PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721450

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721450

Drone Communication Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

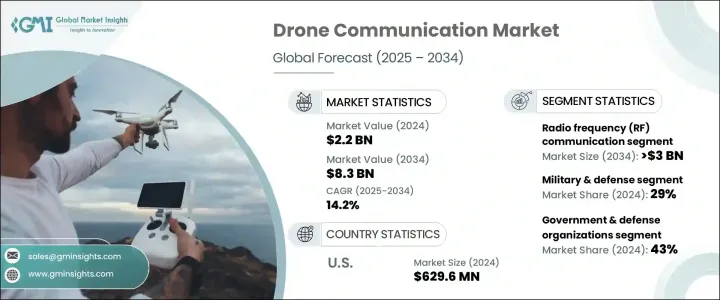

The Global Drone Communication Market was valued at USD 2.2 billion in 2024 and is estimated to grow at a CAGR of 14.2% to reach USD 8.3 billion by 2034. This remarkable growth trajectory reflects the rising importance of seamless, high-speed communication systems in both military and commercial drone operations. As unmanned aerial vehicles (UAVs) continue to play a pivotal role across a range of industries, the need for secure, real-time, and resilient communication technologies becomes increasingly critical. The emergence of AI-integrated systems, 5G-enabled networks, and advanced satellite communication platforms is revolutionizing drone capabilities, thus pushing the boundaries of what UAVs can achieve.

With demand surging for beyond-visual-line-of-sight (BVLOS) operations, the industry is shifting focus toward innovative technologies that ensure uninterrupted connectivity, even in remote or high-risk zones. Drones are now an integral part of defense, disaster response, infrastructure monitoring, and logistics, necessitating ultra-reliable and encrypted data transfer systems. As the global landscape becomes more complex, geopolitical tensions and security concerns are prompting nations and enterprises to invest heavily in sophisticated communication infrastructures. The integration of swarm intelligence, edge computing, and real-time threat detection is shaping a new era in drone operations, where communication technology is no longer an add-on but a mission-critical component.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.2 Billion |

| Forecast Value | $8.3 billion |

| CAGR | 14.2% |

The drone communication market spans a wide spectrum of technologies, including radio frequency (RF), satellite communication (SATCOM), 5G and LTE-based systems, mesh networking, and optical and infrared communication. In 2024, RF communication accounted for a dominant 41% share of the global market. This widespread adoption is primarily due to RF's cost efficiency, reliability, and compatibility with diverse applications. RF systems enable real-time data transmission, command and control operations, and offer encrypted, interference-resistant connectivity. These attributes are essential for military, industrial, and emergency response operations that demand high accuracy and security.

On the basis of application, the market is segmented into agriculture, construction, oil and gas, defense, commercial, and emergency services. The defense segment led the market in 2024 with a 29% share, reflecting the growing adoption of autonomous drones for surveillance, reconnaissance, and secure communication missions. AI-powered swarm technology, encrypted SATCOM links, and BVLOS capabilities are redefining defense strategies, placing communication technology at the core of mission planning and execution.

North America held a 34% share of the global drone communication market in 2024. The United States continues to lead the charge with strong investments in AI-enhanced UAV systems, 5G infrastructure, and next-gen satellite communications. The growing demand for autonomous drones in agriculture, logistics, and emergency management is further driving regional market growth.

Key players in the global drone communication market include BAE Systems, Drone Deploy, Elbit Systems, Honeywell, Iridium, Israel Aerospace Industries, L3Harris Technologies, Lockheed Martin, Northrop Grumman, and Skydio. These companies are aggressively focusing on AI integration, secure SATCOM, and strategic partnerships to scale their presence across defense and commercial sectors.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 360º synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Component suppliers

- 3.2.2 Software & networking providers

- 3.2.3 OEMs

- 3.2.4 Network infrastructure providers

- 3.2.5 Regulatory & standards organizations

- 3.2.6 Distributors & system integrators

- 3.2.7 End users

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Rising demand for BVLOS drone operations

- 3.8.1.2 Advancements in 5G and SATCOM technologies

- 3.8.1.3 Increased military and defense drone adoption

- 3.8.1.4 Expansion of commercial drone applications globally

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 Regulatory restrictions on drone communication frequencies

- 3.8.2.2 High infrastructure costs for SATCOM and 5G

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter’s analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Communication, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Radio frequency (RF) communication

- 5.3 Satellite communication (SATCOM)

- 5.4 5G and LTE-based communication

- 5.5 Mesh networking

- 5.6 Optical and infrared communication

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Agriculture

- 6.3 Construction & mining

- 6.4 Oil & gas

- 6.5 Military & defense

- 6.6 Commercial

- 6.7 Emergency services

- 6.8 Others

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Government & defense organizations

- 7.3 Commercial enterprises

- 7.4 Private operators

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 ANZ

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 AeroVironment

- 9.2 ASELSAN

- 9.3 BAE Systems

- 9.4 DJI

- 9.5 DroneDeploy

- 9.6 Droneshield

- 9.7 EchoStar

- 9.8 Elbit Systems

- 9.9 General Atomics Aeronautical Systems

- 9.10 Honeywell

- 9.11 Inmarsat

- 9.12 Iridium

- 9.13 Israel Aerospace Industries

- 9.14 L3Harris Technologies

- 9.15 Lockheed Martin

- 9.16 Northrop Grumman

- 9.17 Orbit communication

- 9.18 Parrot Drones

- 9.19 Qinetiq

- 9.20 Rheinmetall

- 9.21 Skydio

- 9.22 Skytrac System

- 9.23 Teledyne Flir

- 9.24 Thales

- 9.25 Yuneec