2021 - 2034 (USD Million and Units)

- 5.1 Inertial sensors

- 5.2 Pressure sensors

- 5.3 Microphones

- 5.4 Environmental sensors

- 5.5 Optical sensors

- 5.6 Ultrasonic sensors

- 5.7 Others

Chapter 6 Market estimates & forecast, By Material, 2021 - 2034 (USD Million and Units)

- 6.1 Silicon

- 6.2 Polymers

- 6.3 Ceramics

- 6.4 Metallic materials

Chapter 7 Market estimates & forecast, By End Use, 2021 - 2034 (USD Million and Units)

- 7.1 Consumer electronics

- 7.2 Automotive

- 7.3 Healthcare

- 7.4 Industrial

- 7.5 Aerospace & defense

- 7.6 Telecommunications

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million and Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Robert Bosch GmbH

- 9.2 STMicroelectronics

- 9.3 Broadcom Inc.

- 9.4 Texas Instruments

- 9.5 Qorvo Inc.

- 9.6 Goertek Inc.

- 9.7 Hewlett Packard Enterprise Development LP

- 9.8 TDK Corporation

- 9.9 Knowles Electronics LLC

- 9.10 Infineon Technologies AG

- 9.11 Honeywell International

- 9.12 Analog Devices Inc.

- 9.13 Murata Manufacturing Co. Ltd.

- 9.14 Teledyne DALSA

- 9.15 Sony Semiconductor

- 9.16 X-FAB Silicon Foundries

- 9.17 Tower Semiconductor

- 9.18 TSMC (Taiwan Semiconductor Manufacturing Company)

- 9.19 United Microelectronics Corporation (UMC)

- 9.20 Safran Sensing Technologies Norway AS

- 9.21 MEMS Engineering Limited

- 9.22 Redbud Labs

- 9.23 USound

- 9.24 Windfall Bio

- 9.25 ZERO POINT MOTION LTD.