PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721446

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721446

PEGylated Proteins Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

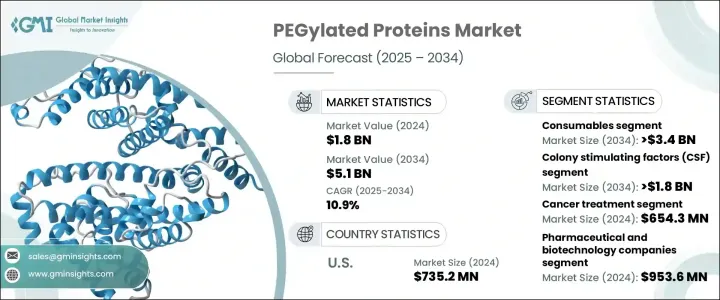

The Global Pegylated Proteins Market was valued at USD 1.8 billion in 2024 and is estimated to grow at a CAGR of 10.9% to reach USD 5.1 billion by 2034. This notable growth trend reflects the expanding use of protein-based therapeutics in modern medicine. With biologics and biosimilars steadily gaining traction in the global pharmaceutical space, the role of PEGylation technology is becoming increasingly indispensable. This process involves the chemical modification of proteins or drugs with polyethylene glycol (PEG), enhancing their stability, solubility, and half-life. These benefits make PEGylation an essential tool in drug delivery, especially for complex biologics like monoclonal antibodies and recombinant proteins.

As research efforts intensify to develop targeted therapies, PEGylated formulations are emerging as a preferred choice due to their improved pharmacokinetics and reduced immunogenicity. Increasing government support for biologics development, combined with a higher volume of clinical trials in protein therapeutics, continues to push the boundaries of innovation within this sector. The growing incidence of chronic and life-threatening diseases, including cancer, autoimmune disorders, and diabetes, has significantly escalated the need for safer, long-acting treatment options-further reinforcing market expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.8 Billion |

| Forecast Value | $5.1 Billion |

| CAGR | 10.9% |

The market is broadly segmented into consumables and services. The consumables segment is poised to witness a steady CAGR of 10.9% during the forecast period as the demand for specialized PEG derivatives rises. These derivatives are key to enhancing the performance of PEGylated biologics, such as monoclonal antibodies and enzymes. With chronic disease rates on the rise globally, the requirement for advanced therapeutics that offer prolonged efficacy is prompting greater reliance on premium-grade PEG reagents and polymers. The emphasis on drug delivery systems that provide better patient compliance and therapeutic efficiency is also bolstering growth within this category.

Based on protein type, the PEGylated proteins market includes interferons, colony-stimulating factors (CSF), erythropoietin, antibodies, recombinant factor VIII, and other protein categories. The CSF segment is projected to grow at a CAGR of 11% from 2025 to 2034, primarily due to the increasing prevalence of hematological disorders such as anemia and leukemia. CSFs play a critical role in supporting bone marrow recovery and enhancing immune function in patients undergoing chemotherapy and other intensive treatments. Their applications are also expanding into newer therapeutic areas like stem cell mobilization and chronic neutropenia.

The U.S. PEGylated Proteins Market reached USD 735.2 million in 2024 and is expected to grow substantially, driven by the high incidence of chronic illnesses and the presence of advanced healthcare infrastructure. A strong concentration of pharmaceutical companies and ongoing innovation in PEGylation technologies are helping the U.S. maintain a dominant market position.

Key players in the global market include Biopharma PEG Scientific, Merck KGaA, Celares, Abcam, Biomatrik, Enzon Pharmaceuticals, JenKem Technology, Aurigene Pharmaceutical Services, Quanta BioDesign, Thermo Fisher Scientific, Laysan Bio, Iris Biotech, Profacgen, Creative PEGworks, and NOF Corporation. These companies are advancing through R&D investments, portfolio expansion, acquisitions, and collaborative strategies to enhance therapeutic efficacy and global market presence.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of chronic diseases

- 3.2.1.2 Advantages of PEGylation in drug delivery

- 3.2.1.3 Growing biopharmaceutical and biotechnology industry

- 3.2.1.4 Increasing adoption of PEGylated drugs

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High costs of PEGylation and protein-based drugs

- 3.2.2.2 Regulatory challenges and stringent approval processes

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Consumables

- 5.3 Services

Chapter 6 Market Estimates and Forecast, By Protein Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Colony stimulating factors

- 6.3 Interferons

- 6.4 Erythropoietin

- 6.5 Recombinant factor VIII

- 6.6 Antibodies

- 6.7 Other protein types

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Cancer treatment

- 7.3 Autoimmune diseases

- 7.4 Hematological disorders

- 7.5 Hepatitis

- 7.6 Chronic kidney diseases

- 7.7 Gastrointestinal disorders

- 7.8 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Pharmaceutical and biotechnology companies

- 8.3 CROs and CMOs

- 8.4 Academic and research institutes

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Abcam

- 10.2 Aurigene Pharmaceutical Services

- 10.3 Biomatrik

- 10.4 Biopharma PEG Scientific

- 10.5 Celares

- 10.6 Creative PEGworks

- 10.7 Enzon Pharmaceuticals

- 10.8 Iris Biotech

- 10.9 JenKem Technology

- 10.10 Laysan Bio

- 10.11 Merck KGaA

- 10.12 NOF Corporation

- 10.13 Profacgen

- 10.14 Quanta BioDesign

- 10.15 Thermo Fisher Scientific