PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721456

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721456

Cardiovascular Drugs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

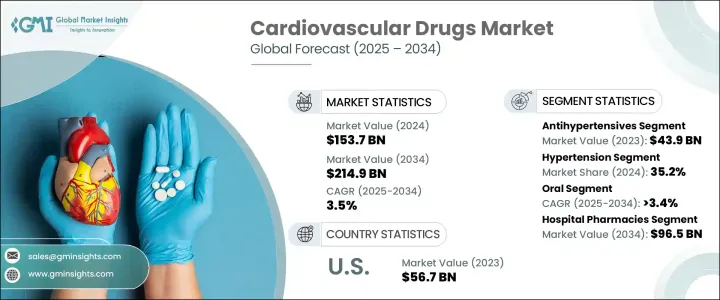

The Global Cardiovascular Drugs Market was valued at USD 153.7 billion in 2024 and is projected to grow at a CAGR of 3.5% to reach USD 214.9 billion by 2034. As the global burden of cardiovascular diseases continues to rise, the demand for effective and accessible treatment options is growing at an unprecedented pace. Healthcare systems around the world are under immense pressure to manage conditions such as coronary artery disease, heart failure, arrhythmias, and hypertension, which remain the leading causes of mortality across all regions. Increasing awareness of cardiovascular health, growing diagnosis rates, and a surge in preventive care initiatives are contributing significantly to market growth. In addition, lifestyle-related risk factors like physical inactivity, poor dietary habits, stress, smoking, and alcohol consumption are amplifying the need for ongoing pharmaceutical intervention.

The aging global population, particularly in developed nations, is further fueling the need for cardiovascular drugs as elderly individuals are more prone to developing chronic heart-related ailments. On the innovation front, advancements in drug delivery technologies and the introduction of next-generation treatment modalities are enhancing both therapeutic efficacy and patient compliance. Key players are investing heavily in research and development to launch drugs that offer better outcomes, reduced side effects, and tailored treatments suited for a variety of patient needs. The growing inclination toward personalized medicine is also reshaping the cardiovascular treatment landscape, allowing companies to address previously unmet medical needs through more targeted therapies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $153.7 Billion |

| Forecast Value | $214.9 Billion |

| CAGR | 3.5% |

The market is segmented based on drug classes such as antihypertensives, antihyperlipidemic agents, anticoagulants, antiarrhythmics, and other therapies. Among these, the antihypertensives segment alone generated USD 43.9 billion in 2023, fueled by the increasing prevalence of high blood pressure worldwide. This drug class includes ACE inhibitors, angiotensin II receptor blockers (ARBs), beta-blockers, calcium channel blockers, and diuretics-all considered essential in lowering blood pressure and minimizing the risk of severe cardiovascular complications. The hypertension segment accounted for a 35.2% share in 2024, driven by the growing global incidence of high blood pressure and its direct link to life-threatening conditions such as strokes, kidney failure, and heart attacks. Managing hypertension effectively remains a top priority for healthcare providers, and the availability of both monotherapies and fixed-dose combination therapies ensures treatment can be customized to individual needs.

North America held a 41.2% share of the global cardiovascular drugs market in 2024 and is projected to grow at a 3.2% CAGR through 2034. The region benefits from strong healthcare infrastructure, high per capita health expenditure, and the presence of leading pharmaceutical firms. Additionally, the rising incidence of cardiovascular conditions and a rapidly aging population in the U.S. are boosting demand for advanced therapies. Government-driven initiatives promoting healthcare innovation and treatment accessibility are expected to further support regional market expansion.

Key players operating in the Global Cardiovascular Drugs Market include Pfizer, Johnson & Johnson, Bristol-Myers Squibb, Gilead Sciences, Bayer, Merck, Amgen, Sanofi, Novartis, AstraZeneca, Lupin, and Viatris. These companies are actively expanding their portfolios with novel drug classes and next-gen therapies, while strategic collaborations and investments in R&D continue to drive competitive advantage.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of cardiovascular diseases

- 3.2.1.2 Technological advancements in drug formulation

- 3.2.1.3 Growing awareness of preventive healthcare

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory frameworks

- 3.2.2.2 High costs of drug development

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Future market trends

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Drug Class, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Antihypertensives

- 5.3 Antihyperlipidemic

- 5.4 Anticoagulants

- 5.5 Antiarrhythmics

- 5.6 Other drug classes

Chapter 6 Market Estimates and Forecast, By Indication, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hypertension

- 6.3 Hyperlipidemia

- 6.4 Coronary artery disease

- 6.5 Arrhythmia

- 6.6 Other indications

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Parenteral

- 7.4 Other routes of administration

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacies

- 8.3 Online pharmacies

- 8.4 Retail pharmacies

- 8.5 Other distribution channels

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Amgen

- 10.2 AstraZeneca

- 10.3 Baxter

- 10.4 Bayer

- 10.5 Boehringer Ingelheim

- 10.6 Bristol-Myers Squibb

- 10.7 Gilead Sciences

- 10.8 Johnson & Johnson

- 10.9 Lupin

- 10.10 Merck

- 10.11 Novartis

- 10.12 Pfizer

- 10.13 Sanofi

- 10.14 Viatris